Sensex is trading higher today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, June 13, 2024: US CPI remained unchanged in May’24 (est. 0.1% increase), after increasing by 0.3% in Apr’24 on a YoY basis. Core CPI too moderated to 0.2% from 0.3% in Apr’24. Even so, the Fed remained cautious and indicated the possibility of only a single rate cut in 2024, down from 3 rate cuts expected at the beginning of the year. Notably, while the Fed kept its growth forecasts unchanged, inflation estimates (PCE and Core PCE) for both 2024 and 2025 were revised up by 20bps and 10bps respectively. Separately, unemployment rate in Australia eased to 4% in May’24 from 4.1%, providing some comfort to policy makers. In UK, GDP growth was flat in Apr’24 following a 0.4% rise in Mar’24. In India, CPI inflation eased marginally to 4.75%, led by lower core inflation despite sticky food inflation. IIP growth eased to a 3-month low at 5% from 5.4% in Mar’24, due to moderation in manufacturing output.

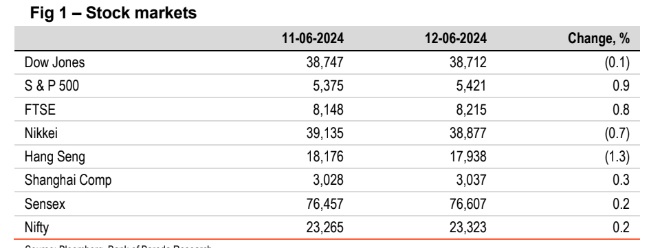

§Global equity indices closed mixed. Investors remained cautious tracking Fed policy which showed that majority of FOMC members favoured one quarter point cut in CY24, down from three earlier. Easing US CPI also impacted investor sentiments. S&P 500 and FTSE inched up. Hang Seng moderated amidst reports of 38% tariff hike on Chinese EVs by EU. Sensex rose by 0.2%. It is trading higher today, while other Asian stocks are trading mixed.

§ DXY snapped its 3-day streak and ended lower after a weaker than expected US inflation report. EUR gained the most by 0.6% amidst hawkish comments from ECB officials. INR appreciated marginally. It is trading further stronger today, in line with other Asian currencies.

§ Except China and India (stable), global yields closed lower. UK’s 10Y yield fell at the sharpest pace as GDP data remained flat and industrial production weakened, strengthening the case for rate cut to support growth. 10Y yields in US and Germany fell by 9bps each, as Fed dot plot suggested faster pace of rate cuts in CY25. India’s 10Y yield is trading lower at 6.99% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)