Silver fell over 2.5% below $74.50 and at one point plunged as much as 5% — its most pronounced swing since 1980. While lower yields typically support non-yielding assets such as gold, reduced liquidity due to the Lunar New Year holidays amplified near-term volatility.

FinTech BizNews Service

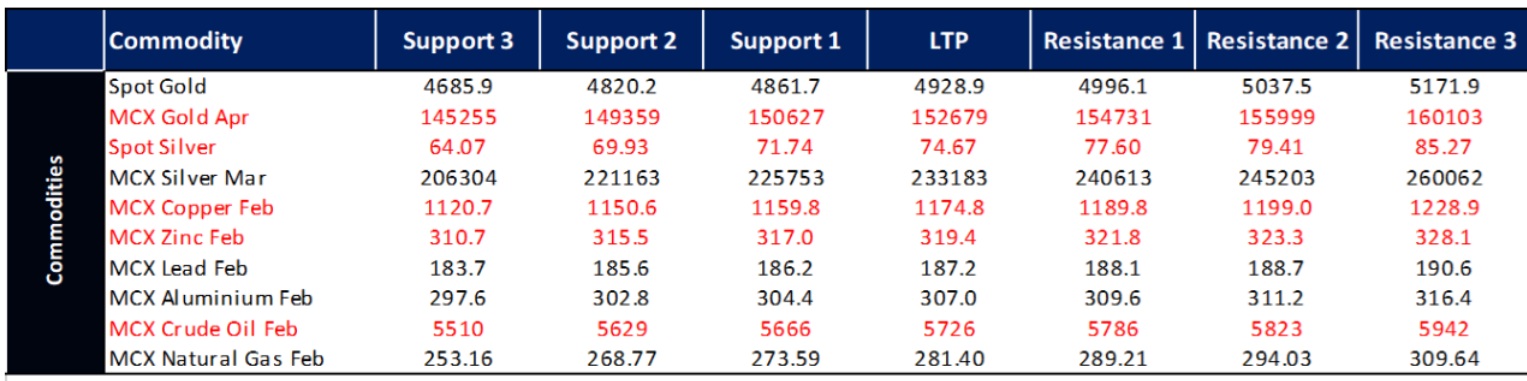

Mumbai, 17 February 2026: Spot gold slipped below $4,900 per ounce in thin trade, touching its lowest intraday level in over a week, extending the prior session’s 1% decline. The pullback follows a brief rebound triggered by softer US inflation data, which strengthened expectations for Federal Reserve rate cuts. While lower yields typically support non-yielding assets such as gold, reduced liquidity due to the Lunar New Year holidays amplified near-term volatility, according to the Kotak Securities' Commodity Research report.

Silver underperformed sharply, falling over 2.5% below $74.50 and at one point plunging as much as 5% — its most pronounced swing since 1980. The metal’s smaller market depth and thinner liquidity continue to exaggerate price moves relative to gold.

Markets are now pricing in slightly more than two Fed rate cuts this year, potentially beginning in July. Attention shifts to the Fed’s January meeting minutes, advance US GDP, and PCE inflation data for policy clarity. With geopolitical risks simmering and monetary easing expectations building, the medium-term bias for precious metals remains constructively supported despite near-term volatility.

WTI crude is trading roughly 1% higher near $63.50/bbl as geopolitical tensions reintroduce a measurable risk premium into the market. Iranian Revolutionary Guard naval drills in the Strait of Hormuz—through which nearly 20% of global seaborne crude flows—have elevated immediate supply disruption concerns. The deployment of

a second U.S. aircraft carrier ahead of renewed nuclear negotiations in Geneva further intensifies the strategic backdrop. While Tehran has signaled conditional flexibility tied to sanctions relief, the path to de-escalation remains uncertain. Simultaneously, U.S.-led Russia–Ukraine discussions are underway, though the market assigns a low probability to any near-term restoration of disrupted Russian export flows. Balancing these upside risks, reports suggest OPEC+ may resume phased output increases from April, potentially adding incremental barrels into an already well-supplied market. Near-term price action will remain geopolitically driven, but unless physical supply is materially disrupted, prospective OPEC+ supply normalization is likely to cap rallies and keep crude within a broadly range-bound structure.

Base metals are exhibiting a mixed trading pattern amid the ongoing Lunar New Year holidays, with aluminum gaining 0.38% to reach $3,064/ton, while copper is down nearly 1% at $12,748/ton. This decline in copper is influenced by a surge in global inventories, now at the highest level in over two decades, exceeding 1 million tons across Shanghai, London, and New York exchanges. The cooling of physical demand in China has contributed to rising stockpiles and dampened near-term buying interest,

exacerbated by high prices and holiday lags. Despite the near-term weakness, the broader outlook remains supported by strong structural demand trends. BHP Group

reported stronger-than-expected results, with copper overtaking iron ore as its main earnings contributor, highlighting the metal’s increasing importance amid rising demand.

US natural gas futures dropped nearly 8% to below $3 per MMBtu, the lowest level in four months, as updated forecasts signaled warmer-than-normal temperatures across central and southern US regions. The shift in weather expectations has materially reduced near-term heating demand, reversing last month’s rally when winter

storms pushed prices to a three-year high. Thin liquidity during the President’s Day holiday likely amplified Monday’s downside move. Despite the correction, underlying fundamentals remain firm. Working gas inventories are about 130 bcf below the five-year average, and LNG exports continue near record highs, anchoring structural

demand. Near-term price direction hinges on weather revisions and storage data. Any return of cold risks a sharp rebound, but sustained warmth could keep prices pressured despite tight inventory.