INR is trading stronger today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, June 11, 2024: Global markets await key US CPI report and the outcome of Fed policy meet this week; even as latest US jobs data dented prospects of a rate cut. While the Fed is expected to keep rates unchanged in this meeting, focus will be on any update to Fed’s economic projections. US headline CPI is expected to moderate to 0.1% from 0.3% in Apr’24 (MoM). In Eurozone, the French President called for a snap election which spooked investor sentiment. Bank of Japan also meets this week and while no rate action is expected, focus will be on BoJ’s bond purchase programme which is widely expected to be curtailed. In India, the Prime Minister allocated portfolios to the Union Cabinet ministers. Separately, CPI report due tomorrow is likely to show a marginal pickup in inflation led by higher food inflation.

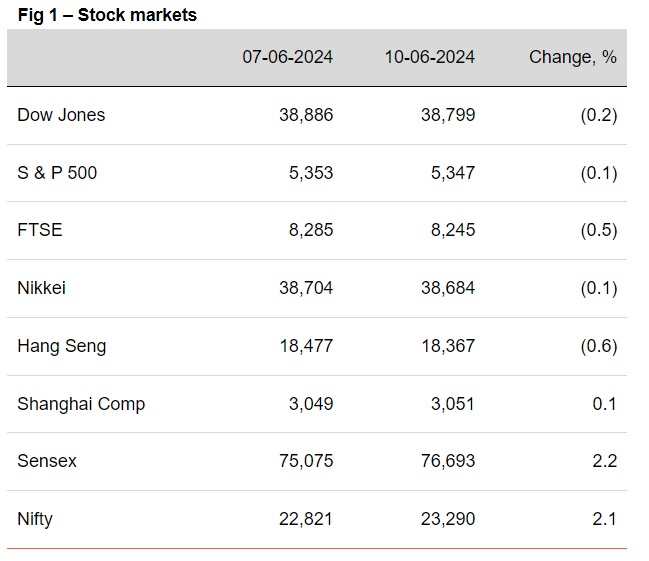

§ Except China and India, global indices ended lower. Investors remained cautious as a firmer dollar weighed on sentiments, buoyed by better-than-expected payroll numbers and earnings data in the US. Political uncertainty in the Eurozone also impacted investor sentiments. Hang Seng fell the most, followed by FTSE and US stocks. Sensex rose by 2.2%. It is trading lower today, while Asian stocks are trading mixed.

§ Global currencies broadly closed weaker against the dollar. DXY edged up by 0.3% ahead of Fed meeting and US CPI data. EUR depreciated the most amidst political uncertainty in France. INR too fell by 0.2% as oil prices inched up. However, it is trading stronger today, while other Asian currencies are trading mixed.

§ Global yields closed higher. Japan’s 10Y yield rose at the sharpest pace as market is anticipating fresh guidance on tapered bond buying. Expectation of a deferred rate cut by Fed impacted global 10Y yields. ECB Chief also hinted at a cautious approach on rates. India’s 10Y yield rose by 2bps. It is trading at 7.02% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)