The federal reserve took a dovish stance in the December meeting indicating a 75bps cut with the dot plot showing the median year-end 2024 projection for the federal funds rate falling to 4.6%

policy brates

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited (NSE)

FinTech BizNews Service

Mumbai, January 2, 2024: This is the fourth part of the series on the December edition of the ‘Market Pulse’, published by NSE. The third, second and first part was published on this website on December 29, December 28 and December 26, 2023.

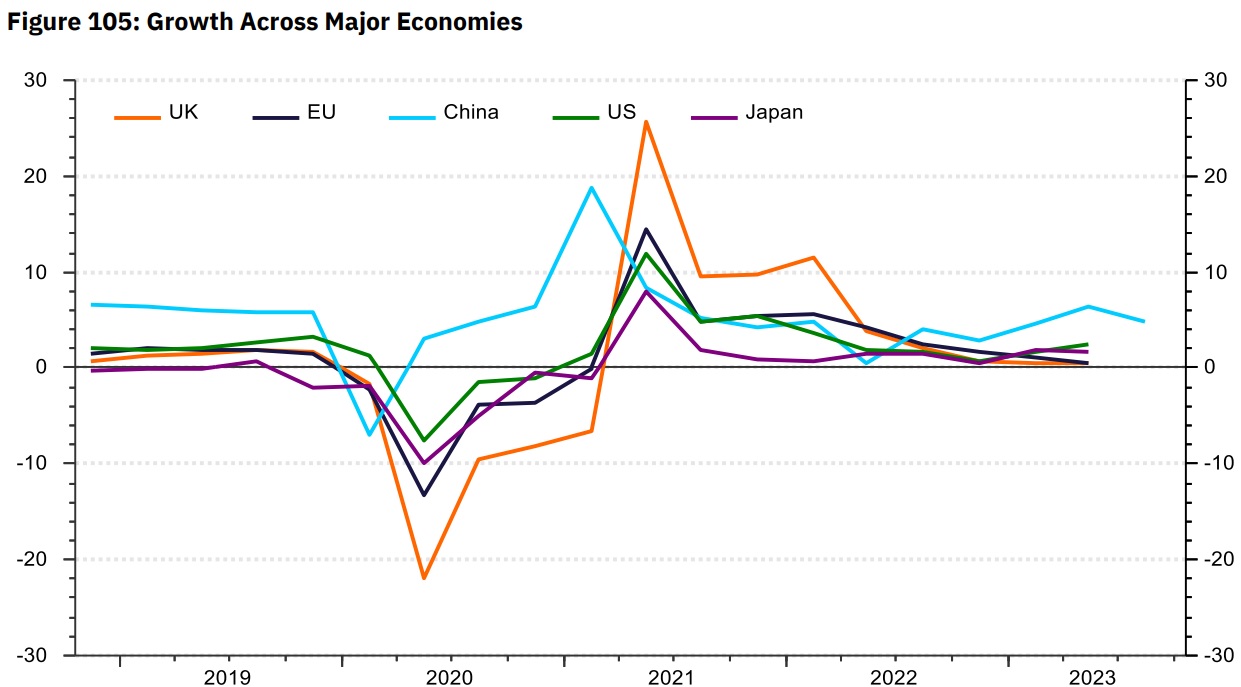

Global PMI Composite Output Index came at 50.4 in November, marginally up from 50 in October after declining consistently nine straight months. The service sector again outperformed its manufacturing counterpart in November.

The federal reserve took a dovish stance in the December meeting indicating a 75bps cut with the dot plot showing the median year-end 2024 projection for the federal funds rate falling to 4.6%. The ECB on the other hand pushed backed against bets on imminent cuts going into 2024 with BoE also indicating an extended period of restrictive monetary going into 2024.

The core inflation remained constant at 4% YoY in November even as the shelter costs eased. Fed continued to keep the target range for the policy rate at 5.25%-5.50% for third consecutive time in the December meeting. However, FOMC indicated a possibility of 75bps cuts in 2024 on account of economic growth slowdown and moderation in job gains.

Chinese Economy throws mix data

The attempt to revive a sluggish Chinese economy has continued as government has been taking steps to revive after its property sector meltdown. Aided by the festive season, retail sales in November grew at the fastest pace since May at 10.1%YoY primarily led by acceleration in clothing sales and communications equipment. That said, the monthly momentum contracted (-0.06% Nov’23). The composite PMI rose sharply in November to 51.6 after declining consecutively for the last 5 months even as it remained in expansionary zone. On a sequential basis, CPI dropped by 0.5% (vs. -0.1% in Oct’23) even as the Peoples Bank of China (PBOC) boosted liquidity in the banking system by offering commercial lenders a net 800 billion yuan ($112 billion) of one-year loans through its medium-term lending facility.

Eurozone stuck in resession

The downturn in euro zone business activity continued to deepen in December. The economy contracted by 0.1% in the third quarter of 2023 primarily led by fall in inventories. Within the Euro zone, Germany, France and Netherlands contracted while Spain and Italy expanded by 0.3% and 0.1%, respectively. The composite PMI which has remained in contractionary zone since May, fell futher to 47.0 in Dec’23 (vs. 47.6 in Nov’23). The ECB kept the interest rate unchanged at 4.5% in the December meeting as it pushed back against bets on imminent rate cuts going into 2024, remaining in stark contrast to the more dovish tone of the US Fed.

Japanese Economy Shrinks:

The Japanese economy shrank by 0.7% QoQ in Q3 (vs. +0.9 % in Q2) even on a low base of last year as it continues to face weak domestic private consumption and external demand. On the positives, composite PMI came out of contractionary zone increasing to 50.4 in Dec’23 (vs. 49.6 in Nov’23) primarily led by strong services PMI at 52— the fastest pace since Sep’23.

Slowdown continues in UK

The preliminary GDP data shows that the UK economy came to a halt with a print of 0% QoQ in Q3 2023 after expanding in last three quarters. The slowdown has been primarily led by contraction in investments, household spending and government consumption. BoE held the policy rate at 5.25 % for the third consecutive meeting even as economy continues to slow down considerably, while also indicating an extended period of restrictive monetary policy going into 2024

Authors Tirthankar Patnaik, PhD; Prerna Singhvi, CFA; Ashiana Salian, Prosenjit Pal, Smriti Mehra, Ansh Tayal, Anand Prajapati, Shuvam Das, Isha Sinha

(To be continued)

(This report is intended solely for information purposes. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources. NSE does not guarantee the completeness, accuracy and/or timeliness of this report neither does NSE guarantee the accuracy or projections of future conditions from the use of this report or any information therein. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risks, which should be considered prior to making any investments.)