Risk Aversion Visible In Global Markets

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, April 16, 2024: Risk aversion was visible in global markets with increased demand for safe-haven assets such as gold and dollar amidst tensions in Middle East. On macro front, US retail sales inched up by 0.7% in Mar’24 (est. 0.3%) from an upwardly revised 0.9% in Feb’24 (MoM). Continued strength in US economy is likely to delay Fed’s easing cycle. In China, GDP growth was higher than expected at 5.3% (est. 4.6%), led by positive policy response. Separately, both industrial production and retail sales missed estimates to increase by 4.5% (est. 6%) and 3.1% (est. 4.1%), respectively in Mar’24. However, growth in fixed asset investment was robust at 4.5% in Q1CY24 (est. 4.1%). In India, IMD predicted an above normal monsoon for this year which bodes well for growth and inflation outlook. Domestic markets are expected to remain subdued as investors await more clarity on the conflict in Middle East.

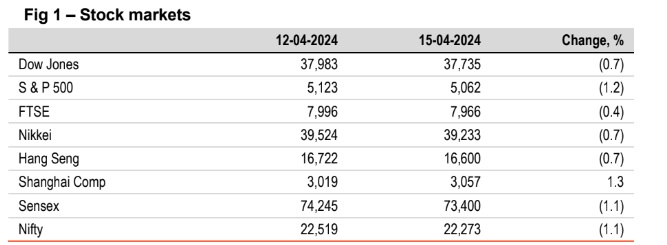

§ Except Shanghai Comp (higher), global stocks closed lower. Risk appetite of investors has fallen amidst rising geopolitical tensions. Apart from this, higher than expected retail sales print in the US raised doubts about the future course of action by Fed. Sensex fell by 1.1% dragged down by banking stocks. It is trading further lower today, in line with other Asian stocks which got impacted tracking China’s patchy macro data points.

Global currencies depreciated. DXY hovered near a 6-month high after US retail sales rose more than expected. JPY depreciated by 0.7%, to its weakest since Jun’90. INR depreciated to a record low amidst concerns over Middle East crisis. It is trading further weaker today, in line with other Asian currencies.

Except China and India (stable), global yields broadly closed higher. UK’s 10Y

yield rose at the sharpest pace ahead of BoE Governor’s speech. This was followed by US and UK’s 10Y yield. San Francisco Fed President spoke of no urgency to rate cut. Retail sales data of US also reflected the same. India’s 10Y yield is trading a tad higher at 7.19% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)