The overall trend of the market is positive but in the short run, it seems to be overheated and a meaningful correction will be healthy for the markets

Aditya Gaggar,

Director,

Progressive Shares

FinTech BizNews Service

Mumbai, December 16, 2023:

Domestic

COVERAGE NEWS: 11 Dec 2023-15 Dec 2023

Cipla Ltd: InvaGen Pharmaceuticals Inc. (WoS of Cipla) is voluntarily recalling one lot of Vigabatrin for Oral Solution, USP 500mg, to the consumer level. Vigabatrin has been found to have seal integrity issues allowing for powder leakage from the pouch. Cipla has not received any reports of adverse events related to this recall. Sumitomo Chemical India Ltd: At the hearing held on 7th December, 2023, the counsel of the Central Government stated that the notification (restricting use of glyphosate) is proposed to be implemented on 15th February, 2024 and not before that. The Hon’ble High Court fixed 29th January, 2024 as the next date of hearing on the petitions.

Sun Pharmaceutical Industries Ltd: (i) The company has proposed to acquire all of the outstanding shares of Taro’s other than any shares held by the company or its affiliates, for a purchase price of USD43 per share in cash (revised proposal) as against the earlier purchase price of USD38 per share. (ii) SunP’s specialty product ILUMETRI, (Tildrakizumab Injection) is now included in category B of China’s National Reimbursement Drug List, which shall be officially implemented from 1st January, 2024. The inclusion of ILUMETRI in category B of the National Reimbursement Drug List will further improve the accessibility and affordability of the innovative drug to benefit more patients. Torrent Pharmaceuticals Ltd: The USFDA conducted a pre-approval inspection at the company’s oral oncology manufacturing facility from 5-11th Dec’23. At the end of the inspection, the company was issued a Form 483 with 5 procedural observations. There was no observation related to data integrity reported.

The Indian Hume Pipe and Co. Ltd: The matter pertaining to contractual dispute against non-settlement of full and final payment by TWAD Board in respect of providing combined water supply scheme is pending with the Madras High Court. Litigations worth Rs258mn are expected to be released on settlement of the above matters. Sandhar Technologies Ltd: The company has entered into an agreement to disburse the loan of 5,00,000 euros to its subsidiary, Sandhar Technologies Barcelona S.L. (STB), at an interest rate of 10% per annum. The loan is repayable, along with the accrued interest, on or before March 30, 2024, or such other date as may be mutually decided by the company and subsidiary.

GMM Pfaudler Ltd: The Patel Family, through Millars Machinery Company, has completed the acquisition of 1% equity stake in GMM Pfaudler from Pfaudler Inc. through an off-market inter-se transfer between promoters at Rs1,700 per share. 75% of the amount has been paid upfront, and the remaining 25% will be paid on or before March 15, 2024. The Patel family’s shareholding now stands at 25.18%, and they remain the largest shareholder of the company. Texmaco Rail & Engineering Ltd: The Ministry of Railways has awarded an order worth ~Rs13,744mn to the company for manufacture and supply of 3,400 BOXNS wagons.

The Week That Went By:

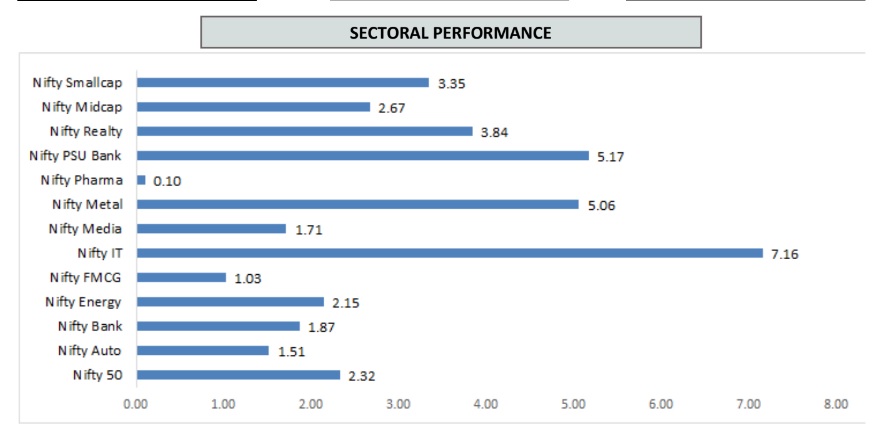

Indian equities started the week on a steady note but due to negative divergence in RSI, the higher levels did not last for long and a corrective move was seen in the markets. Fed’s decision to keep the rates unchanged along with rate cut indications in the next year provided an impetus for the markets to rally. As the week progressed, bulls were dominating the markets by registering a fresh high. With a weekly gain of 487.25 points, Nifty50 ended at 21,456.65. Among the sectors, all of them ended the week with gains where IT (+7.16%) and PSU Banks (+5.17%) were the major performers.

Nifty50=21,456.65

BSE Sensex30=71,483.75

Nifty Midcap 100=45,586.55

Nifty Smallcap100=14,885.80

MARKET OUTLOOK

The overall trend of the market is positive but in the short run, it seems to be overheated and a meaningful correction will be healthy for the markets. Among the sectors, we continue to hold our bullish stance on the select Auto and Energy stocks (Eicher Motors, Hero Motocorp, and HPCL). From the Banking indices (BankNifty+PSU Banks), couple of stocks have experienced positive pattern breakouts (Bandhan Bank- Descending Channel Breakout, RBL Bank- Rounding Bottom Breakout, SBIN- Symmetrical Triangle Breakout). As indicated in the previous weekly report, the IT sector performed on expected lines, giving a breakout and hinting towards a continuation of the current move (HCL Tech- Rounding Bottom Breakout). We are bullish on SAIL and NALCO as both of them have given a strong breakout from a Symmetrical Triangle and Falling Channel Formation respectively. The technical development in Chemical stocks indicates that the bottom has been placed and is all set to realign with its primary uptrend (Gujarat Fluorochemicals, SRF- Symmetrical Triangle Breakout, Sudarshan Chemicals- Flag and Pole Breakout).

With gains of 7.16%, the IT sector outperformed the Benchmark Index. All the components ended the week with gains where Persistent (+11.52%) and Coforge (+10.94%) were the top performers followed by Mphasis (+9.57%) and HCL Tech (+9.35%). As shown in the chart, the sector has given a much-awaited range breakout which was confirmed with a long-term trendline breakout. Trend following indicator, MACD has also given a positive crossover which suggests an extension of the current up-move.

With the Market sentiment being bullish, all the sectors have ended the week on a positive note.

(DISCLAIMERS AND DISCLOSURES: Progressive Share Brokers Pvt. Ltd. and its affiliates are a full-service, brokerage and financing group. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. PSBPL or its associates and Research Analyst or his/her relative's does not have any material conflict of interest in the subject company. The research Analyst or research entity (PSBPL) has not been engaged in market making activity for the subject company. PSBPL or its associates may have received any compensation including for brokerage services from the subject company in the past 12 months. PSBPL or its associates may have received compensation for products or services other than brokerage services from the subject company in the past 12 months. PSBPL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Subject Company may have been client of PSBPL or its associates during twelve months preceding the date of distribution of the research report and PSBPL may have co-managed public offering of securities for the subject company in the past twelve months. PSBPL and/or its affiliates may seek investment banking or other business from the company or companies that are the subject of this material.)