India GDP: Growth remains resilient

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

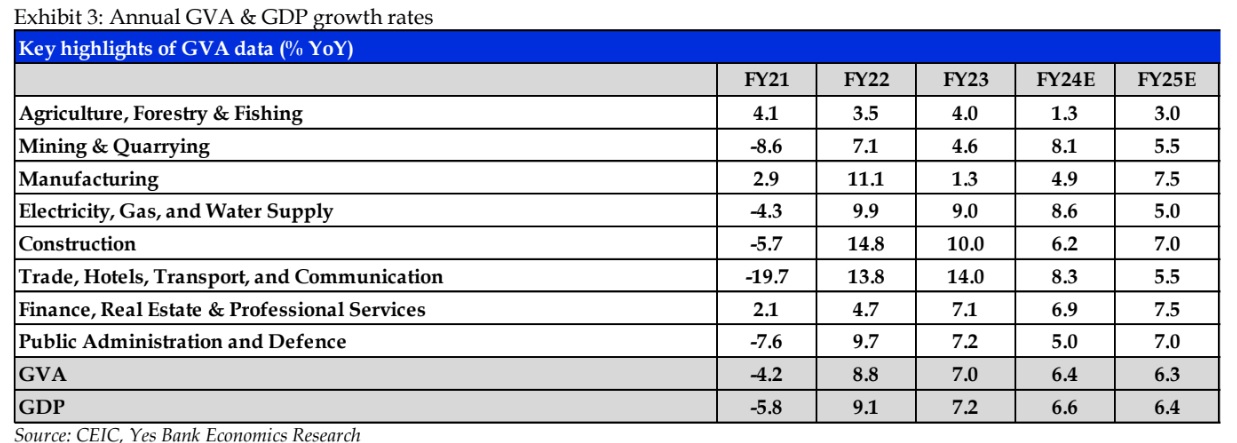

Mumbai, December 1, 2023: India’s real GDP rose 7.6% YoY in Q2FY24 (Q1FY24: 7.8% YoY), while real GVA was up by 7.4% YoY (Q1FY24: 7.8% YoY). Manufacturing sector outperforms, growing at 13.9% whereas services sector growth moderated to 5.8% YoY. On the expenditure side, private consumption remain weak and rose by 3.1% YoY (2.5% QoQ) while gross fixed capital formation registered a growth of 11.0% YoY. With stronger than expected growth in the first two quarters, we revise up our FY24 GDP estimate to 6.6% (6.1% earlier). We do expect growth to moderate in H2FY24 on account of lagged impact of monetary policy tightening, deepening of global slowdown, demand weakness due to lower agricultural growth and tightening of credit standards through risk weight increases and likely slowing of government expenditure ahead of elections. GVA exhibits strong growth supported by manufacturing sector: India’s GVA grew by 7.4% YoY, driven by the strong growth in industry sector at 13.2% YoY. Within the industry sector, manufacturing grew by 13.9% YoY whereas ‘mining’ and ‘electricity, gas & water supply’ grew at 10% YoY and 10.1% YoY, respectively. On a QoQ basis, the manufacturing sector grew by 7.1%. The strong growth in the manufacturing sector is reflective of the reduced input cost pressure that resulted in improved profit margins. The construction sector grew by 13.3% YoY corroborating the strong growth seen in steel production (13.7% YoY) and cement production (10.3% YoY). The agriculture sector growth moderated to 1.2% YoY from 3.5% YoY in the previous quarter (2.5% in Q2FY23).

Services sector growth waning

Services sector grew by 5.8% YoY in Q2FY24 vs 10.3% YoY Q1FY24. Globally, the post-Covid recovery in the services sector is complete and the demand factors that were leading to the strong growth in the services sector are now softening. India is also possibly witnessing the same. On a QoQ basis, the services sector grew by 4.3%. Contact intensive services, in particular trade, hotels, transport and communications sector registered a growth of 4.3% YoY vs 9.2% YoY in the previous quarter (15.6% YoY in Q2FY23). Financial services and real estate grew by 6.0% YoY in Q2FY24 but registered a flat growth on a QoQ basis. Public administration & defense grew by 7.6% YoY (7.1% QoQ).

Private consumption expenditure still a concern

India’s GDP grew by 7.6% YoY and by 3.4% on a QoQ basis. Private consumption expenditure grew by 3.1% YoY (6.0% in Q1FY24) while on a sequential basis it grew by 2.5% YoY. The share of private consumption came down to 56.8% from 57.3% in the previous quarter. Government consumption improved to 12.4% YoY. Gross Fixed Capital Formation (GFCF) or the investment demand in the economy expanded by 11.0% YoY, accounting for a share of 35.3% in GDP. This is possibly due to the central and the state government’s capital expenditures. Private investments have not possibly picked up in earnest, except in specific industry segments. Net exports worsened marginally to INR (-) 2858 bn in Q2FY24 from INR (-) 2584 bn in Q1FY24. Exports of goods and services grew by 4.3% YoY whereas imports of goods and services grew by 16.7% YoY. Importantly, valuables registered a strong growth of 276% QoQ (-4.0% YoY) in Q2FY24. Net taxes grew by 10.2% YoY vs 7.7% YoY in the previous quarter.

FY24 GDP growth revised upwards to 6.6% FY24 GDP growth revised up to 6.6%: The manufacturing sector appeared to be in a sweet spot in Q2FY24 with the support coming from the improved margin growth of companies, likely on the back of lower input costs. On the expenditure side, the government’s capital expenditure and growth in valuables appear to have boosted growth. Going ahead, we see growth to be weaker in H2FY24 compared to H1FY24. The specific factors that could lead to the slowdown are: (a) weaker agriculture growth could further dampen rural demand. The increase in demand under the MNREGA is probably a reflection of the stress in the rural economy, (b) lagged impact of monetary policy percolating through the system as the reflection of the 250bps increase in the repo rate is still not seen in the lending rates on fresh loans, (c) likely reduction in the pace of government expenditures as we head into the Union Elections, (d) likely widening of net trade as exports slow following a slowdown in AEs while imports remain relatively resilient. Further, RBI has recently also increased the risk weights on consumer loans and also is attempting to tighten lending from NBFCs. This can slow down personal loan growth and reduce private consumption further. Factoring all the of above, we now expect FY24 GDP growth at 6.6% YoY (earlier 6.1% YoY).

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)