Gold has returned 11% CAGR in the last 20 years

FinTech BizNews Service

Mumbai, November 08, 2023: Gold is an efficient asset class that provides safety and acts as an efficient hedge against inflation hence it is better to invest in a portfolio that includes gold, says a study conducted by Windmill Capital, a wholly owned subsidiary of smallcase Technologies Pvt. Ltd. The study indicates that demand for gold is likely to remain robust during the festive season, especially Diwali.

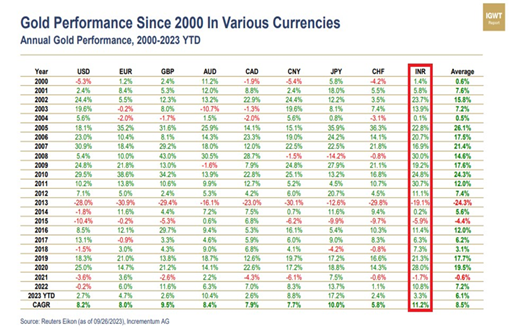

The recent study by Windmill Capital highlights that in times of geopolitical uncertainty, gold is expected to trend higher in the immediate term. The study talks about the performance of gold over the last two decades to understand the long-term trend for the yellow metal. It shows that on an average, gold has returned 11% CAGR in the last 20 years.

Naveen KR, smallcase manager & Senior Director - Investment Products, Windmill Capital said, “It would be ideal to advise investors to invest in portfolios including both gold and equity. The performance of gold will offset the poor performance of equities during unfavorable macro events or persistently high inflation”.

Gold is a safe haven asset class

As per the study, Gold is an efficient asset class that provides safety. Historically, whenever there is turmoil in the market, investors’ natural tendency is to flee to safety. Gold as an asset class tends to do well during crises. For example, while Nifty returns have been negative during Covid crisis or Russia-Ukraine war, Gold returns have been positive with <20% returns. Hence gold is an effective hedge against equities. The table compares performance of gold against Nifty 50 performance during times of crises.

Secondly, gold also acts as an efficient hedge against inflation outperforming Nifty 50 during high inflation periods. High inflation has generally correlated with lower equity returns. On the other hand, over the long term, gold acts as an efficient hedge against inflation. The table illustrates the performance of Nifty 50 and gold during periods of high inflation periods considering wholesale price inflation for the purpose of below analysis.

As far as the methodology of the aforementioned returns are concerned, they follow a simple process. From the start date to the end date, Nifty value and MCX Gold Commodity Future Continuation 1 value is used for return calculations.

Geopolitical impact on Gold

While gold has always been in demand, a fresh exuberance was seen in 2022 post Russia’s invasion in Ukraine. When Russia invaded Ukraine, the US in an attempt to punish Russia, froze Russia’s forex reserves worth ~$300 billion. In addition, it also introduced sanctions against Russia. These measures prompted other countries, especially emerging economies, to wonder if the US can levy a sanction on Russia’s forex reserves (which have to be mandatorily located in the United States), there is no guarantee why the US cannot freeze their reserves too. In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Another interesting trend that is emerging is the dichotomy between the Western and the Eastern nations, when it comes to gold. The west is relying on its wealth while East is purchasing Gold.

The geopolitical trends and the way the market performs during the current quarter makes Gold a favorite asset class. Clearly, the traditional urge to invest in gold, especially during the festive season in India will linger for ages.

smallcase is a financial technology company building a platform for direct indexing & model portfolios of stocks & ETFs known as smallcases. In the last six years, smallcase has developed an ecosystem of 350+ businesses in the capital markets space. The ecosystem includes some of India’s prominent financial institutions and brands that leverage the smallcases platform & technology. Over 6.5 million investors use smallcase products and apps every month.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. “Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investors should consider all risk factors and consult their financial advisor before investing. This should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy / sell any security or financial products. Representations are not indicative of future results.