Innovation remains a cornerstone of Zaggle's success, and it is continuously focusing on deploying emerging AI technologies to fundamentally reshape the way it engages with its customers and users.

FinTech BizNews Service

Mumbai, May 12, 2025: Zaggle Prepaid Ocean Services Limited, a SaaS fintech player which provides spend management products and solutions, has announced its audited results today. The listed Fintech SaaS Zaggle's reported its Q4FY25 & FY25 results are noteworthy.

Key Highlights:

Additionally, ahead of the Q4 earnings announcement the shares of Zaggle surged close to 8.38% today at INR 366.6 apiece on the BSE.

Commenting on the performance Raj P Narayanam, Founder and Executive Chairman,

Zaggle Prepaid Ocean Services Limited said,

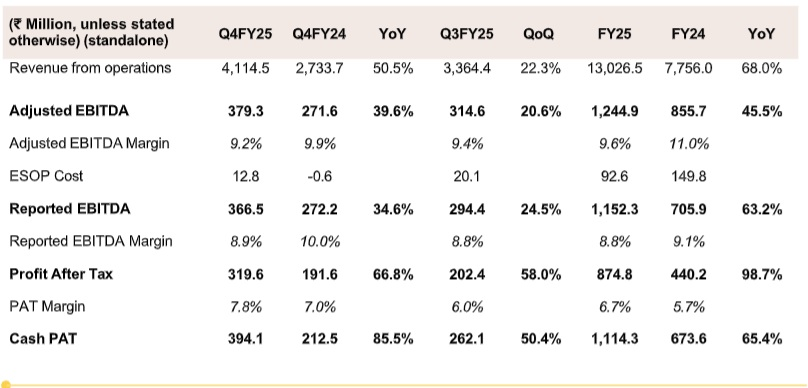

“This year has been exceptional with our highest yearly performance ever. FY25 revenues have

surpassed our guidance, crossing the INR 13,000 million mark and achieving a 68.0% year-on-year

growth. Also, our PAT at INR 874.8 Mn was almost double that of last year. This combination of

high growth and strong profitability is a clear sign of the longevity of our business model and

discipline in execution.

We recorded our highest ever performance for the third time in a row, with a topline of INR

4,114.5 Mn a 50.5% YoY growth and PAT of INR 319.6 Mn a 66.8% YoY growth.

This year has been a year of strategic execution, with a few strategic investments and product

innovations that align with our long-term goal of growing our umbrella of offerings to meet the

expansive needs of our customers. This ever-evolving portfolio positions us well in this dynamic

world.

Innovation remains a cornerstone of our success, and we are continuously focusing on deploying

emerging AI technologies to fundamentally reshape the way we engage with our customers and

users.

Building on our strong performance, we project our organic FY26 topline growth to range between

35-40%. As we continue to scale, we remain focused on driving margin expansion through

increased operating leverage, operational efficiencies, and cross-sell opportunities."