Agenda Of RBI’s DPSS & IT For 2024-25; 340 e-BAAT programs conducted

FinTech BizNews Service

Mumbai, May 31, 2024: The Reserve Bank during 2023-24 sustained its endeavour towards providing secure, accessible, affordable and efficient payment systems for every user of the country. The Reserve Bank also explored avenues for expanding the global outreach of Unified Payments Interface (UPI) and RuPay cards. The Reserve Bank remained steadfast in its efforts to ensure robust and secured Information and Communication Technology (ICT) infrastructure for smooth functioning of IT systems and applications in the Reserve Bank, according to RBI’s ANNUAL REPORT 2023-24, released on 30 May, 2024.

EKP, Sarthi, And EKAMEV

The Reserve Bank explored the possibilities for increasing the global footprints of UPI and RuPay cards by engaging with the central banks of various countries. During the year, besides enhancements in e-Kuber and payment systems, several initiatives were undertaken towards revamping major internal software applications such as enterprise knowledge portal (EKP), Sarthi (electronic document management system/digital workflow application), and EKAMEV (single sign-on portal for the employees).

DEPARTMENT OF PAYMENT AND SETTLEMENT SYSTEMS (DPSS)

During the year, the DPSS launched initiatives in line with the Payments Vision Document 2025 across anchor goalposts of integrity, inclusion, innovation, and internationalisation.

Payment Systems

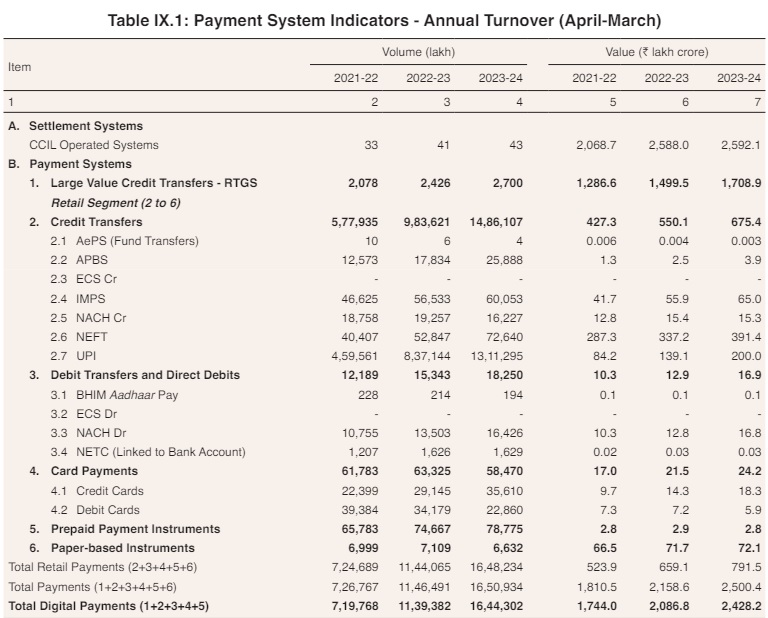

The payment and settlement systems1 recorded a growth of 44 per cent in terms of transaction volume during 2023-24 on top of the expansion of 57.8 per cent in the previous year. In value terms, the growth was 15.8 per cent in 2023-24 as against 19.2 per cent in the previous year, with moderation in growth rate of both retail and large value payment system [viz., real time gross settlement (RTGS)]. The share of digital transactions in the total volume of noncash retail payments increased marginally to 99.8 per cent during 2023-24 from 99.6 per cent in the previous year.

Digital Payments

Among the digital modes of payments, RTGS transactions increased by 11.3 per cent during 2023-24 in volume terms and 14 per cent in value terms. The volume and value of retail transactions increased by 44.1 per cent and 20.1 per cent, respectively. As at end-March 2024, RTGS services were available through 1,70,855 IFSCs2 of 247 member banks, while NEFT services were available through 1,72,290 IFSCs of 233 member banks.

Payments Infrastructure Development Fund (PIDF) substantially aided the growth in digital payments during the year by subsidising deployment of Point of Sale (PoS)/mobile PoS (mPoS) terminals, interoperable Quick Response (QR) infrastructure, Aadhaar enabled biometric devices, and other contemporary devices. It has improved the availability of acceptance infrastructure, especially in Tier III to Tier VI centres. During 2023-24, the number of PoS terminals increased by 14.3 per cent to 89.0 lakh, while the number of Bharat QR (BQR) codes deployed increased by 16.1 per cent to 62.5 lakh. UPI QR codes increased by 35.0 per cent to 34.6 crore as at end-March 2024.

Authorisation of Payment Systems

During the year, the Reserve Bank accorded Certificate of Authorisation to 22 online Payment Aggregators (PAs), two non-bank Prepaid Payment Instrument (PPI) issuers and one Trade Receivables Discounting System (TReDS) platform operator, besides granting in-principle authorisation to a few other online PAs, PPIs, one white label ATM (WLA) operator and one TReDS platform operator. Moreover, during the year, the Reserve Bank granted approval to one bank for PPI issuance, two banks for operating as Bharat Bill Payment Operating Units (BBPOUs), and 52 banks for providing mobile banking facility to their customers.

Implementation Status

The PIDF scheme was extended by a period of two years, i.e., up to December 31, 2025. The Reserve Bank is working on the implementation of the ‘payee name look-up facility’ in compliance with newly enacted ‘The Digital Personal Data Protection Act, 2023’. The Reserve Bank is also working on enhancing coverage and granularity of published payment transaction data.

Financial Inclusion

Expanding the Scope of TReDS

The Reserve Bank expanded the scope of activity in TReDS by permitting insurance for transactions, increasing the pool of financiers, and enabling secondary market for factoring units (FUs). This will improve the cash flows of MSMEs.

Enhancing UPI Transaction Limit for Specified Categories

The Reserve Bank enhanced the limit for UPI payments made to hospitals and educational institutions from Rs1 lakh to Rs5 lakh per transaction.

Enhancing the Robustness of Aadhaar Enabled Payment System (AePS)

The Reserve Bank proposed to streamline the onboarding process, including mandatory due diligence, for AePS touchpoint operators, to be followed by banks. In 2023, more than 37 crore users undertook AePS transactions, which points to the important role played by AePS in financial inclusion. Additional fraud risk management requirements will also be considered, which will enhance the robustness of the AePS.

Enhancing Public Awareness through Various Channels

The Reserve Bank has been conducting electronic banking awareness and training (e-BAAT) programmes regularly for the benefit of various strata of society across the country. During the year, 340 e-BAAT programmes were conducted by the regional offices of the Reserve Bank.

Digital Payments Index (DPI)

The Reserve Bank had constructed a composite DPI in 2021 to capture the extent of digitisation of payments across the country. The RBI-DPI index is computed semi-annually and has demonstrated significant growth, representing rapid adoption and deepening of digital payments across the country. The DPI increased by 10.9 per cent to 418.8 in September 2023 from 377.5 in September 2022.

Agenda of DPSS for 2024-25

In 2024-25, the DPSS Department will focus on the following goals: ● The Central Payments Fraud Information Registry (CPFIR) reporting will be extended to local area banks, state cooperative banks, district cooperative banks, regional rural banks (RRBs) and non-scheduled urban cooperative banks (UCBs) for payment fraud reporting (Utkarsh 2.0); ● Presently, CTS has two settlements, one for presentation session and other for return session. Under on-realisation model, a single settlement would be arrived at after closure of return session for net position of each bank. This is expected to improve liquidity efficiency of the CTS;

● In light of goals for Viksit Bharat 2047, the Reserve Bank, along with NPCI International Payments Ltd. (NIPL) will work towards taking UPI to 20 countries with initiation timeline of 2024-25 and completion timeline of 2028-29. Further, Fast Payment System (FPS) collaboration with group of countries like European Union and South Asian Association for Regional Cooperation (SAARC), as well as multilateral linkages will be explored;

● At present, the payments ecosystem (card networks/banks/PPI entities) has largely adopted SMS-based one-time password (OTP) as additional factor of authentication (AFA). However, with the advancements in technology, various innovative solutions are now available to address the fraud and friction in payments. Hence, an alternate risk-based authentication mechanism leveraging behavioural biometrics, location/ historical payments, digital tokens, and inapp notifications will be explored; and

● Presently, centralised payment systems (RTGS and NEFT) rely only on account number and IFSC for transfer of funds. With an aim to curb frauds and enhance the payment experience further, the introduction of real-time payee name validation before the actual fund transfer will be explored in compliance with newly enacted ‘The Digital Personal Data Protection Act, 2023’.

An extended six-month long cybersecurity awareness drive across the Reserve Bank with the overarching theme of ‘Secure Our World’ has also been implemented. While the construction of the ‘Enterprise Computing and Cybersecurity Training Institute’ is under progress to foster a safe and responsible cyber culture within the Reserve Bank, 26 training programmes covering around 753 officers from various locations have been conducted till March 31, 2024.

Global SFMS Hub

Further, in line with the Payments Vision Document 2025, and in order to support the global outreach and expand the footprint of domestic payment systems, a Global Structured Financial Messaging System (SFMS) Hub project was initiated. This would further improve the efficiency of the Reserve Bank’s payment system.

Implementation Status

The IT Department upgraded e-Kuber to e-Kuber 2.0 with the latest technology. All the participants are now using the upgraded version of e-Kuber online portal. The currency management module has also been upgraded and is in use by various offices of the Reserve Bank. Currency chest (CC) holding banks have also started using the upgraded currency chest portal for real-time reporting of CC related transactions.

The construction of the data centre has commenced with the laying of foundation stone by the Governor, Reserve Bank, on March 22, 2023. The core and shell construction of the data centre is in the advanced stage of completion. The project is expected to be completed within the stipulated timeline.

The Department updated and upgraded RTGS system during 2023-24 with new functionality like Foreign Contribution (Regulation) Act (FCRA) code introduction, improved and efficient automated message flow, among various nodes of RTGS. Apart from these, the security features of the system have been upgraded in terms of better user management control and compatibility with latest digital certificates issued by the certifying authority, viz., Institute for Development & Research in Banking Technology (IDRBT).

‘Seamless SWAGAT’

With the enhanced access management system christened as ‘Seamless SWAGAT’, the Department is seeking to implement facial recognition for employee access management and QR code technology for visitor access management system. This technology is presently being developed on a pilot basis at the Reserve Bank’s central office building, Mumbai. This is expected to be rolled out gradually in phases, based on feedback and user experiences.

the reversal of liquidity facilities availed under Automated Sweep-In and Sweep-Out (ASISO) facility for the transactions over the weekends and holidays were previously carried out on the next working day at Mumbai. Changes were also carried out in e-Kuber to facilitate reversal of these ASISO transactions immediately on next day (regardless of whether holiday or not).

Making NEFT Compliant to ISO 20022 Messaging Standards

The process of onboarding more than 230 member banks on ISO 20022 messaging standards has already started. The migration and onboarding of all the member banks is expected to be completed in early 2024. The adoption of ISO 20022 will provide structured and granular data, improved analytics, end-to-end automation, and better global harmonisation. It will also pave the way for interoperability between RTGS and NEFT.

Private Cloud Infrastructure Augmentation

The Department initiated the process of augmentation of its private cloud infrastructure (viz., virtualised compute, memory and storage) to increase the capacity of the existing clusters and replace servers reaching end of support. The added capacity will host next generation core banking solution (CBS) application (e-Kuber 3.0) as well as additional non-payment applications in the pipeline. The Reserve Bank’s private cloud provides additional benefits like centralised management of servers, scalability, and reduction in the overhead costs for application hosting.

Centralised Digital Application Receipts and Tracking System

A secured web-based centralised portal named as PRAVAAH (Platform for Regulatory Application, Validation And AutHorisation) has been developed to simplify and streamline the process of submitting applications seeking licence/authorisation/regulatory approvals from the Reserve Bank under various statutes/ regulations. By end-to-end digitisation of the entire processing lifecycle of applications, it will bring greater efficiencies into regulatory processes and facilitate ease of doing business for the regulated entities (REs).

Agenda of IT for 2024-25

The IT Department’s goals for 2024-25 are set out below:

● The Reserve Bank has initiated the project to construct a new state-of-the-art greenfield next generation data centre to address the capacity expansion constraints, meet ever-increasing IT landscape needs and avoid region specific risks. The data centre, which is envisaged to cater to the internal needs of the Reserve Bank and its subsidiary organisations, shall commence its operations in 2024-25 (Utkarsh 2.0);

● To enhance the security, integrity, and privacy of Indian financial sector data, cloud facility will be set up and initially operated by the IFTAS. This cloud facility is intended to be rolled out in a calibrated fashion in the medium term.

● The Indian Financial Network (INFINET) runs the critical payment system applications such as RTGS, NEFT and e-Kuber. INFINET 3.0 seeks to refresh the existing INFINET 2.0 with better technology, bandwidth, and overall services. It is proposed to be built with the latest software-defined wide area network (SD-WAN) technology. The features proposed under SDWAN include effective load balancing of the links, voice and video traffic optimisation and application aware routing. SD-WAN also provides for centralised management of the network and zero touch provisioning.

The interested countries can connect their local messaging system to Global SFMS Hub for cross-border payment messaging in their local currencies. This may help India in reducing dependence on other major trading currencies and may help in foreign exchange management; and

● To support the ‘AatmaNirbhar Bharat’ initiative of the country, the Department plans to develop the following applications in-house to reduce external dependencies (including vendors), besides providing increased flexibility in terms of carrying out changes in the system by providing full control over the source codes:

The development of the core accounting platform along with government payment module (GPx) is in progress.

Developing an alternate messaging system framework to support domestic as well cross-border financial and nonfinancial message communication. It would be based on globally accepted ISO 20022 messaging standards with functionalities like cross-border solution, and letter of credit/bank guarantee (LC/BG) message. o Develop an alternate mechanism for digital payment systems, which would offer all the functionalities currently being offered by existing CPS along with other advanced functionalities. The system would support retail and high value payment services, bulk message support and low value fast payment services. It would provide options like thick client and open API solution to connect to CPS. It is also proposed to offer this in-house developed comprehensive system to other countries as well.

CONCLUSION

The Reserve Bank continued its efforts to develop state-of-the-art payment and settlement systems in the country through launch of several initiatives during the year in line with Payments Vision Document 2025 across anchor goalposts of integrity, inclusion, innovation and internationalisation. During the year, possibilities were also explored for increasing the global footprints of UPI and RuPay. Besides, enhancements in e-Kuber and payment systems, a revamp of major internal applications of the Reserve Bank was also undertaken. Best practices in cyber hygiene have been adopted to ensure the security of the Reserve Bank’s IT infrastructure.The initiative towards setting-up of a cloud facility has commenced to enhance security, integrity, and privacy of Indian financial sector. Going forward, a state-of-the-art greenfield next generation data centre would be operationalised to address the capacity expansion constraints, meet ever-increasing IT landscape needs and avoid region specific risks.