Sensex is trading higher today

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, May 6, 2024: Non-farm payrolls in the US rose by 175k in Apr’24, much lower than estimated 240k and also lower than 315k in Mar’24. Unemployment rate also rose, to 3.9% in Apr’24 from 3.8% in Mar’24. Average hourly earnings also rose at a slower pace, by 0.2% (MoM) in Apr’24 versus 0.3% in the previous month. Separately, ISM services index fell to 49.4 from 51.4 in Mar’24, led by steep decline in new export orders, and employment. All these data points suggest that economic activity in the US is indeed slowing and has solidified hopes of a rate cut by the central bank in Sep’24 (48.8% chance as per CME FedWatch tool). Elsewhere in Asia, China’s Caixin services PMI also suggests slowdown in activity with index moderating to 52.5 in Apr’24 from 52.7 in Mar’24. In Australia too, services activity has slowed with PMI easing to 53.6 from 54.2 in Mar’24. This week, markets await BoE and ECB rate decisions.

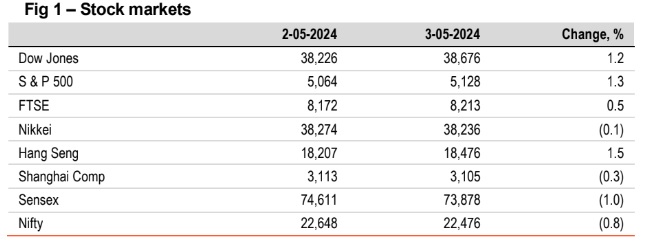

Global stocks ended mixed. US indices closed in green after softer than expected jobs report raised bets of Fed cutting rates earlier than anticipated.

Hang Sang gained the most, supported by rally in tech stocks. Sensex declined by 1%, dragged down by losses in real estate and capital good stocks. However, it is trading higher today, in line with other Asian stocks.

Barring INR (flat) and CNY (lower), other global currencies ended higher. DXY dropped by 0.3% after the data reported lower job addition in Apr’24 and unemployment inched up to 3.9% (3.8% earlier). Amidst reports of possible intervention by government authority, JPY strengthened by 0.4%. INR ended flat. However, it is trading stronger today, in line with other Asian currencies.

Global yields closed sharply lower, led by 7bps decline in US 10Y yield. Less hawkish comments from Fed in their policy and weaker than anticipated employment data, impacted investor sentiments. Weak growth outlook for Europe also played a role. India’s 10Y yield fell by 1bps. Today, following global cues, it is trading even lower at 7.13%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)