In the data heavy week, markets traded cautiously

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, April 3, 2024: In the data heavy week, markets traded cautiously. Amongst major macro prints, in the US, JOLTS job openings rose by 8,756K (est.: 8,730K). Factory orders of the region also rose more than expected by 1.4% (est.: 1%) in Feb’24. Two Fed officials (San Francisco and Cleveland Fed President) spoke of easing albeit no rush to lowering borrowing cost. Swap traders have also pared down expectations of their earlier quantum of rate cuts. Elsewhere, in UK, manufacturing PMI entered expansion recording 50.3 (est.: 49.9). In Germany, CPI moderated. In China, Caixin services PMI inched up to 52.7 from 52.5, supported by fastest pace of increase in new business in the last three months. On domestic front, India’s manufacturing PMI rose to its 16 year high supported by buoyant production and sales.

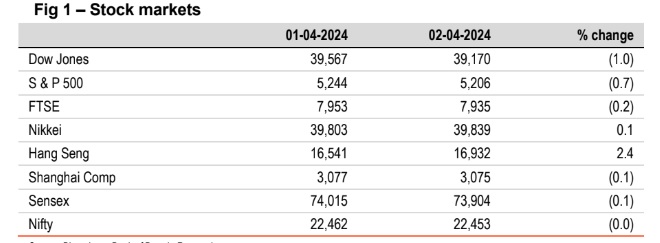

§ Barring Nikkei and Hang Seng, other global indices ended in red. Strong macro data from US has led to speculation of a delay in Fed rate cut cycle. This view was also reinforced by an uptick in global commodity prices. Stocks in US fell the most, with investors awaiting comments from Fed Chair. Despite a strong pickup in manufacturing PMI, Sensex fell by 0.1%. Technology shares led the decline. It is trading further weaker today, following its Asian peers.

Except CNY, other currencies appreciated broadly against the dollar. DXY fell by 0.2% despite stronger than expected macro data (job opening and factory orders). Investors await comments from Fed Chair later in the day. EUR gained even as manufacturing PMI slipped further to 46.1 from 46.5 in Feb’24. INR is trading at similar levels today, while other Asian currencies are trading mixed.

Except China (tad lower), global yields closed higher. Germany and UK’s 10Y yield rose the most. In Germany, even a moderation in CPI and inflation expectation data of Eurozone could not arrest the increase in yields. 10Y yield in the US also rose tracking macro data. India’s 10Y yield also inched up monitoring higher crude prices. It is trading at 7.11% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)