Mutual Funds Continue Backing Small-Cap Growth Stories: Ventura Securities

FinTech BizNews Service

Mumbai, 10 November 2025: According to a study by Ventura, a full-service stock broking platform, in the quarter ended on Sept 2025, the mutual fund industry has shown robust participation in newly listed companies, with total investments amounting to over 8,752 crores across recent IPOs.

A majority of these new entrants fall under the small cap category, with only one categorised as a mid cap.

The data shows the MF industry's allocation towards smaller, scalable businesses having the potential to deliver superior returns over time.

New Entrants –IPO | Market Value (Rs. in crores) | Categorisation |

Anthem Biosciences | 2,754 | Mid Cap |

Aditya Infotech | 1,272 | Small Cap |

JSW Cement | 1,039 | Small Cap |

Travel Food Services | 793 | Small Cap |

Urban Company | 777 | Small Cap |

Bluestone Jewellery And Lifestyle | 452 | Small Cap |

Saatvik Green Energy | 383 | Small Cap |

National Securities Depository | 363 | Small Cap |

Indiqube Spaces | 340 | Small Cap |

Vikram Solar | 326 | Small Cap |

Brigade Hotel Ventures | 253 | Small Cap |

Note: Companies with a market value above Rs. 20 Crore have been considered. From those, the top 10 according to market value are considered.

According to Ventura, given below is the Future Possibility of Changes in Market Cap as per AMFI's New Market Cap List

Mid Cap that could become Large Cap

Small Cap that could become Mid Cap

Indian Equity Markets and FII / DII Cashflows

Study also highlights that The Nifty50 fell by 3.6% in the Sept’25 quarter, compared to a rise of 8.5% in the previous quarter. The BSE Midcap & BSE Small-Cap indices fell by 4.1% & 4.6%, respectively, as opposed to rises of 12.8% and 17.3% in the previous quarter. During the Sept’25 quarter, Foreign Institutional Investors (FIIs) were net sellers to the extent of Rs 76.62 billion in the equity market (Rs. 38.67 billion net buyers in the previous quarter). Domestic Institutional Investors (DIIs) continued to be net buyers, marking a net inflow of Rs221.11 billion in the Sept’25 quarter (Rs141.62 billion net buyers in the previous quarter). From April to September 2025, FIIs saw net outflows of Rs37.9 billion, while DIIs remained strong buyers with Rs362.7 billion inflows. In the same period last year, FIIs had net inflows of Rs. 89.7 billion and DIIs invested Rs232.4 billion.

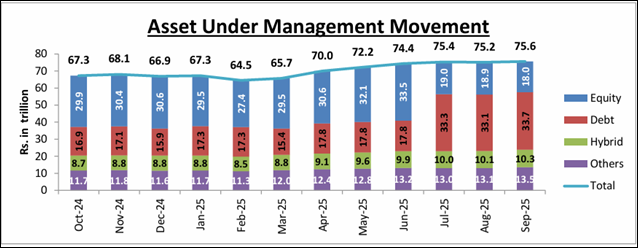

Overall Mutual Fund Industry

According to Study, For the Sept’25 quarter, equity schemes saw an inflow of Rs. 1,06,554 crores as compared to an inflow of Rs. 66,869 crores in the previous quarter. Debt schemes saw an outflow of Rs. 3,156 crores in the Sept’25 quarter vis-à-vis an inflow of Rs. 2,01,516 crores in the previous quarter. Once again, Hybrid schemes saw an inflow of ~Rs. 45,570 crores in the Sept’25 quarter, after an inflow of ~Rs. 58,235 crores in the previous quarter. Monthly SIP numbers touched an all-time high of Rs. 29,361 crores by the end of Sept’25 as compared to Rs27,269 crores in the month of June’25.

Equity Schemes

In the previous quarter, major equity categories recorded robust double-digit AUM growth. However, in the current quarter, Small Cap and Mid Cap categories saw a sharp slowdown—from 20% and 17% to just 0.6% and 0.4%. This change is mostly due to correction in mid and small cap indices during the current quarter, while the Nifty 50 registered only a marginal gain.