The market is expecting the Fed to begin the easing cycle from Sep’24 onwards

Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, June 19, 2024: Retail sales in the US inched up at a much slower pace than anticipated at 0.1% in May’24 (estm: 0.3%). This was attributed to the drop in sales at gasoline stations (-2.2% in May’24) on the back of lower gasoline prices and lower sales in furniture and home furnishing. This also signalled that consumers are cutting down on discretionary spending due to higher prices and interest rates. Also, banks have been tightening credit access towards low-income borrowers. Against this, the market is expecting the Fed to begin the easing cycle from Sep’24 onwards. BoJ in the minutes highlighted, there remain upside risks to inflation from weaker Yen, tight labour market and expansionary fiscal policy. It also noted currency movement is amongst key a factor impacting the economy and prices.

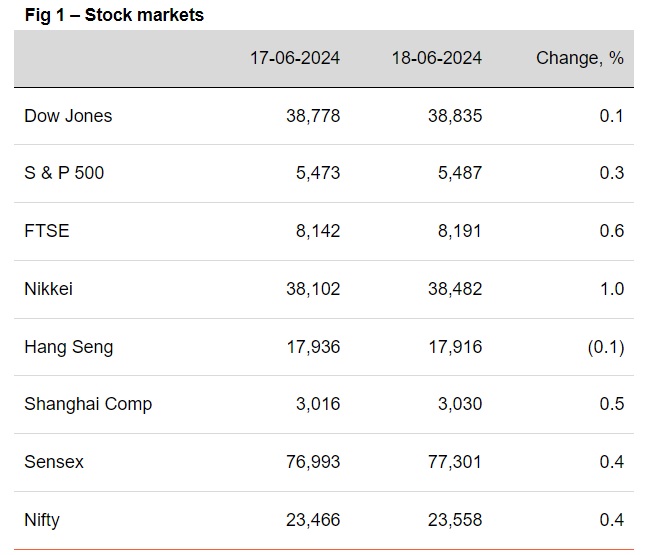

§ Barring Hang Seng, other global equity indices closed mixed. US indices inched up supported by rally in financial stocks and gains in AI stocks. Awaiting the result of rate decision by BoE, European stocks climbed higher, with gains in construction stocks. A rally in real estate and consumer durable stocks, pushed Sensex higher. It is trading higher today, in line with other Asian stocks.

§ Global currencies closed mixed. DXY fell by 0.1%, tracking weakness in US macros and due to increased probability of rate cut (67%) by Fed in Sep’24. INR and EUR gained the most against the dollar, while JPY fell. INR appreciated by 0.2%, supported by FPI inflows. It is trading even stronger today, while other Asian currencies are trading mixed.

§ Except Japan (higher), other global yields closed lower. UK and US 10Y yield fell the most. Weaker than expected retail sales data in the US, and the hopes of UK inflation nearing 2% mark, led to dip in yields. India’s 10Y yield fell, even as oil prices rose. Tracking global cues, it is trading even lower today at 6.97%.