Market Pulse April 2024

Tirthankar Patnaik, PhD

Chief Economist

National Stock Exchange of India Limited

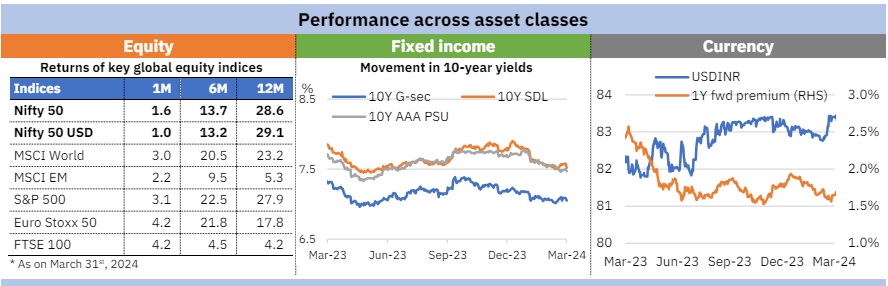

Mumbai, April 29, 2024: Indian markets ended the fiscal year FY24 up a solid 29%, after a tepid March that saw the benchmark index Nifty 50 rise 1.6%. The last fiscal, with flat returns was different, while the previous two fiscal years had delivered bumper returns; the Nifty 50’s five-year CAGR stands at 14% now.

Market perceptions generally tend to look at calendar years somewhat more, and from that perspective, India’s 20% return in calendar 2023 was the 8th consecutive year of positive returns, unlike many major markets like the US, Japan, China, etc. In fact, the Indian markets have delivered positive returns in the past 20/25 years. Over 80% of the 9.2 crore investors we have in the markets today have joined after 2015, the last year of negative returns.

From a fiscal year perspective, however, FY24 has been standout year, on almost all fronts. A new record 1.8 crore investors joined the markets this year, second only to the 1.9 crore we saw in FY22. Trading activity rose significantly across both cash and derivatives, and fund mobilisation was up 28% to Rs 2 lakh core in equity and Rs 13.8 lakh crore overall. Beyond the NIFTY50’s, the Nifty Next 50 index’s performance was even better, at 60%. NSE has recently introduced derivatives on this index; this edition of the Pulse includes a white paper from the Product team. Please see our Story of the Month for a comprehensive review of the markets and macro in the fiscal gone by. We plan to introduce an annual review of the markets soon, with long-term data and insights.

Continuing with investors, activity levels eased in March across the board, reflecting the general weakness seen in the markets in March—advance/decline of stocks for the month at 0.75 was the lowest since February 2023 (0.69). Turnover in the cash markets fell 24% to Rs18.6 lakh crore (Average Daily Turnover (ADT) below Rs 1 lakh crore), 11% for equity futures and 25% to Rs12.5 lakh crore for equity options. Participation fell too—down 19% to 1.2 crore in cash, and -9% to 43 lakh for the equity options market. The pace of new investor additions dropped as well. The top 25 states added 15.7 lakh of them, in contrast with over 20 lakh added in each of the previous three months. Individual investors were sellers for the month, in line with foreign investors, but in stark contrast with domestic institutions, whose inflow peaked for the year at Rs 36,660 crore.

In March, global equities saw consistent returns, supported by strong corporate earnings in the US and expectations of monetary easing amid decreasing inflation. The MSCI World Index rose by 3.0%, driven by widespread gains, though it faced corrections in April due to increasing geopolitical tensions. Emerging markets lagged, with the MSCI EM Index up by 2.2%, bolstered by significant gains in AI technology stocks in Taiwan and improvements in Chinese and Indian equities. However, global debt markets experienced a sell-off in April, influenced by intensified geopolitical issues and hawkish US Federal Reserve comments delaying expected rate cuts. Notably, the Bank of Japan concluded its negative interest rate policy, raising its benchmark rate for the first time in 17 years. We had written about this in the previous edition of the Pulse. In contrast, Indian equities, as we have mentioned above, showed modest improvement in March, supported by steady economic fundamentals and both foreign and domestic investment, despite sell-offs in mid and small-cap sectors due to concerns over high valuations and regulatory directives.

On the macro front, the Indian economy concluded the past fiscal year on a robust note, driven by strong business and consumer sentiments, sustained public investment, easing inflation, and a favourable external environment. However, extended geopolitical tensions and persistent high real interest rates pose risks to the growth trajectory. The RBI MPC kept interest rates stable at 6.5% in April amid mixed views on future rate cuts. March saw a decrease in headline inflation to 4.9%, with a reduction in all groups, although Food and Beverages inflation remained high. Core inflation also declined, reflecting subdued prices across its components.

Erratic weather and ongoing geopolitical conflicts, however, could push inflation higher. Wholesale Price Inflation (WPI) slightly increased due to reduced disinflation in Fuel and Power and Manufacturing goods. Industrial production grew by 5.7% year-on-year in February, slightly below expectations, with all sectors expanding year-on-year but contracting sequentially. Rural demand showed signs of weakness, as indicated by the production gap between consumer durables and non-durables. Manufacturing and Services sectors remained strong as per PMI figures. The government's fiscal deficit widened to Rs 15 lakh crores by February 2024, though tax increases suggest the fiscal targets for the year are likely achievable.

While the ECB could still cut rates in summer, the wait from the Fed looks all set to get longer. The rise in the dollar continues to pose a worry for growth prospects in EMs and their central bankers. The recent 5.3% GDP print in China is a positive; we have written earlier about cheaper imports from China and implications on global inflation. Countries in Asia and Latin America, like Brazil, Peru and Chile, Mexico have nearly a fifth of their imports from the Middle Kingdom. Closer home in Asia, Japan, Indonesia and Malaysia have seen lower inflation given their trade with China. Far more detail in our global macro section of the report.

In the Insights section, apart from the paper on Nifty Next 50 derivatives, NSE Indices has a position paper on the exciting world of Alternative Investment Funds (AIFs). We also have three others in the field of Behavioural Science, summarised by the CBS team at IIM Ahmedabad. The first paper finds financial literacy to be a better predictor of happiness than income, the second asks if securities designed specifically for households with low risk-appetites can improve their participation in the security markets (Yes, they do), and the last paper examines the effectiveness of a negative interest rate policy, or NIRP.

Our marker from the tech world this month involves a shift to hardware, specifically to the semiconductor world, colloquially also known as ‘chips’. The importance of semiconductors in our lives, and the tenuous nature of global supply chains became apparent during the pandemic when industries like Automobiles saw production halts on lack of availability of vital components and countries realised their vulnerability to emerging geopolitical realities. Legislative measures like the US CHIPS Act seek to support domestic semiconductor production. In India, the need for shift in semiconductor trade dynamics (imports to exports) has been long felt. Policy measures like the PLI (Production Linked Incentives), DLI (Design-Linked Incentive) schemes, SPECS (Scheme for Promotion of Electronic Components and Semiconductors) and the US$10bn National Semiconductor Mission launched in 2021 involve setting up of fabrication facilities in India, reduce import dependence, and secure supply of crucial raw materials.

India is a late entrant to a complicated global semiconductor industry that has entrenched players and entry barriers remain very high. Having said that, the arrival of made-in-India iPhones point to early growth and success that would need to be maintained in the years ahead. On that hopeful note, we bring you the April edition of the Market Pulse. As always, we welcome your comments and suggestions.