Services activity remains solid in India (most robust growth in 14 years) and balanced in Japan

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, May 7, 2024: Softer than expected labour market data in the US has refuelled hopes of maybe 2 rate cuts (cumulative 50bps) by Fed this year. Probability of rate cut in Sep’24 has also risen to 66.6% as per CME FedWatch Tool. This has led to sharp decline in global yields and US$. As a result, gold prices have gained. Markets now await rate decision of BoE. In Europe, services activity seems to be rebounding with Eurozone PMI at 11-month high of 53.3 in Apr’24 versus 51.5 in Mar’24. Germany and France also noted improvement in performance. This is driven by renewed domestic demand, as new export orders continue to dip. Notably, price pressures are also seen reviving, which could pose a concern for Central Banks. Elsewhere in Asia, activity remains solid in India (most robust growth in 14 years) and balanced in Japan (PMI at 54.3 versus 54.1).

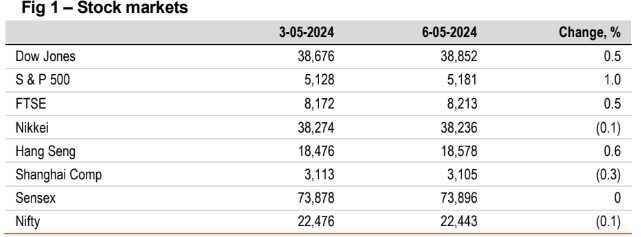

§ Global stocks ended mixed. Recent commentary by Fed officials buoyed some hopes of a possible rate cut by Fed this year, with inflation remaining sticky. US stocks advanced higher supported by gains in energy index. Hang Sang continue to climb higher. Sensex virtually ended flat with gains in real estate stocks. It is trading higher today, in line with other Asian stocks.

§ Global currencies ended mixed. DXY remains steady post softer than expected jobs report and the focus shift towards commentary by Fed officials and consumer confidence index. JPY weakened by 0.6%. INR depreciated by 0.1% amidst a rise in oil prices. However, it is trading stronger today, in line with other Asian currencies.

§ Global yields fell sharply, led by 9bps decline in US 10Y yield. Smaller than expected job additions in the US have revived hopes of 2 rate cuts by Fed this year. Probability of a rate cut in Sep’24 has also increased to 66.6%. India’s 10Y yield fell by 5bps, following global cues. It is trading flat today at 7.11%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)