With REITs becoming a mainstream asset class, institutional participation in mutual funds is expected to rise.

FinTech BizNews Service

Mumbai, October 3, 2025: WhiteOak Capital MF has come out with a noteworthy report on Investment opportunities in REITs and InvITs.

SEBI’s amendments mark a pivotal shift in the Indian investment landscape by reclassifying REITs as equity and broadening the scope of strategic investors. These changes not only align Indian REITs with global standards but also enhance liquidity, attract foreign capital flows, and integrate REITs into global equity indices. With mutual funds now able to treat REITs under equity allocation and InvITs retaining exclusive benefits, the reforms strike a balance between both asset classes. By widening investor participation and facilitating easier capital access, SEBI has laid the groundwork for stronger growth, deeper market participation, and long-term value creation in the real estate and infrastructure sectors.

Indian REIT Landscape: InvITs – large market opportunity

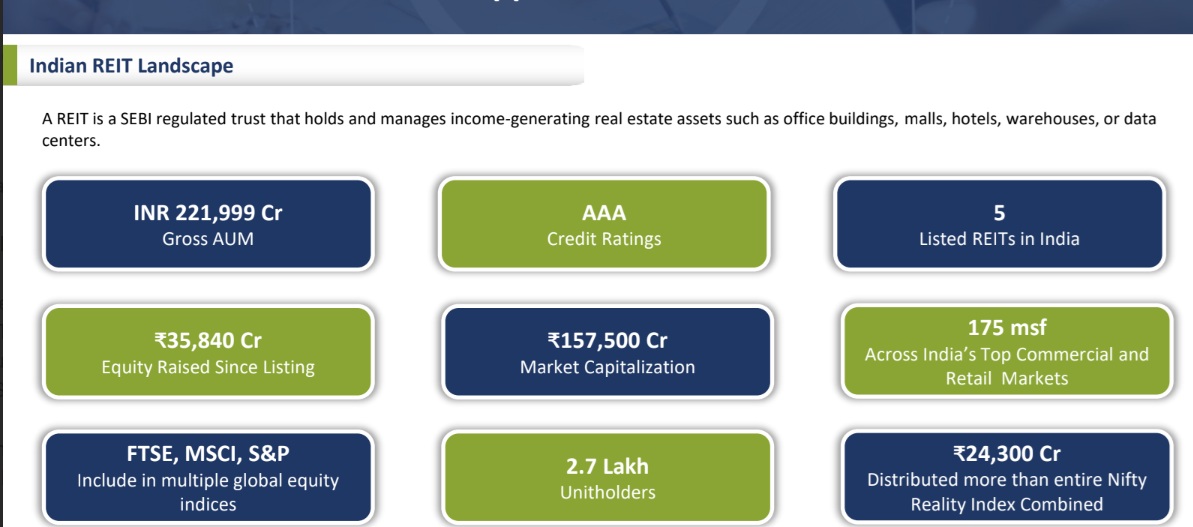

A REIT is a SEBI regulated trust that holds and manages income-generating real estate assets such as office buildings, malls, hotels, warehouses, or data centers.

AAA Credit Ratings ₹157,500 Cr Market Capitalization 2.7 Lakh Unitholders 5 Listed REITs in India 175 msf Across India’s Top Commercial and Retail Markets ₹24,300 Cr Distributed more than entire Nifty Reality Index Combined Infrastructure Investment Trusts (InvITs) are a relatively new but rapidly growing investment structure in India, aimed at facilitating longterm investments into infrastructure projects by pooling capital from investors.

Data Source : WhiteOak, All other data based on the latest available results (Q1 FY2026) and flings on respective REIT/InvITs websites. Numbers are approximate.

Recent announcements by the Regulator:

SEBI in its board meeting dated September 12, 2025 have made some remarkable changes to the REITS and InvITs framework:

• REITS are now classified as equity to align with the global practices and enhance liquidity. InvITs are retained as hybrid products.

• This reclassification will lead to an increased inflow of global capital into Indian markets.

• Indian REITs are forming part of some of the global equity indices such as MSCI India Small Cap Index, FTSE India Index, etc. post this change REITs can be a part of equity indices as well.

• Mutual Fund investments in REITs will be considered within the equity allocation limit of the scheme.

• Thus, the existing limit of 10% currently available for both REITs and InvITs will be solely available for InvITs, thereby facilitating growth in this segment as well.

• With REITs becoming a mainstream asset class, institutional participation in mutual funds is expected to rise.

• The scope of Strategic Investors has been expanded, making it easier for REITs and InvITs to attract capital from a wider pool of investors.

• What is a Strategic Investor - Strategic investors are those investors who get allocation of a REIT or the InvIT before the issue opens for subscription for other market participants.

• Prior to this change, many regulated institutional investors like public financial institutions, insurance funds, provident funds, pension funds, etc. who make investments in units of InvITs and REITs were unable to participate as Strategic Investor.

• Now under this proposed change, QIBs, family trusts, NBFCs, and others are now included in the definition of Strategic Investors. This will broaden investor participation and strengthen the overall market ecosystem

Impact of these announcements on mutual fund schemes:

Diversified Portfolio: With REITs now classified as equity and emerging as an accessible asset class, mutual fund equity exposure will also include REITs. The 10% investment limit will apply exclusively to InvITs, thereby broadening the asset class exposure within funds. Fund managers can diversify beyond listed equity into real estate which reduces reliance only on stock price appreciation.

• Stability: Similar to equities, REITs are dividend-paying instruments. In fact, they generally offer higher dividend payouts, making them relatively less volatile compared to the broader stock market. This may improve the overall stability of the products.

• Taxation: Direct investment In REITs is taxed differently (interest income is taxed as per slab rate and capital gains treatment also varies). When included in equity, investors get the benefit of equity taxation (STCG <12 mts = 20%, LTCG >12 mts = 12.50%)

• Liquidity: REITs and InvITs in India are currently facing low retail participation and thin liquidity. Their inclusion in equity mutual funds may drive inflows, improving liquidity, trading volumes and price discovery. Also, investors will indirectly get access to real estate through mutual funds, without having to invest directly in these instruments.

• Yield + Growth Combo: Unlike pure equities, REITs generate stable yields (dividend and interest) along with capital appreciation. Thus, investors can get a hybrid flavor inside a pure equity fund.

• In addition to equity funds, REITs and InvITs, with their hybrid return profile of regular income along with potential capital appreciation, are a natural fit for hybrid funds. At WhiteOak we have already been using these instruments in our hybrid category products such as Equity Savings and Multi Asset Allocation Fund. We see this development providing greater flexibility to deliver an optimal risk–return balance for our investors in these categories.

• Currently, the mutual fund schemes at WhiteOak have exposure to REITs and InvITs across certain equity and hybrid schemes. As of August 31, 2025, the total exposure to REITs and InvITs stands at 2.09% and 1.43% respectively of the total Assets Under Management (AUM). With these enhancements, the schemes may respond to market dynamics effectively and facilitate acceleration of real estate capital.

Risk Considerations:

• REITs and InvITs carry sector specific risks – real estate cycle, regulatory challenges, project risks.

• Funds need to be balanced so these risk do not dominate the portfolios.

• Correlation with equities may be low, but interest rate sensitivity is high.

WhiteOak’s Competitive Edge in Managing REITs and InvITs

• REITs & InvITs are currently an under-researched area. An in-depth understanding might provide several opportunities for strong risk adjusted returns

• Experience of having invested in the asset classes globally. Four dedicated professionals focused on researching REITs and InvITs.

• The firm’s Strong reputation built provides access to equity issuances

• Actively engaged with the regulator on policy

• The notable segment exposure as a percentage of AUM demonstrates strong commitment.

• A high-growth segment with upcoming listings is set to offer increased opportunities over the medium term.