Money Expo India 2025 explored key themes through interactive workshops, keynote sessions, and expert-led panels, covering topics such as AI-powered finance, stock market movements, mutual funds, regulatory updates, compliance tools, and digital payments.

FinTech BizNews Service

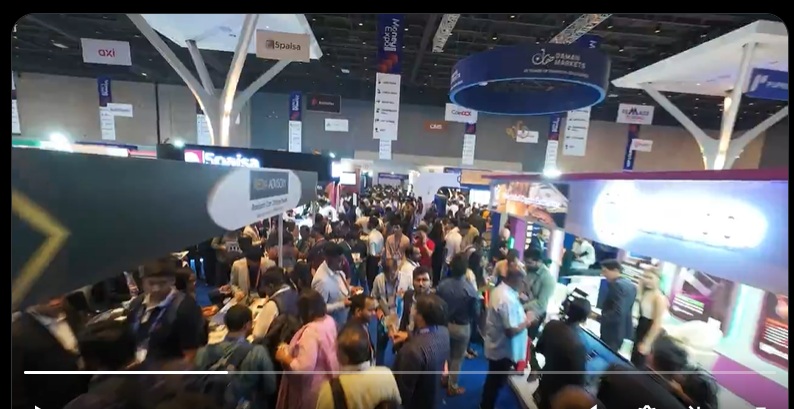

Mumbai, 24 Aug 2025: The 4th edition of the country’s premier fintech and trading platform conference, Money Expo India 2025, being held at Mumbai’s Jio World Convention Centre, Mumbai concluded with a resounding success with over 12,000 participants attending the two-day exhibition and conference on financial learning, fintech, digital financial innovations and more.

With 100+ brands participation, 80+ high-profile speakers, and attendees from over 10 nations, made Money Expo India 2025 one of the highest attended exhibition and conference for the financial sector.

This event provided a platform for industry veterans to mingle and share their knowledge with young and new investors, entrepreneurs and professionals in this field.

Money Expo India 2025 explored key themes through interactive workshops, keynote sessions, and expert-led panels, covering topics such as AI-powered finance, stock market movements, mutual funds, regulatory updates, compliance tools, and digital payments.

This two-day exhibition and conference showcased a host of solutions for investors, financial learners and customers to connect with brands and speakers by one-to-one interactions, live demos, product showcases and networking activations from top fintech and trading brands including MondFX, 9X Markets, 5Paisa, FxPro, My MAA Markets, CMS Prime, GTC Prime, Coin DCX, AXI; JustMarkets, Trive, XS.Com, Traze, Uniconserve,CPT Markets, Macro Global Markets, among many others, presenting the latest solutions and platforms designed to empower India’s financial and trading community.

With regulatory updates on finfluencers, Money Expo’s panel session on ‘Finfluencers – Hype vs Help’ provided timely guidance and insights for the young audience members. Moderated by Ms Ekta Mourya, Crypto Lead, FxStreet SLU and participated by Mr Vipul Katkar, Regional Head, Pemaxx Global Ltd and Mr Akhil Gupta, Founder, ONO Creators discussed the several ways in which individuals can do their own research and follow financial advice from authorised SEBI advisors and analysts. The timeliness of this topic by Money Expo was greatly appreciated by all participants and strengthens the exhibition and conference’s ethos of providing fact-based knowledge with experiential networking platform.

In another key panel session, ‘Taxation Challenges: Digital Assets, Derivatives & Stocks’, participants were provided inputs and insights on decoding complex audits. The panel saw Mr Jitesh Agarwal, Founder, Treelife joined by Mr Nitesh Buddhadev (CA), Founder, Nimit Consultancy and Mr Sonu Jain (CA), Chief Risk and Compliance Officer, 9Point Capital. Speaking about taxation, Mr Buddhadev called on solutions which can optimise investments and taxation. “Investors and traders are looking at options where investment and taxation can be kept separately. We are looking at broking software which can advise investors to make the right decision,” he said.

Mr Jain highlighted the gaps in the blockchain system when it comes to investment in bitcoins and a pivot towards Bitcoin ETFs which has opened a whole new segment in India. In a similar vein, Mr Agarwal welcomed the latest use of AI-based tools in the last budget for the sector and remains hopeful of a clarity when it comes to taxation.

In the ever-dynamic realm of fintech, India’s role in blockchain and strengthening financial solutions was discussed in a panel session. Moderated by Ms Neha Sawant, VP- Marketing, Zebpay, she was joined by Ms Ekta Mourya, Crypto Lead, FxStreet SLU, Mr Kamlesh Nagware, Founder, Global Tokenization Forum, Mr Dilip Chenoy, Chairperson, Bharat Web3 Association, and Mr Aishwary Gupta, Global Head of Payments and RWA’s, Polygon Labs.

While challenges remain for innovative fintech solution providers, Mr Chenoy said, “When it comes to regulations, in the current situation, the constellations of various government stakeholders are falling in place for the many players in this space to have a dialogue and create an ecosystem. This is a positive stance and will help in the growth for digital India.”

In a keynote address, Mr Gautam Kalia, Head Investment Solutions, Mirae Asset Sharekhan educated the audience on the power of ‘money making machine’, highlighting the importance of compounding and change in thinking while investing. “You need money to pull your money. Patience and tactical decision play a key role in growing your wealth”, he said.

Appreciating the event, GTC Prime stated that Money Expo in Mumbai was a fantastic platform to connect with clients and industry experts, helping showcase GTC's global services and stay updated on market trends. Similarly, CMS Prime thanked the Money Expo team for a well-organized and insightful event for an outstanding opportunity to learn, network, and grow.

Since its inception, Money Expo has become India’s premier exhibition and conference providing a one-stop platform for individuals interested in the finance, investment, fintech ecosystem and bringing together thought leaders and thousands of professionals, including traders, investors, brokers, fintech providers, and financial institutions.