Cash back incentive has significantly increased acceptability of digital transactions

Study by Economic Research Department,

State Bank of India

Mumbai, 25 October, 2023: The PM Street Vendor's AtmaNirbharNidhi (PM SVANidhi) Scheme, a micro credit scheme for urban street vendors that aims to provide collateral-free loans up to Rs 50,000 in incremental tranches is a pioneering initiative by the GoI aimed at integrating street vendors access to formal channels of credit. PSBs have largely anchored the ambitious program through a focused and dedicated approach, in line with other similar path breaking GoI schemes.

• 43% female share indicates empowerment of entrepreneurial capabilities of urban female

• The ratio of people repaying first loan of Rs 10000 and taking the second loan of Rs 20,000 loan is 68%

• The ratio of people repaying second loan of Rs 20000 and taking the third loan of Rs 50,000 loan is 75%

• Borrowers between 26-45 years constitute 2/3rd share of the beneficiaries while 3/4th of the beneficiaries are from 18-45 years age group

• The spending pattern of the poor are same for those at the bottom quintile. Truly Poverty has no religion, caste, creed or gender, vouching basic tenets of demand and supply are religion antagonistic and good economics can trump even the supposedly deep running fault lines with wholehearted engagement of all stakeholders to bring in deep, durable and sustainably meaningful changes ? Categorizing the beneficiaries into three distinct categories based on change in spending pattern by analyzing primarily debit card spend of the beneficiaries' post receipt of loan installment (first and second loan) using quintile analysis, we find large evidence of emergence of Active spenders (those moving at least to next upper quintile)

• The average debit card spending of PM SVANidhi account holders increased by 50% post disbursement of loan installment

• There is a 61% probability of a loan recipient who were earlier not spending starts to spend actively post disbursement of the PM SVANidhi loan • On an average 63% of those below the age 25 and above 60 age groups spend more post disbursement of loan…

• The share of active spenders in those having received the second and third loan installments is as much as 30%

• 65% of the bottom quintile (or 9 lakh street vendors) are active spenders post the loan was disbursed. Clearly, the loan instalment is acting as capital investment in upending the spending/consumption pattern significantly

• Of the mega and million+ cities, Varanasi is the top performer where 45% of total spenders are active spenders, followed by Bengaluru, Chennai, Prayagraj, etc.

Behavioral Habits

Further, to consider how PM SVANidhi is impacting the behavioral habits in terms of spending and digital transactions post receipt of loan installment for a nearly identical class of marginalized population like PMJDY depositors we mapped the PMJDY accounts either being a PM SVANidhi borrower /Treatment Group or not being a PM SVANidhi borrower /Control Group

• Using Difference in Difference estimation technique (for Treatment Group / PMJDY and also having a PM SVANidhi account and Control Group / PMJDY but no PM SVANidhi accounts), we estimate Treatment Group sample has increased their spending at merchant outlets in comparison to Control Group sample by at least ~Rs 1500

Digital Transactions

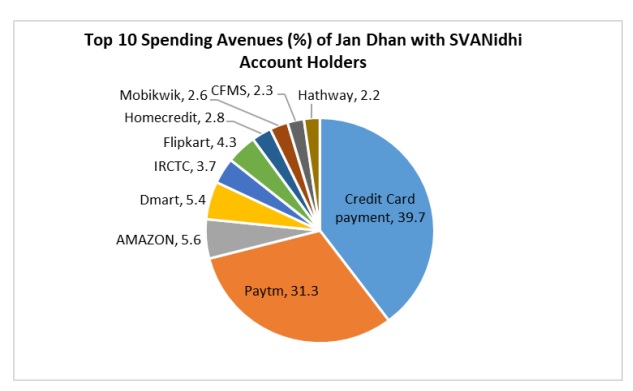

• In terms of digital transactions, Spending Avenues of Control Group sample are primarily towards basic amenties, while the spending pattern of Treatment Group Sample are more on consumeristic avenues, indicating again that capacity building efforts in empowering the marginalized in terms of credit access is always a self-fulfilling prophecy of empowerment of the masses marginalized also have a dream and it should be our endeavour to fulfil them…poverty has no religion, formalization of credit acts as a force multiplier for deeper and meaningful formalization of deposits beyond mere thrift.

Cash Back Incentive

• Furthermore, the cash back incentive has significantly increased acceptability of digital transactions. We find at least 9.5% people belonging to Control Group sample who were doing less than 10 transactions have moved into higher digital transactions, even higher than 100 in some cases.

A back-of the envelope calculation suggests that the number of beneficiaries who have been either new to credit/deposit in the last nine years is around 30% on an average (of the new credit accounts added during this decade), contributing around 8% of incremental credit growth. In deposits, around 42% of the new account opened is only due to PMJDY & SSY. If we look to the incremental GDP growth during FY14-23, then the formalization through new Government schemes (Deposits + Credit) stands at 6%. We believe there is a revolution at the bottom of the pyramid, and this is likely to sustain the credit growth.

• Heuristic data analysis of select borrowing profile reveals that both NTC (New to Credit) and NTCC (New to Credit Card) segments (i.e., people getting inducted into formal credit mechanism first time, either through institutional lenders or a credit card company) are showing little divergence in credit behavior post onboarding, alleviating concerns being raised from select quarters of an uneven spending post pandemic.