COMING OF (A TURBULENT) AGE: THE GREAT GLOBAL GOLD RUSH

Dr. Soumya Kanti Ghosh

Group Chief Economic Adviser

State Bank of India,

Mumbai, November 5, 2025: Cherished by households, Cheered by investors, hoarded by Central Banks and feted by speculators, the recent chequered journey of the shiny metal has been straight out of a story book but also cautions as a fear gauge of the tempest waiting on the sidelines.... Time for India to have a dedicated long term Gold policy that supports localization

Role of Gold: From Gold Standard to Bretton Woods to evolving contours

❑ The US, before 1933, had an exchange rate mechanism, defined as Gold Standard, where the dollar was defined in terms of gold; Gold was primary mechanism to settle differences in international trade flows (BoP imbalances)

❑ After the abandonment of the Gold Standard, the world moved to Bretton Woods, a quasi-Gold Standard exchange rate mechanism, whereby gold transactions were limited to official settlements with other countries’ central banks. Under Bretton Woods, capital controls were permitted so that the governments could stimulate their economies without suffering from financial market penalties

❑ The world formally moved out of such a system in 1974, with the dollar being globally recognized as the principal medium of transaction (The Nixon shock of August 1971, orchestrated by Paul Volcker, ensuing Fed chairman to delink the US dollar from gold anchored this)

❑ Oil shock of 1973 and legalization of private gold ownership in the United States in mid-70s boosted gold’s return from shelves and store houses to speculative and investment landscape, a primer for subsequent years’ exuberance... the swinging 70s can truly be dubbed as the period of reckoning for the alchemic metal for whom Warren Buffet once said "if you own one ounce of gold for an eternity, you will still own one ounce at its end"

❑ However, post 2000, following a commodity market boom, the yellow metal came back with a vengeance. Additionally, countries like China started aggressively diversifying their cash reserve position away from dollar denominated instruments (between 2004 and 2009, China doubled its official holdings of gold by 500 metric tonnes). India also augmented its gold reserves by purchasing $6.7 billion of IMF gold in November 2009 and since then has continued to purchase gold possibly as a strategy of asset diversification and risk management

❑ Shanghai Gold Exchange formed in 2002 has emerged as the world's largest physical gold spot exchange by trading volume

❑ India started the International Bullion Exchange (IIBX), the country's first international bullion exchange located at GIFT IFSC

India’s gold policy – Historical Developments............

❑ Since independence, policies relating to gold have centered around six elements: i) make people migrate away from gold to other asset classes, ii) regulate the supply of gold, iii) reduce smuggling, iv) reduce household demand of physical gold and v) reduce price of gold in domestic market vi) exchange rate management and financial stability

❑ In 1978, in the context of gold auctions, there were consultations by the RBI related to measures to reduce the demand for gold, the stance on import of gold and related matters. There were views that the GOI need not pursue an active gold policy

❑ In same year [1978], a Committee to review the gold policy of the Government was appointed under the Chairmanship of Dr. I.G.Patel, then Governor of RBI. In view of the strain in the balance of payments at that time, the report did not find enough justification to suggest import of gold nor did they favour resuming gold auctions, though it was in favour of the RBI accumulating gold to add to official reserves rather than let it be exported

❑ A Working Group to Review Gold Policy in 1986 under the Chairmanship of Dr. C Rangarajan was appointed to have a `second look' at the Gold Control Act. Group’s key recommendation were related to import of gold, separate treatment for import of gold by NRIs, bringing gold into the country as part of personal baggage, and nonutility of the Gold Control Act as an anti-smuggling measure

❑ In recognition of the importance of gold in the changed circumstances following the collapse of Soviet Union, the RBI came out with a discussion paper in 1992, underscoring its bearing on external debt. In this paper RBI called for an institutional mechanism called ‘Gold Management Corporation’ (GMC). The GMC was to be guided by the ‘Gold Policy Board’ that was to be developed into a mechanism to evaluate the required schemes for gold mobilisation as also its utilisation in the event of external constraints

At around the same time [1992-93] an internal committee of RBI made detailed recommendations on the contours of an integrated national policy on gold.. Some of the recommendations were:

• There is a need for an integrated national policy on gold, covering trading, import, jewellery export, investment, refining, etc

• Import policy for gold and silver should be further liberalised to put an end to smuggling and hawala activities. Select Bullion Associations in the

country or some canalising agency like the SBI or MMTC may be allowed to import gold and silver subject to some annual ceiling

• It is desirable to regulate the bullion market and introduce uniform trading practices all over the country and the country’s potential to become an international centre for bullion trading

• Standardisation of market practices would lead to transparency in dealings, investor protection and market efficiency and could be prescribed for wholesale trade in bullion

• It is desirable to introduce forward trading in gold as a price hedging mechanism after further liberalisation in the gold import policy of the Government

• A separate statutory body called the ‘Gold Management Board’ should be set up with statutory powers to oversee wholesale bullion operations and

provide focus to the trade. The Board should examine and take steps to upgrade the standard and quality of the refineries in the country. Hallmarking of gold jewellery should be introduced in the country at the earliest as a measure of consumer protection

• The granting of permission for the participation of commercial banks in bullion trading may be deferred till the import of gold is more freely allowed

• The implementation of any future schemes for mobilization of gold from the public should be entrusted to agencies like mutual funds, which have greater flexibility in their operations. The mobilized gold could be offered to jewellers for meeting their inventory needs in order to make the scheme viable

• Gold-price-linked instruments may be made available in the market as an investment avenue to wean the public away from physical gold

The most recent RBI study on gold is the Report of the Working Group to Study the Issues Related to Gold Imports and Gold Loans NBFCs in India (Chairman: K U B Rao), 2013

• This report covers a wide canvases and discusses many issues relating to gold imports and its impact on current account deficit (CAD), institutional issues relating to gold, linking of gold to financial stability, consumer protection etc

• The reports devote a full section to NBFCs engaged in gold lending

• The important recommendations of this study relevant for our purpose are related to monetization of gold stocks with public, creation of domestic gold market, role of banks in sale of physical gold

• Most importantly the group recommended creation of Gold Bank or Bullion Corporation of India with the objective of providing backstop facility’ to provide refinance to institutions lending against the collateral of gold or besides being a backstop facility, it can also undertake retailing functions in gold including pooling of idle gold in the system

• The study recognizes the social security aspect of gold and therefore correctly recommended a gold pension scheme.

❑ Niti Aayog released a gold policy report in 2018 with 84 recommendations to transform the gold market. Key recommendations included financializing gold by integrating it into the financial system, creating a "Gold Board of India," improving the Gold Monetisation Scheme, revamping tax structures, and developing a gold databank to collect industry-wide data. The report aimed to boost domestic supply, increase exports, and address challenges in regulation and the supply chain

If one were to take an objective view of the policy discussions on gold since 1978, one finds that major thrust has been to wean away the masses from physical gold. They were therefore only short term in horizon

❑ Only three reports, the RBI Internal Report 1992 and two Tarapore Committee Reports tried to address the issue with some long-run perspectives

❑ Interestingly, the geopolitical importance of gold in the long-run was not emphasized at that point of time,

that has now become the cornerstone of all discussion. Also, none of the reports laid down the contours of

a national policy for gold from a long-term perspective, apart from the RBI 1992 report

❑ Past policy interventions have not accommodated the opinion of gold industry which provides direct and indirect employment to a very significant number of populace

Recent policy interventions

❑ The Finance Minister in Union Budget 2015-16 announced three concrete measures regarding monetization of gold. These included:

• GMS replacing both the present Gold Deposit Scheme (GDS) 1999 and Gold Metal Loan Schemes– The minimum quantity of gold for deposit was proposed at 30 grams. This is substantially lower than 500 grams in 1999 GDS. The scheme is much more simplified, streamlined with well-defined roles for banks, refineries and testing centers.

• SGBS which will be an alternative to purchasing metal gold– The main objective of SGBS was to reduce the demand for physical gold and shift a part of the physical bars and coins purchased every year for Investment into ‘demat’ gold bonds

• Developing Indian Gold Coin, which will carry the Ashok Chakra– This measure was akin to “American Eagle Bullion Coins‟ issued by the United States Government. Similar coins are also issued by Perth Mint of the Government of Western Australia. But the focus is to recycle the domestic gold such as scrap gold

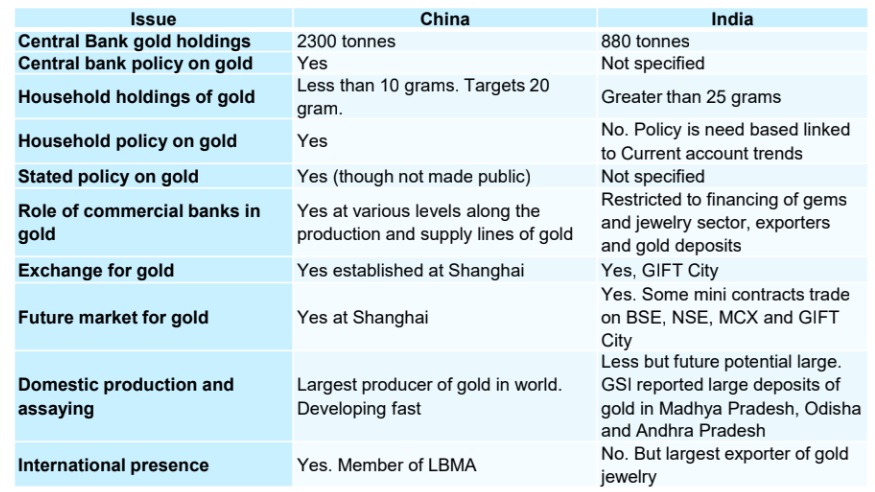

India Vs China

❑ China has a national policy on gold which has a specific purpose. It has comprehensive approach to reshaping how gold is traded, stored, valued, and used in international commerce. It represents a coordinated approach to addressing several economic and geopolitical priorities simultaneously. Gold plays a crucial role in China's broader Belt and Road Initiative

❑ China is implementing sweeping changes to its gold market infrastructure, creating a potential shift in the global monetary system. These strategic initiatives include expanding vault capacity, establishing new clearing systems, and relaxing import regulations—all designed to position China as a central player in global gold trading and potentially challenge dollar dominance

Recent perspectives on Gold

India is one of the largest markets for gold, influenced by cultural affinity for shiny metal, investment demand and other economic factors, including hedge against inflation and a safe haven asset

❑ Total consumer demand of Gold in India increased to 802.8 tonnes in 2024, which is 26% of the global gold demand taking India at 2nd rank, next just to China with consumer demand

of 815.4 tonnes. However, higher prices have led to lower demand of Gold in 2025. In Q3 2025 consumer demand of gold declined by around 16% yoy, driven by reduced jewllery demand (-31% yoy in Q3)...

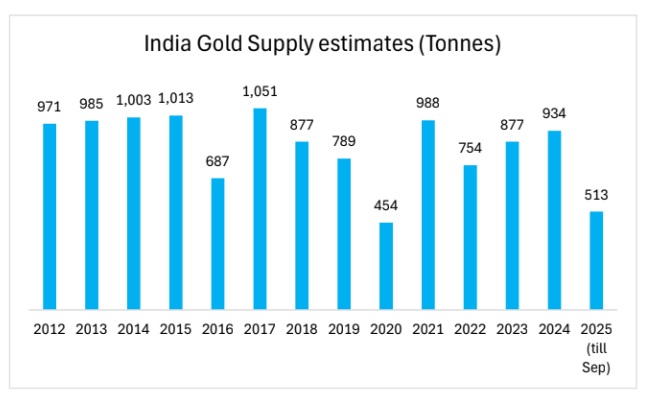

❑ Domestic supply of gold is only a fraction of the total supply of Gold in India, with imports contributing around 86% of the total supply in 2024 (World Gold Council estimate). Gold imports increased around 31% in FY24 and 27% in FY25. Higher prices have however reduced gold imports by 9% to $26.5 billion in FY26 Apr-Sep from $29 billion during the same period in FY25

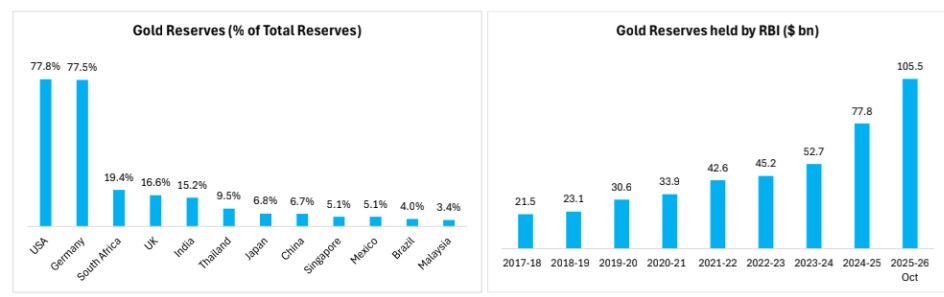

❑ Another interesting trend visible is the increase in gold reserves by the central banks. The RBI gold reserves rose to 880 tonnes in 2025 as part of strategic reserve management

❑ Policy tools as Sovereign Gold Bonds (SGBs) aimed to provide alternative to holding physical gold and reduce its imports, has led to increase in Government debt. Capital loss alone for the outstanding SGB units accounts for Rs 93,284 crore (assuming the latest redemption price persists)

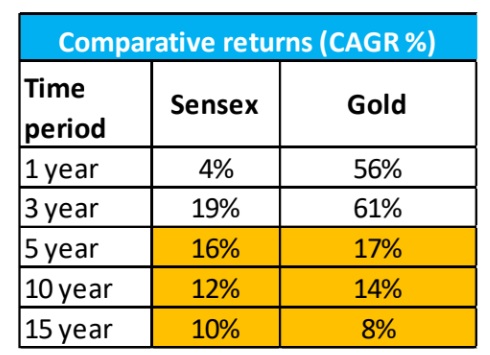

❑ Return on gold has been comparable to equity market (Sensex) over a 5, 10 and 15-year period, however, it far exceeds market return over 1 year and 3-year period

❑ Recent price volatility — with gold touching record highs in October 2025 — is likely to put moderate impact on CAD. Assuming price of gold remains around $4000/ oz in the remaining months and considering quantity of gold imports as 90% of last year it will increase our CAD by at most 0.3% of GDP. We believe overall CAD is expected to remain comfortable around 1-1.1% of GDP in FY26

❑ Furthermore, the recent discoveries of new gold mines in various districts of Odisha as Deogarh, Keonjhar, Mayurbhanj (with an estimated 1,685 kg of gold ore detected by the GSI) among others, Jabalpur in Madhya Pradesh (estimated quantity could run into lakhs of tonnes) and Kurnool district in Andhra Pradesh (India’s first large private gold mine expected to produce 750 kg of gold annually) could help ease the pressure on imports and are positive for our current account balance. Also improving state finances as royalty is Ad-valorem

❑ The present treatment of gold under national income, balance of payment and its links to CAC all need careful harmonization. At present there is no such policy that tries to reconcile these divergent aspects. The Government brought three schemes in 2015-16, the Gold Monetisation Scheme (GMS), the Sovereign Gold Bond Scheme (SGBS) and Indian Asoka Chakra Gold Coin

❑ Gold’s co-relation with Virtual Digital Assets too remains an interesting point of confluence as both assets have shown remarkable price swings, and a vote of confidence in recent times......

Gold price continue oscillating in higher zones....with swings of volatility

❑ Gold price has been reaching new heights driven by geo-political tensions, economic uncertainty, and a weakening US dollar

❑ The year to date price has increased over 50% in 2025. The price came down to below $4000/oz for a few days in October but again moved above $4000/oz in November

New paradigms of assets in Tango...... Co-existence in interesting times

In the rapidly changing world order with localization and self interests becoming the force du jour of disruptions, Gold has probably been reckoned by some ‘ingenuous’ minds as a sliding wall, a safety chute, an investment mechanism with sufficient liquidity & capital protection and hedge against the exuberance created through surrender of faith in digital assets and payment architectures built on Blockchains whose efficacy, is being driven by the self sufficing interests and remain akin to a House of Cards.....

Higher prices limiting consumer demand of gold

❑ Gold has significant importance in Indian society, playing a unique role in social and financial life finding usage as jewellery for occasions and inheritance as well as physical gold as a household store of value

❑ Gold has deep social security features particularly for women in the form of stree-dhana* which is the intergenerational transfer of wealth to bride during marriages ensuring gender parity in property rights vis-à-vis women

❑ Total consumer demand increased to 802.8 tonnes in 2024, which is 26% of the global gold demand putting India at 2nd rank, next just to China, with consumer demand of 815.4 tonnes

❑ Higher prices led to lower demand of Gold in 2025. In Q3 2025 consumer demand of gold declined by around 16% yoy, driven by reduced jewellery demand (-31% yoy in Q3)... Average imports have, however, been lower in recent years as compared to 2010-13 period Limited mining of gold leads to huge import dependency to meet domestic gold demand

❑ Domestic supply of gold is only a fraction of the total supply of Gold in India, with imports contributing around 86% of the total supply in 2024 (World Gold Council estimate)

❑ Mining of gold in India is limited, thereby increasing its reliance on imports. Gold primary mined during FY25 was 1627 kg

❑ Gold imports increased around 31% in FY24 and 27% in FY25. However, spike in gold prices led to reduction in imports of gold. In FY26 Apr-Sep, gold imports have declined by 9% to $26.5 billion from $29 billion during the same period in FY25

❑ The recent discoveries of new gold mines in various districts of Odisha as Deogarh, Keonjhar, Mayurbhanj (with an estimated 1,685 kg of gold ore detected by the GSI) among others, Jabalpur in Madhya Pradesh (estimated quantity could run into lakhs of tonnes) and Kurnool district in Andhra Pradesh (India’s first large private gold mine expected to produce 750 kg of gold annually) could help ease the pressure on imports and are positive for our current account balance. Also improving state finances as royalty is Ad-valorem

Central banks has increased their gold holdings... RBI gold reserves crossed 880 tonnes

❑ Countries such as US and Germany hold more than 77% of their total reserves in the form of gold

❑ RBI held 15.2% of its reserves in gold in FY26 (till 10 Oct) compared to 13.8% in FY25 and 9.1% in FY24...

❑ Rise in gold prices too contributed to higher share..... In terms of reserve change, RBIs gold reserves have increased by $25 bn in FY25 and $27 bn in FY26 so far till 10 Oct’25, mainly because of valuation increase

❑ In terms of quantity, RBI added only 0.6 tonnes of gold in FY26 (Apr-Sep) compared to 31.5 tonnes in FY25 (Apr-Sep)

❑ However, there has been a great emphasis on storage localization, a prudent move indeed going by the fractured lines of policy upheavals globally

Higher gold price is associated with Rupee depreciation

❑ Gold price has direct impact on USD INR exchange rate too owing to the country’s huge dependence on gold imports

❑ The two are highly correlated, around 0.73 implying higher gold prices is associated with Rupee depreciation though the average import quantum makes it a not too significant factor

Gold vs Equity & Bonds: Gold is a new indicator of Geo-Political uncertainty

❑ “Gold is a way of going long on fear“........ The Oracle of Omaha once said citing gold has two significant shortcomings, being neither of much use nor procreative

❑ Notwithstanding that, Return on gold has been comparable to equity market (Sensex) over a 5, 10 and 15-year period

❑ However, the return on gold has exceeded the return on Sensex over 1 and 3-year period. The geo-political uncertainty has increased the demand for Gold, leading to its price increase and corresponding superior returns over equities

❑ The historical S&P 500 and gold returns show that gold return has been higher than the equity market return during the period of crises economic or geo-political

Sovereign Gold Bond causing loss to the Government owing to jump in Gold price

❑ The government started issuing Sovereign Gold bond in November 2015 and continued issuing 67 tranches with the last one issued in February 2024

❑ As of 23 October, outstanding SGBs stand at 125.3 tonnes. Taking into account the redemption price of Rs

12,704 announced for 2017-18 Series IV the total cost to the Government would be Rs 1.59 lakh crore. When the issue of these units is taken into account it amounted to Rs 65,885 crore. Thus, it amounts to Rs 93,284 crore loss to the Government on account of increase in gold price

Is Gold a hedge against inflation?

❑ There have been various research done if gold acts as a hedge against inflation

❑ One such study, The Golden Dilemma (2013) by Claude Erb and Campbell Harvey concludes that it is not always a case; in the two decades from 1985, it lagged inflation, in the two decades since it has outstripped it comfortably

❑ Another cross-country study by Hoang, Lahiani and Heller (2016) found that gold is not a hedge against inflation in the long run in China, India, Japan, France, the United Kingdom and the United States of America in periods ranging from 1955 to 2015. However, in the short run, gold is an inflation hedge only in the UK, USA, and India. There is no long-run equilibrium between gold prices and the CPI in China, India and France

❑ It is debatable whether higher gold inflation is associated with higher imported inflation in India. For example, the data from Jan 2015 shows low positive correlation between gold price inflation and overall CPI inflation, suggesting gold compensates for inflation but not perfectly

RBI (Lending Against Gold Collateral) Directions, 2025

❑ RBI has harmonized the treatment of loans secured by gold and silver collateral across all types of regulated entities

❑ Lending against the collateral security of gold jewellery, ornaments and coins for meeting the short-term financing needs of borrowers (but not permitted in case of bullion)

❑ LTV increased for lower amount loans

≤Rs2.5 lakh 85 per cent

> Rs2.5 lakh & ≤ Rs5 lakh 80 per cent

> Rs5 lakh 75 per cent

❑ Valuation: the lower of (a) the average closing price of that specific purity over the preceding 30 days, or (b) the closing price of that specific purity on the preceding day, as published either by the IBJA or by a commodity exchange regulated by the SEBI

❑ Reserve price cannot be less than 90% of the current value, and can be reduced to 85% only after two failed auctions

❑ Release or return the pledged eligible collateral held as security to the borrower on the same day but in any case, not exceeding a maximum period of seven working days upon full repayment or settlement of the loan. In case of delay attributable to the lender, the lender has to compensate the borrower at the rate of Rs5,000 for each day of delay

❑ RBI also made changes in the bullet repayment loans

❑ These changes are expected to increase the compliance cost for NBFC but in the long run it will improve asset quality and risk management

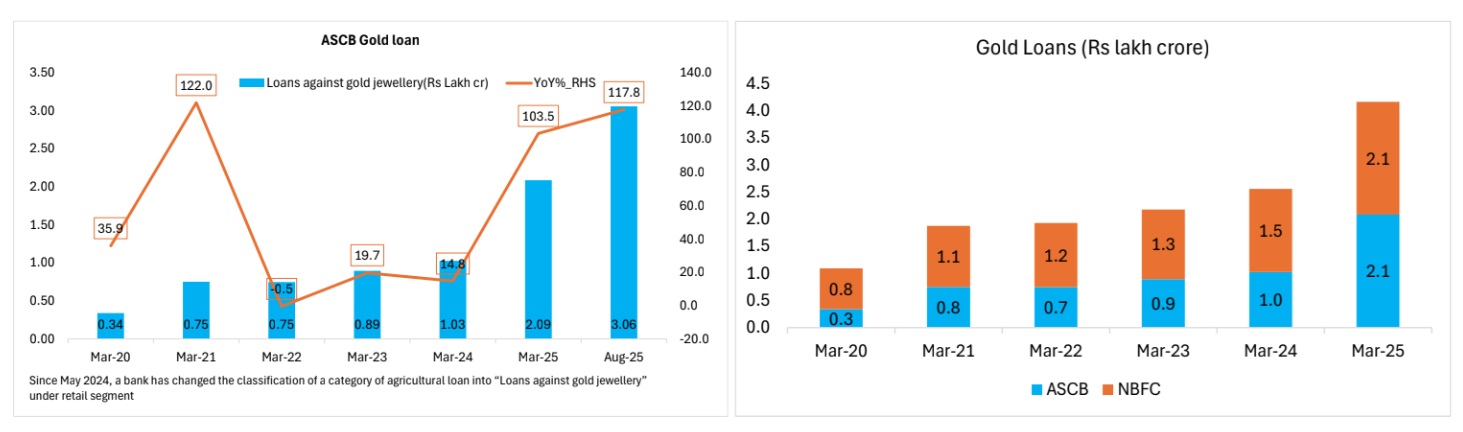

Loans against Gold Jewelery has been increasing

❑ ASCB loans against gold jewelery has increased rapidly, over 100% in the year ending March 25

❑ Majority of the Gold loans are taken in the Southern states (accounting for around 80% of the total) with around 60% from Tamil Nadu and Karnataka, where gold-backed loans serve as a major source of short-term agricultural credit, especially for small and marginal farmers, tenant cultivators, and those engaged in allied activities

Accounting of Gold in National Income

❑ Under the United Nations System of National Account 1993 (UNSNA 1993) gold is classified as: i) monetary gold, ii) gold held as store of value and iii) used as industrial purposes. The first category of gold (monetary gold) is kept with Central Banks is treated for financial purposes while the transaction of gold in remaining two category (non-monetary gold) is treated as transaction in commodity

❑ Furthermore, under the UNSNA1993 which CSO implemented in 2000, the valuables are placed under Gross Capital Formation (GCF) as a separate heading which has inflated the CGF figures, while reducing the savings and also private final consumption expenditure (PFCE) as gold purchases are not treated as part of consumption under UNSNA1993

❑ Hence, neither the popular perceptions that the household purchase of gold constitutes physical savings nor the perception that its consumption by household, reflects in national income accounting. RBI 2011 working paper succinctly highlighted this anomaly that classifying valuables under GCF while not accounting them in savings or consumption implies valuables portion of GCF have no saving (financing) counterpart. Hence, it may be incorrect to treat valuables and hence gold purchases by household as GCF in the economy from technical as well as behavioral point of view (consumption, investment and social security motives)

❑ In a similar token, IMF balance of payment manual BPM06 which also retains the monetary and non-monetary classification of gold, but excludes jewelry from non-monetary gold and puts jewelry under merchandised imports

❑ The present treatment of gold under national income, balance of payment and its links to CAC all need careful harmonization. At present there is no such policy that tries to reconcile these divergent aspects. The Government brought three schemes in 2015-16, the Gold Monetisation Scheme (GMS), the Sovereign Gold Bond Scheme (SGBS) and Indian Asoka Chakra Gold Coin

Way forward....Need for National Policy on Gold?.......

❑ The time has now come to conceive a comprehensive policy on gold and for such it is important that one defines what is gold (commodity or money) and how is gold perceived by its ultimate consumer

❑ The perceptions on gold in economic thoughts in East and West bear a striking difference. Gold in the West has achieved the status of public property as against its dominant status as private property in the East particularly in countries like India, Japan, Korea and China

❑ The West’s perception of gold is shaped by its past – social turmoil and wars - fought over gold for centuries. However, the West has not been able to change the perception of gold among households in Asia who continue to be net buyers of gold. Also, people in East do not share the same traumatic history as West vis-à-vis gold

❑ The net effect of this psychological conditioning is an alienation of gold as pure private property - a pure material asset (as against monetary asset) in public memory in West that can be owned and traded at will... However, with increased financialization and investment dictums, the cognitive biases may be in for some permanent bends

❑ The present trends in respect of gold policy, prominently include demand reducing measures and recycling of existing gold stock for productive purpose. However, since gold constitutes the sources of fund with no corresponding application in capital formation, monetization of gold will impact the future investments in a positive way

❑ However, there is also a need to have greater debate on evolving a comprehensive policy on gold (say gold backed pension scheme) that will integrate with broader financial sector reforms and with currency convertibility on capital account