Sector-wise, Financials is expected to contribute nearly 30% to the absolute earnings change over FY23-25, followed by Energy at 27.4% and Consumer Discretionary at 15%, together contributing 72%, much higher than their combined share of 59% to total earnings; Hope smiles from the threshold of the year

revenue nifty 26 dec nse

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited (NSE)

FinTech BizNews Service

Mumbai, December 26, 2023: Writing at the end of 2023, it is hard not to get a feeling of déjà vu—after all, FIIs are back and in a hurry, markets have risen 5% this month, supply chains are at risk again with the Suez Canal imbroglio, and yes, COVID cases seem to be back too. Thanks to a late surge across global markets, India ends the year a US$4trn market having risen 17% this year, capping a fourth year of positive returns for the fifth largest, and fastest growing economy in the world. Tennyson’s hope for the new year seems copasetic for the Indian economy and markets.

To see why and get a sense of the markets and economy this year, it is instructive to note where we were last year. Quite unlike 2023, 2022 was the worst year for global markets since the Global Financial Crisis of 2008, where both the developed (MSCI World) and the emerging (MSCI EM) world ended near bear market territory. India had a different story—individual investors. After years of lacklustre net investment in the market, the years 2020-22 saw significant inflows from this class, enough for positive return for the year, despite the highest FII outflows, ever, at US$17bn.

A resurgence in the fourth quarter of 2022 saw global equities begin the year well, until a turnaround in the inflation trajectory and expectations of a soft landing provided further wings to a ‘rate-peak’ rally that continued until the Fed reminder in July about possible further hikes. The US markets are up 24% this year, and in line, the MSCI World Index is up 21%. In contrast, the MSCI EM index has remained weak, with 4% rise, dragged down by Chinese markets that have lost 5% this year. Beyond the 18% rise this year (~17% in USD terms), 2023 has been different for Indian markets in other ways too. FIIs are back, as we mentioned above, having put in US$6.7bn in December thus far (As of December 20th, 2023), catching up to DII inflows, in turn thanks to steady and rising SIP flows, where average monthly figures have now risen above Rs 15,500 crores. Individuals seem to have taken their foot off the pedal for now, in fresh investments. That said, the number of individual investors continues to grow steadily on a yearly basis. We have over 8.35 crore unique investors in the markets today, vs. 6.94 crores as of the end of last year. Indian households have shown an increasing preference for equities over the years, with new investors from across the country.

More recently, following the previous three months of lacklustre performance, global equities as well as debt ended the month of November on a positive note as easing inflation and signs of economic weakness in the US strengthened expectations of an end to the rate hiking cycle. Developed equities (MSCI World Index) ended the month 9.2% higher—the highest monthly gain in the last three years, and another 3.4% in December thus far (As on December 15th, 2023). Emerging equities also caught up and rallied 7.9% in November. The rally was even stronger in global debt, with the US 10-year sovereign yield falling by 100bps since October-end to 3.9% currently (As of December 15th, 2023).

Indian equities followed global suit and generated strong returns last month. The benchmark Nifty 50 Index rose by 5.5% in November and by another 6.6% in the first 15 days of December, crossing the 21000 mark on December 1st, 2023. In fact, India with a market capitalization of US$4trn surpassed Hong Kong to become the fourth largest equity market early this month. Global risk-on apart, robust corporate earnings and stronger-than-expected GDP growth back home, coupled with robust buying by domestic as well as foreign investors—institutional as well as retail—added to the rally. FIIs also turned net buyers of Indian equities last month, strengthening it further in December.

Indian debt, on the other hand, remained on sidelines last month, weighed down by a hawkish RBI commentary in the October policy, tighter-than-expected liquidity conditions and tightened capital norms for unsecured lending by banks and NBFCs. That said, falling global bond yields and strong buying by FIIs provided an upside support.

In terms of market activity, the average daily turnover in NSE’s cash market segment rose by 5.1% MoM to Rs 70,615 crores in November, but on top of a near 20% drop in the previous month, while that in the equity options and equity futures dropped by 12.4% and 4.5% MoM respectively to Rs 46,581 crores and Rs 1.15lakh crores respectively. Individual investors remained the dominant player with a 35% share of overall cash market turnover in this fiscal year thus far—the lowest in last eight years but much higher than the 27% share of institutional investors — domestic as well as foreign. Notwithstanding this drop, the influx of new investors and consequently higher participation in terms of number of active investors[1] has gathered pace over the last few months. New investor registrations at NSE averaged at 13lakhs/month in the first eight months of FY24 vs. 11lakhs/month in FY23.

In this edition, we have also analysed the distribution of investors that traded in the equity cash and derivatives segments by turnover. Our analysis shows that nearly 79% of 37lakh active investors (That have traded at least once in the month) in the equity options segment in November traded less than Rs 10lakhs in the entire month but contributed a mere 2.5% to the total turnover. The figures are even more skewed for the cash segment. Nearly 91% of 1.07 crore active investors in the cash segment in November traded up to a total of Rs 10 lakh last month but accounted for 3.2% of the total turnover in the month.

Our Stories of the Month section presents analysis on two interesting topics. The first story on corporate performance analysis shows a strong growth in corporate earnings in the second quarter, reflecting the impact of margin tailwinds in the light of easing crude oil and commodity prices. The second story explores ownership trends and patterns in NSE listed companies since 2001. The analysis shows a pick-up in DMF share to fresh record-high level of 8.7% in the September quarter, a drop in FPI ownership to 18.4% despite strong foreign capital inflows, and an increase in individual ownership to a 16-year high of 9.7%, supported by strengthened participation. Individuals invested a net of Rs 21,560 crores in the September quarter—the highest in the last five quarters.

For the macro, in contrast with the rest of the world, the Indian economy has performed better than expectations, with growth in the first half of the year at 7.7% being much higher than the average growth of 6.9% in the last 17 years. This translated into upward growth revisions, with the RBI raising its FY24 GDP growth forecast by 50bps to 7%. India’s resilient growth environment is also reflected in several high frequency indicators. Industrial production expanded by a 16-month high of 11.7%YoY in October (7MFY24: +7% YoY), benefiting from strong capex push by the Government. Manufacturing and Services PMI have remained well within the expansionary zone. The trade deficit—merchandise as well as services—dropped to a seven-month low of US$5.3bn in November, thanks to a strong services surplus and lower imports. Inflation trajectory has been evolving in line with expectations, with the RBI expecting the average for the year at 5.4%, moderating to 4% by the second quarter of FY25.

Our Insights section this month has seven papers. The first paper summarized by the EPR team assesses the influence of wholesalers on liquidity, pricing and market efficiency given the advent of zero-commission brokerage services and shift towards Payment for order flow (PFOF) practice. The next six are summaries from the field of behavioural finance by the CBS team at IIM Ahmedabad. The first of these leads to the compelling inference of changing subjective value of money depending on the payment method and advocates the use of cash when saving to trigger the pain of payment. The second examines the impact of social media on stock market investing in India from the viewpoints of psychology and risk perception. We next see that the likelihood of altering an investment venture due to previous gains or losses is closely tied to the perceived level of personal accountability held by the decision maker. The fourth paper studies the role of analysts in fuelling the stock price momentum. investigate whether consumers opt to charge 'Buy now, pay later' (BNPL) transactions to their credit cards and explore the variation in such behaviours among different consumers.

The global economy seems primed for a slower 2024, thanks to the delayed effects of tighter monetary policy. Inflation across the world might well be due South for now, but as central bankers would tell you, it is the expectations that matter, and at this point, it is not clear if they are under control. Despite the downward trend in core, food inflation worries persist. The RBI maintained its FY24 inflation forecast at 5.4% in the latest policy. In the geopolitical space, war continues to rage around the world, with the Israel-Hamas conflict having added to the Russia-Ukraine war that is far from over. A continued China slowdown remains a drag on the global economy; unlike the post-GFC world, the absence of a resurgent China would be felt more this time around.

Q2FY24 Earnings Review

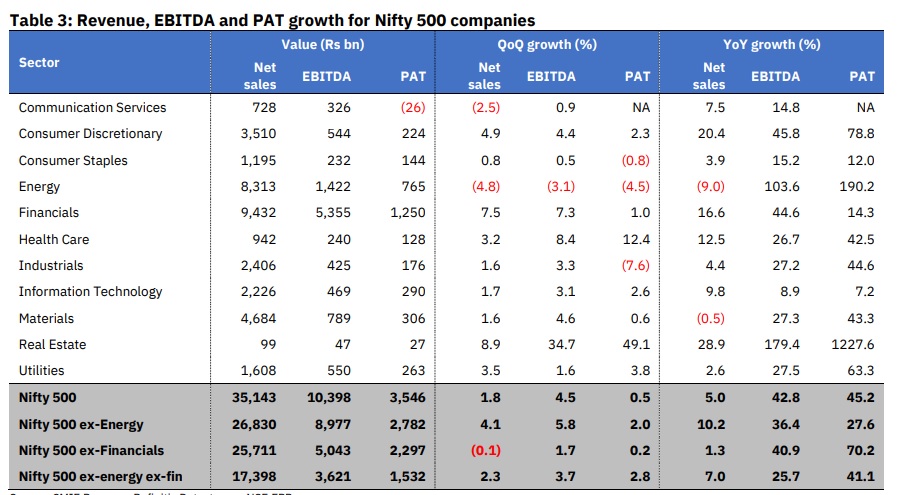

Margin tailwinds drove profits higher: The top line growth of Nifty 50/Nifty 5003 universes slowed to a 11-quarter low of 7.3%/5% YoY in Q2FY24, with expansion mainly led by Financials, and Consumer Discretionary. Excluding these two, revenue growth declined by 1.2% YoY for both Nifty 50 and Nifty 500 universes. Strong credit offtake provided a boost to the topline for Financials, while Consumer Discretionary benefited from strong demand for autos and discretionary services. Aggregate EBITDA growth for non-financial Nifty50/Nifty500 grew by a robust 30.4%/40.9% YoY, albeit off a low base, owing to margin tailwinds emanating from cost cutting initiatives and falling input prices. This led to a strong 36.1%/45.2% YoY growth in aggregate adjusted PAT for the Nifty 50/Nifty 500 companies, primarily attributed to Energy, and Consumer Discretionary. These two sectors together contributed to more than half of the YoY expansion in aggregate profit, excluding which PAT growth came in at much lower 19.4/24.5% YoY for Nifty 50/Nifty 500 companies, thanks to higher interest expenses. Domestic cyclical sectors including Financials, Industrials, and Consumer Discretionary have benefited from resilient domestic demand and reviving capex cycle, while commodity and export-oriented sectors including Materials and Information Technology have continued to face headwinds from weakening global economy and falling commodity prices. This is also reflected in continued downgrades in IT and Material sectors, excluding which aggregate profit estimates of top 200 companies by market cap rose by 1.9% and 0.3% for FY24 and FY25 respectively since September-end. This translates into an expected aggregate profit growth of 28.5%/14.0% in FY24/FY25, implying an earnings CAGR of 21% during FY23-25. The Earnings Revision Indicator4 (ERI) has also moved into the positive territory following a strong Q2, implying higher number of upgrades than downgrades. This was on the back of upgrades in Consumer Discretionary, Energy and Industrials that have outnumbered the downgrades in Information Technology, Materials and Consumer Staples. Weakening global growth is likely to continue to remain an overhang on export-oriented and commodity sectors. On the positive side, strong festive demand, continued government’s thrust on capex and improvement in private capex, thanks to strengthened balance sheets and healthy banking sector, should support corporate earnings. further aided by easing price pressures.

Aggregate adjusted PAT growth for the Nifty 50/Nifty 500 companies expanded 36.1%/45.2% YoY and 1.2%/0.5% QoQ. This was primarily led by Energy, and Consumer Discretionary, together contributing to 59%/54.3% to the YoY expansion in aggregate profit for Nifty 50/Nifty 500 companies. Excluding these two, PAT growth actually came in at much lower 19.4/24.5% YoY, partly attributed to higher interest expenses. Interest expenses for the Nifty 500 ex Financials universe rose by 14.4% YoY, higher than 8.6% jump for the top 50 companies.

Our analysis of earnings performance of top 200 covered companies by market capitalisation show that aggregate profit estimates for FY24 and FY25 were revised upwards for most sectors barring Materials (Metal, Chemicals) and Information Technology. Worsening global demand and continued slowdown in China have weighed on earnings for IT and commodity-focused companies. Excluding these two sectors, comprising of about 21% to overall earnings, aggregate profit estimates of top 200 companies rose by 1.9% and 0.3% for FY24 and FY25 respectively. The upgrades were primarily led by Energy, Financials and Consumer Discretionary. With this, the aggregate earnings of the top 200 companies are now expected to increase by 28.5% and 14.0% in FY24 and FY25 respectively, following a modest 3% PAT growth in FY23, implying an earnings CAGR of 21% during FY23-25. Sector-wise, Financials is expected to contribute nearly 30% to the absolute earnings change over FY23-25, followed by Energy at 27.4% and Consumer Discretionary at 15%, together contributing 72%, much higher than their combined share of 59% to total earnings.

After a sharp drop following the onset of the Russia-Ukraine war in February 2022, the Earnings Revision Indicator (ERI) for the Nifty 50 universe picked up meaningfully in the second half of 2022, indicating higher number of upgrades than downgrades. This was aided by resilient economic performance, strong Government capex and robust credit offtake by banks. Since then, the ERI has hovered in a tight range, and has moved into positive territory now after a strong Q2. This was on the back of upgrades in Consumer Discretionary, Energy and Industrials that have more than made up for downgrades in Information Technology, Materials and Consumer Staples.

Interest expenses

Interest expenses is likely to remain a concern for the India Inc. as transmission of the cumulative 250bps increase in policy repo rate gains strength. Interest expenses rose by 39.3%YoY for Nifty500 ex. Financials vis-à-vis 30.8% increase in top 50 companies implying

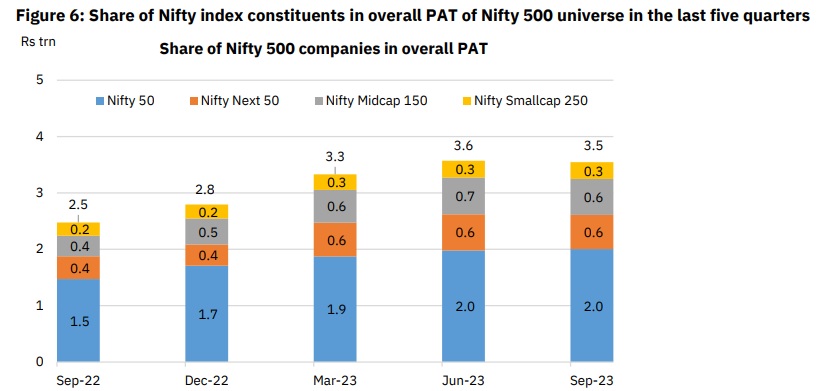

higher cost of funds for smaller companies. The aggregate adjusted PAT for the Nifty 500 companies increased by 45.3% YoY to Rs3.5trn in Q2FY24 vs. (-)10.1% YoY in Q2FY23 and 50.7% in Q1FY24. PAT margins expanded by 281bps YoY while declining marginally over the last quarter (-12bps) to 10.1%. Cyclicals like Financials, Energy and Cons. Discretionary sectors were major contributors to the profit growth in the quarter gone by. For the top 50 companies, PAT increased by 36.2%YoY led by Consumer Discretionary (driven by growth in auto sector), energy, materials and industrials.

Share of Nifty index constituents in overall net sales of Nifty 500 universe in Q2FY24

The share of Nifty 50 companies in the overall net sales of Nifty 500 companies is a significant 49%, while the next 50 companies contribute 22%. Nifty 50 companies have contributed nearly 70% of the YoY growth in net sales of Nifty 500 universe in Q2FY24.

Earnings revision analysis

Consensus FY24/25 aggregate PAT estimates upgraded downgraded marginally: Resilient discretionary demand and strong credit offtake, coupled with margin tailwinds emanating from lower commodity/fuel prices and continued focus on improving cost efficiency, have translated into a strong profit growth for India Inc. in the quarter gone by, partly offset by weak rural and external demand. Our analysis of earnings revisions of top 200 covered companies by market capitalisation6 show that aggregate profit estimates for FY24 and FY25 were revised upwards for most sectors barring Materials (Metal, Chemicals) and Information Technology. Worsening global demand and continued slowdown in China have weighed on earnings for IT and commodity-focused companies. Excluding these two sectors, comprising of about 21% to overall earnings, aggregate profit estimates of top 200 companies rose by 1.9% and 0.3% for FY24 and FY25 respectively. The upgrades were primarily led by Energy, Financials and Consumer Discretionary. With this, the aggregate earnings of top 200 companies are now expected to increase by 28.5% and 14.0% in FY24 and FY25 respectively, following a modest 3% PAT growth in FY23, implying an earnings CAGR of 21% during FY23-25. Sector-wise, Financials is expected to contribute nearly 30% to the absolute earnings change over FY23-25, followed by Energy at 27.4% and Consumer Discretionary at 15%, together contributing 72%, much higher than their combined share of 59% to total earnings.

Authors Tirthankar Patnaik, PhD; Prerna Singhvi, CFA; Ashiana Salian, Prosenjit Pal, Smriti Mehra, Ansh Tayal, Anand Prajapati, Shuvam Das, Isha Sinha

(To be continued)

(This report is intended solely for information purposes. This report is under no circumstances intended to be used or considered as financial or investment advice, a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset. The Report has been prepared on best effort basis, relying upon information obtained from various sources. NSE does not guarantee the completeness, accuracy and/or timeliness of this report neither does NSE guarantee the accuracy or projections of future conditions from the use of this report or any information therein. In no event, NSE, or any of its officers, directors, employees, affiliates or other agents are responsible for any loss or damage arising out of this report. All investments are subject to risks, which should be considered prior to making any investments.)