Sensex trading lower today

Equity market rally in the US was driven by tech stocks

Bob Chart 10 nov

Bob Chart 10 nov

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, November 13, 2023: Hawkish comments from Fed Chair on the trajectory of inflation has again spurred some bit of selling in the bond market. The upcoming CPI inflation data is crucial for market to get some cues. In a separate release, University of Michigan’s, both 1 and 5Year inflation expectation firmed up signalling some un-anchoring. In UK, Q3 provisional estimate of GDP remained flat better than anticipated contraction of 0.1%. Equity market rally in the US was driven by tech stocks. However Asian stocks remained cautious eyeing US-China talks. On domestic front, all eyes will be on CPI data release (market expectation: 4.8%, BoB estimate: 4.7%).

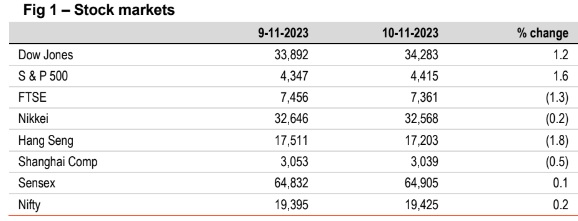

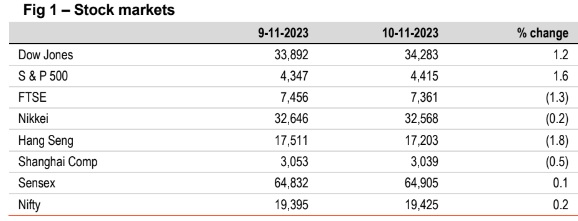

- Global stocks closed mixed. A host of factors starting from hawkish comments of Fed Chair on inflation trajectory to earnings report and also macro data releases (inflation expectation data in the US and GDP print in UK), impacted market sentiments. S& P 500 rose the most followed by Dow Jones, pulled up mostly by tech stocks. Asian stocks were trading lower. Sensex rose by 0.1%. It has further risen by 0.5% in the Muhurat trading session. It is trading lower today, while other Asian stocks are trading mixed.

- Global currencies closed mixed. DXY remained flat as cautiousness prevailed before the release of US CPI data. EUR appreciated by 0.2% awaiting comments from ECB Vice President. JPY depreciated by 0.1% tracking comments from BoJ Governor who said that some distance is yet to cover before reaching 2% inflation target sustainably. INR also depreciated by 0.1% due to FII outflows. It is trading higher today, in line with other Asian currencies.

- Except China (flat), global yields closed higher. Hawkish comments from Fed Chair has spurred selling spree in the market once again. UK’s 10Y yield rose the most by 6bps as GDP data showed some momentum in economic activity. US 10Y yield rose by 3bps as inflation expectation remained firm. India’s 10Y yield rose by 2bps, ahead of CPI data. It is trading at the same level today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)