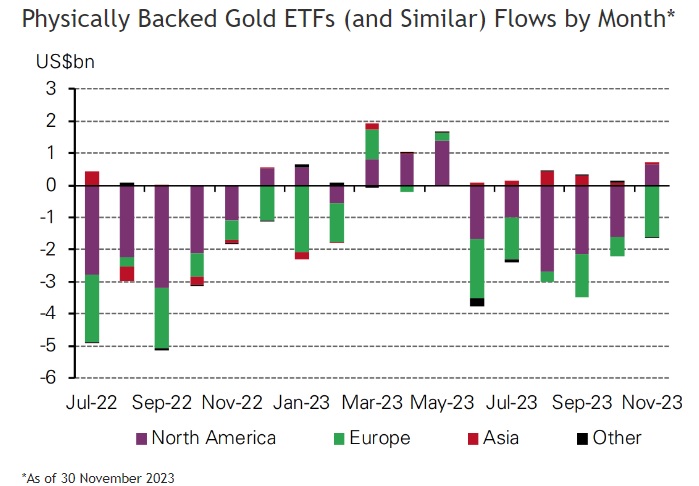

Global gold ETFs outflows slowed significantly in November supported by net inflows into North American funds

FinTech BizNews Service

Mumbai, December 7, 2023: Global gold ETFs outflows slowed significantly in November supported by net inflows into North American funds.

Geopolitical risk and investor positioning helped push gold higher in the month, contributing to the change in trend in the US. So far in 2023, collective holdings of global gold ETFs are down by 7%, while total assets under management (AUM) saw a 5% increase amid a higher gold price.

Central banks’ summer of buying continues into October

Central banks’ gold buying slowed in October but did nothing to alter the overall trend of robust buying that has captured the attention of gold investors. Reported global net purchases totalled 42 tonnes (t) during the month, 41% lower than September’s revised total of 72t, but still 23% above the January-September monthly average of 34t.