Bajaj Finserv AMC: Bank credit up 10.71% CAGR, deposits up 10.25% CAGR over the last decade

FinTech BizNews Service

Mumbai, 3 November 2025 – A study by Bajaj Finserv AMC states that India’s Banking, Financial Services, and Insurance (BFSI) sector has witnessed an extraordinary transformation over the last two decades. The market cap of the Indian BFSI sector has surged more than 50 times, expanding to Rs91 trillion in 2025 from Rs1.8 trillion in 2005, reflecting a CAGR of 22%.

The study highlights that the market cap as a percentage of GDP has significantly risen, from 6% in 2005 to 27% in 2025. This growth has been driven by robust financialization, regulatory reforms and India’s demographic dividend.

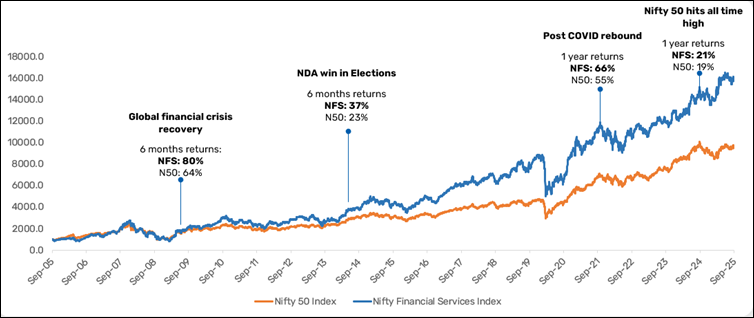

The study also highlights that the BFSI sector has consistently outperformed the broader market over the past two decades, as reflected in the Nifty Financial Services (NFS) Index versus the Nifty 50. Just after the global financial crisis recovery in 2009, NFS surged 80% in just six months compared to Nifty 50’s 64%. Similarly, following the election results in 2014, NFS delivered 37% returns in six months versus 23% for Nifty 50. The post-COVID rebound in 2021 further highlighted this strength, with NFS gaining 66% in one year against Nifty 50’s 55%. Even at the market peak in 2024, NFS managed to edge out broader market returns, rising 21% versus 19%. This consistent outperformance underscores BFSI’s position as a key driver of India’s capital markets, supported by rising financialization, strong fundamentals, and expanding retail participation aligning with the characteristics of a megatrend.

Over the past 10 financial years, the Indian banking sector has grown at a healthy pace, with bank credit registering a CAGR of 10.71% and deposits growing at a CAGR of 10.25%. Banks have demonstrated improving fundamentals, with gross NPAs declining sharply from 5.8% to 2.2% and credit costs reducing from 1.3% to 0.4% between FY22 and FY25.

On the other hand, NBFCs have emerged as a major force, playing a critical role in promoting financial inclusion and catering to the credit needs of underserved segments. They accounted for 18% of total BFSI earnings in FY24, underscoring their growing importance in retail lending. Since FY10, the net worth of NBFCs has grown at a CAGR of ~15%, while over the past two decades, their PAT has expanded at a CAGR of ~31.69%. The sector’s asset quality has also improved, with GNPA steadily declining from 4.5% in FY22 to 2.6% in FY25.

Furthermore, the insurance sector’s market cap has surged to INR 10.6 trillion, driven by increased financialization of savings and rising retail participation. Since FY07, the AUM of life insurance industry has grown 10x to INR 61.6 trillion. Meanwhile, general insurance industry has witnessed 10x growth over last 15 years.

The mutual fund industry’s AUM has grown by 45X over the past two decades. As of March 2025, India’s mutual fund AUM-to-GDP ratio has reached an all-time high of 19.9% of GDP from 7% in 2015.

As of 2025, banks account for just 57% of BFSI’s market cap, down from 85% in 2005. This shift reflects the growing role of NBFCs, fintechs, AMCs, and insurers as major value drivers within the sector. With policy reforms, tax rationalisation, and interest rate cuts, the sector has become both a driver and a beneficiary of India’s 6.3–6.8% growth trajectory.

India’s mutual fund industry has surpassed Rs75 trillion in AUM, reflecting a robust structural deepening and expanding reach across tier-2 and tier-3 cities. This growth has been propelled by digital platforms and simplified access, driving greater financial inclusion. This diversification and formalisation reinforce that BFSI is not merely a sectoral narrative, but a foundational pillar of India’s economic transformation—integral to its vision of becoming a Viksit Bharat and achieving the milestone of a $30 trillion economy.