INR is trading a tad stronger today

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, June 14, 2024: Providing fresh cues of abating inflationary pressures, PPI inflation in US declined unexpectedly by 0.2% in May’24 (est. +0.1%) following a 0.5% increase in Apr’24. Separately, US weekly jobless claims rose to 242,000 (est. 225,000), to the highest level since Aug’23, suggesting a weakening momentum in the labour market. Together, the data has brought back a Sep’24 rate cut back in play. Notably, updated projections by the Fed indicate that the central bank is likely to undertake only a 25bps rate cut in 2024. Separately, Bank of Japan held its policy rates as widely expected. However, the central bank refrained from giving clarity on reducing its bond purchase programme, deferring the decision to its next policy meeting.

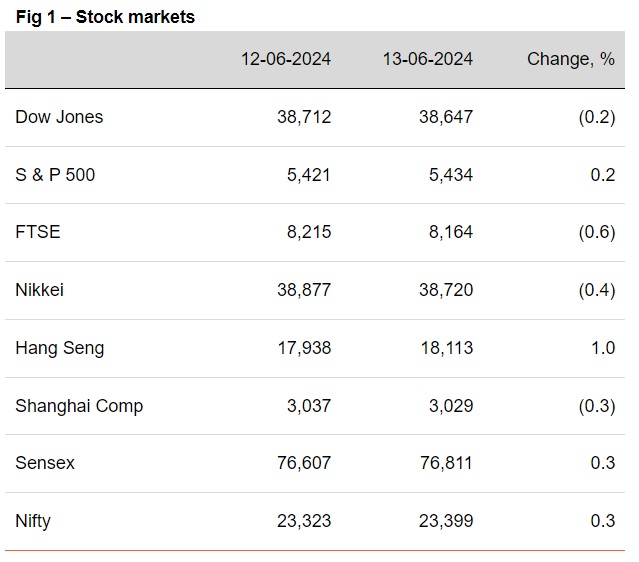

§ Global equity indices closed mixed. Investors remained cautious tracking US increase in US jobless and softening PPI inflation. Reports of China’s retaliatory actions against EU tariff also impacted investor sentiments. Investors also await clarity on BoJ’s approach to reduction in bond purchase, which remains hazy. Hang Seng inched up, while European stocks moderated. Sensex rose by 0.3%. It is trading lower today, while Asian stocks are trading mixed

§ Global currencies depreciated against the dollar. DXY rose by 0.5% even as US PPI unexpectedly declined in May’24. EUR depreciated the most by 0.7% as Eurozone’s industrial production in Apr’24 was weaker than expected. INR ended little changed. It is trading a tad stronger today, while other Asian currencies are trading mixed.

§ Except UK (stable), global yields closed lower. US 10Y yield fell at the sharpest pace by 7bps supported by softening PPI and higher jobless claims data. 10Y yield in Germany also showed moderation amidst expectation of a faster pace of easing in global monetary policy in CY25. India’s 10Y yield fell by 2bps. It is trading lower at 6.98% today, ahead of the weekly auction results.