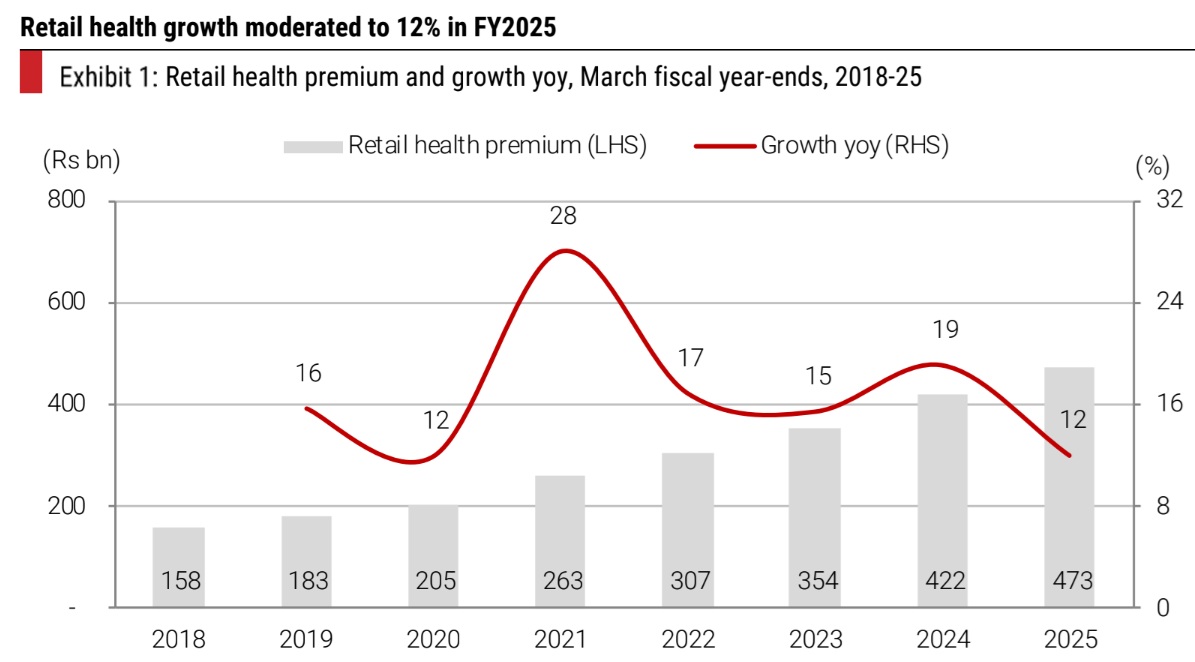

GST relief may drive modest tariff hike in health insurance

FinTech BizNews Service

Mumbai, September 5, 2025: The government has exempted GST on individual life and health insurance policies. A back-of-the-envelope calculation suggests that health insurance companies may need to raise tariffs by 3-5%; this will help the companies compensate for the loss of input tax credit that is currently availed of. At the same time, a 12-15% reduction in price for the customer can potentially boost health insurance demand. We await commentary from life and general insurance companies, as per the latest Kotak Institutional Equities report on Insurance.

Individual insurance policies will be exempt from GST

Individual life and health insurance policies, including reinsurance thereof, will be exempt from GST from September 22, 2025. Currently, health insurance policies are taxed at 18%. We expect health insurance costs to decline by about 12-15% (with 0% GST and 3-5% tariff hikes), which may help stimulate demand.

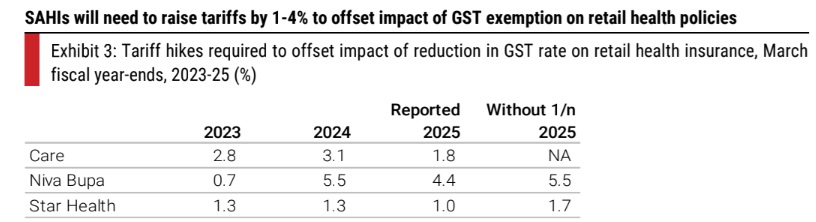

A back-of-the-envelope calculation suggests a 3-5% hike in tariffs (for new and existing retail policies) may be required by health insurance companies in order to make them margin-neutral. Companies currently claim input tax credit (ITC) on services utilized; these include distribution commissions, reinsurance and promotions/other operational expenses. While reinsurance service will also get exempted from GST, companies will continue to pay GST on others. In this calculation, we assume that the benefit of the inverted tax structure (ITS) cannot be claimed by insurance companies since these individual policies are ‘exempt’ and the ITS benefit for insurance is not notified by the government.

Star Health likely paid GST of Rs30 bn in FY2025; we assume 18% GST on all health policies for calculating the above. The company paid GST net of ITC of Rs26 bn in FY2025. In other words, ITC on services consumed by the company was Rs4 bn. The ITC benefit on items other than reinsurance, proportionate to the retail business, is now lost. In order to be margin-neutral, the company will need to raise tariffs by about 1-3%.

The impact of the change in the tax rate will likely be higher for Niva Bupa (4%) compared to Star Health (1%) owing to its higher expenses and ceding ratio. Niva Bupa operates at a higher EoM ratio of 39% (31% for Star Health) and a higher ceding ratio of 22% (7% for Star Health). This results in higher GST paid by Niva Bupa, which cannot be offset by input tax credits, as the GST is dropped to 0% on retail health policies. The tariff hike required by Care will likely be 2%.

Calling out a few risks

We see three risks in this scenario—

(1) tariff hikes may not be immediate but with a lag,

(2) some of the customers may use the one-month free look-back period to surrender policies sold last month and shift to newer, cheaper ones and

(3) multi-line insurance companies may have a lower impact, as some other business lines may partially absorb GST on shared services.