Public Insurers Outpace Muted Industry Growth

FinTech BizNews Service

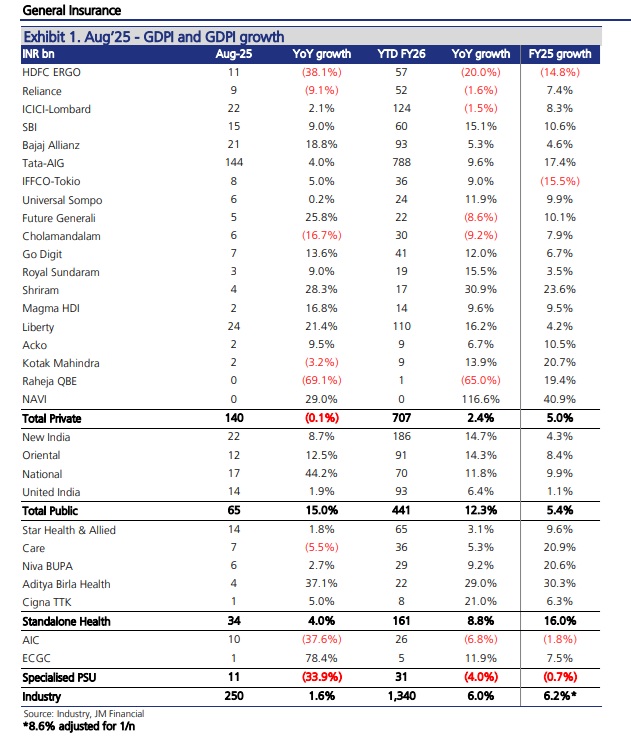

Mumbai, September 10, 2025: The general insurance industry continued to report weak growth in premiums with Aug’25 growth at 2% YoY, reporting INR 250bn on an unadjusted (reported) basis. This follows a growth of 3% YoY in Jul’25, resulting in YTD FY26 growth of 6% till Aug’25. Premiums for private, multi-line players were flat YoY while SAHI and public insurers grew 4% and 15% YoY, respectively, as per the research report published by JM Financial Institutional Securities.

Interestingly, public insurers have contributed 63% to the industry’s YTD growth while Private and SAHIs have only contributed 22% and 17%, respectively. Industry growth has tapered this year majorly due to decline in the crop segment (9% share) while the fire segment has seen strong growth (10% share). A book shift away from crop and towards fire should aid profitability. These growth numbers remain suppressed and we expect growth for the sector to be 3-4% higher on a like-to-like basis, once the base normalises from October. Despite a weak 2% growth in August, we prefer ICICIGI in the general insurance space.

Key multi-line players back to YoY growth:

Private multi-line players reported flat YoY premiums in Aug’25 vs. 3.3% decline in Jul’25; growth in PSUs was strong at 15% YoY vs. 3.4% YoY in Jul’25. Within private multi-line players, Bajaj Allianz reported strong growth of 19% YoY on the back of a 13.0% decline in Jul’25 while ICICI Lombard saw positive growth in premiums at 2.1% YoY after 2 consecutive months of decline (-10.4%/-10.2 YoY in Jun/Jul’25). Go Digit also continued healthy growth momentum at 14% YoY vs. 27% YoY in Jul’25.

SAHI growth moderated:

SAHIs grew at 4.0% YoY vs. 10.3% YoY in Jul’25. Amongst SAHIs, Star Health posted 2% YoY growth (vs. 3.3% YoY in Jul’25). For 1QFY26, Star’s growth, adjusted for 1/n accounting, came in at a respectable 13.2%, despite cutting down on the group business. Niva Bupa reported a weak growth of 3% YoY (vs. 10.0% in Jul’25) while Aditya Birla Health continued its strong growth momentum with 37% YoY growth (26.7% YoY in Jul’25 and 29% YTD FY26).

Valuations and view:

Despite weak growth, we prefer ICICI Lombard in the general insurance, valuing the insurer at 34x FY27e EPS of INR 67 to get a target price of INR 2,250. For Star Health, we wait for stability in claims for a couple of quarters, especially as claims ratios have been quite erratic in the monsoon. We have a HOLD rating on Star Health, valuing it at 21x FY27e EPS of INR 20 to get a target price of INR 420.