INR is trading weaker today

Sonal Badhan

Economist,

Bank of Baroda

Mumbai, June 4, 2024: US ISM manufacturing index slipped to 48.7 (est.: 49.6) in May’24 from 49.2 in Apr’24, on account of contraction in new orders and production. Employment and new export orders improved. Further, government data shows that construction spending fell by (-) 0.1% in Apr’24 (est.: +0.2%), following (-) 0.2% decline in Mar’24. Both private construction (mainly commercial) public construction spending was down. These data points have revived hopes of rate cut by Fed in Sep’24 (CME FedWatchTool reflects 51% probability of 25bps cut). Separately, in Eurozone and Australia, manufacturing activity continued to contract, albeit at a softer pace, signalling some stabilization in conditions. In UK, activity rebounded in May’24. Domestically, results of general elections are awaited today.

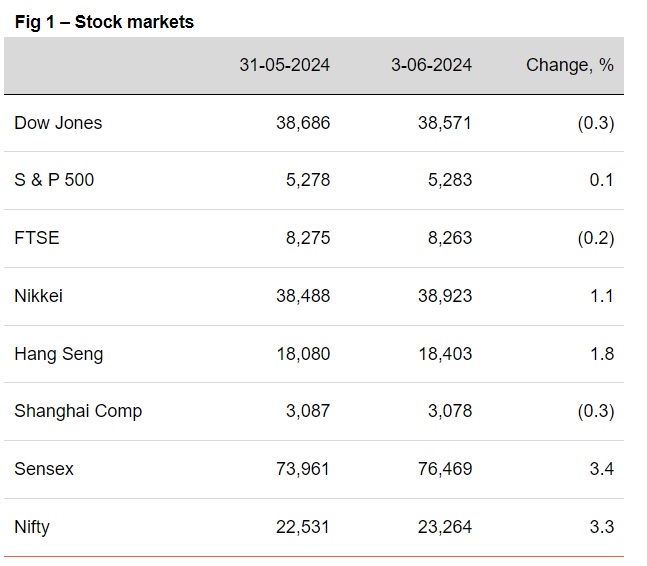

§ Global indices ended mixed. Dow Jones ended lower as investors monitored softer US manufacturing data. FTSE too ended in red with the focus shifting towards the ECB's policy decision. Sensex surged to a record high led by strong GDP print and the exit poll trends. However, Sensex is trading lower today in line with other Asian indices.

§ Barring CNY (flat), other global currencies ended lower against the dollar. The greenback retreated amidst subdued data print (slowdown in US manufacturing for 2nd straight month) and this raised hopes of a possible rate cut. JPY and EUR strengthened. INR appreciated after oil prices slipped. However, it is trading weaker today while other Asian currencies are trading mixed.

§ Except Japan (flat), global yields closed sharply lower. US 10Y yield fell the most (-11bps), followed by UK and Germany. Weaker than expected manufacturing survey data has revived hopes of a Fed rate cut in Sep’24. Following a steep decline in oil prices, India’s 10Y yield also fell by 4bps. However, it is trading higher today at 7.02%, ahead of general election results.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)