Equity Markets Saw Steepest Fall Since March 2020

FinTech BizNews Service

Mumbai, June 4, 2024: It was one of the steepest fall in recent times in the markets today. According to Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd, "Indian equity markets saw the steepest fall since March 2020 as the initial trend showed the BJP winning a lesser number of seats than predicted in exit polls, causing nervousness. Finally, Nifty settled the day on a negative note at 21,884.5. The volatility index (VIX) hit its highest level since February 2022, reaching 31.71. Technically, the index confirmed a hanging man candle and remained below it, indicating weakness. The index will find immediate support around 21,800 levels, followed by 21,250, where the 200-DEMA is located. Conversely, in the near run, the levels 22,800 and 23,340 will serve as significant obstacles.

The Bank Nifty index opened on a negative note and remained under pressure throughout, finally settling the day on a negative note at 46,928.60. Technically, the Bank Nifty has sustained below a low of hanging man candlestick pattern, leading to weakness. On the downside, 100-DEMA is placed near 46,350, which will act as key support, with resistance near 51,130 levels."

Ruchit Jain, Lead Research, 5paisa.com, explains: “Nifty corrected sharply throughout the day as the election results outcome differed significantly from the exit polls and market participants’ expectations. It was one of the steepest fall in recent times as Nifty and Sensex corrected by over 5 percent and the former index ended the day below 22000 mark.

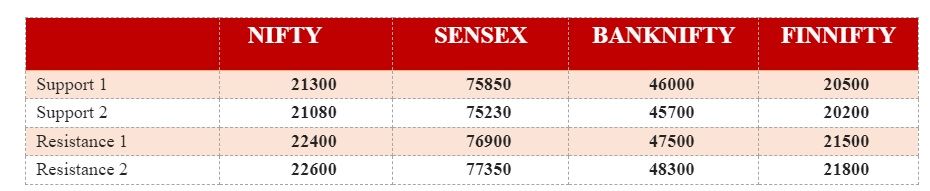

Markets took a complete u-turn as compared to Monday’s session where market participants cheered the exit polls. The broader markets had already seen a rally ahead of the event in last few months and as the result outcome seemed to differ from expectations, traders started unwinding of long positions which resulted in a sharp correction. The recent outperformers from the PSU space were most beaten down counters resulting in over 15 percent correction in the PSE index. Meanwhile, INDIA VIX rallied to surpass the 30 mark, but settled around 26 at closing. Now until we see buying momentum resuming on the markets, it would be difficult to predict the near-term trend. Technically, Tuesday’s low of 21280 will be seen as immediate support followed by 21080 which is the retracement support. On the higher side, 22400-22600 will be seen as immediate resistance zone. As of now, traders should wait on sidelines for the volatility to settle down.”