First cut isn't the deepest; Investor outflows and positive economic surprises weighed on gold in January. Despite seasonal tailwinds, gold prices fell across the board

FinTech BizNews Service

Mumbai, February 8, 2024: Gold prices fell back to US$2,053/oz, to finish the month of January 2024 1% lower, according to the January 2024data released by the World Gold Council on 7th February, 2024.

January Review

Looking Forward

Gold gives back gains

Gold prices fell back to US$2,053/oz, to finish the month 1% lower, and departing from historical seasonal strength. A retracement following such a stellar finish to the year was probably on the cards, with global gold ETF outflows accelerating to 51t and a reduction in COMEX futures net longs (-206t) the main contributors, as per Gold Return Attribution Model (GRAM). Added to this was the headwind of higher Treasury yields and the US dollar as US economic strength sharply surprised to the upside, and hopes of early monetary policy cuts were dashed.

Investor outflows and positive economic surprises weighed on gold in January. Despite seasonal tailwinds, gold prices fell across the board.

Looking forward

First cut isn’t the deepest

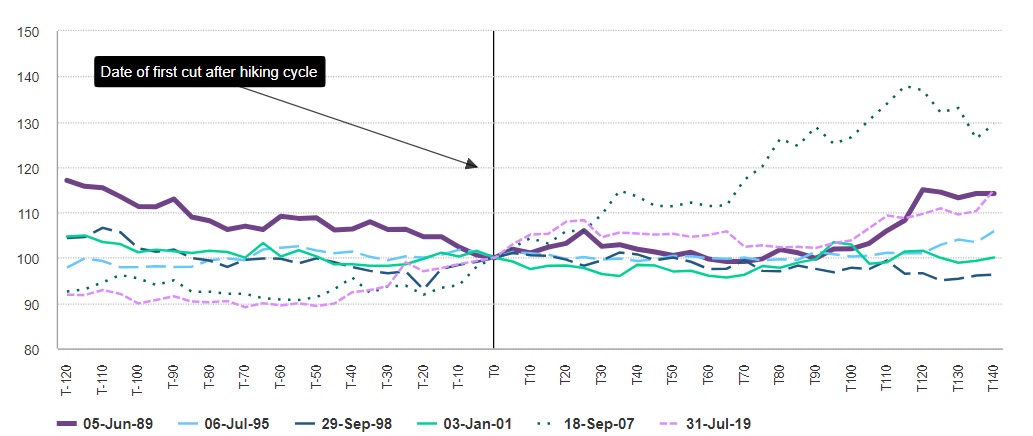

Protestations from some Fed members and a couple of hot data prints, appear to have finally doused expectations for a March Fed rate cut, coupled with a hawkish ECB turn. Falling rates (typically at the longer end of the curve, see here) are on average good for gold, but the first Fed cut after a hiking cycle has been a bit of a damp squib in the past, producing near-term rallies only if and when a material economic or equity correction has ensued, pushing longer maturity yields lower.

This makes sense if the cut is highly anticipated, or if it is bathed in soft-landing rhetoric. After all, recessions historically didn't become evident until some time after that first cut, if they materialised at all.

Gold’s performance post the first cut has been underwhelming.