The yields on government securities will remain range bound and RBI is likely close to end of rate hike cycle : Vishal Goenka, IndiaBonds.com

Data from July 1, 2023 to September 29, 2023

FinTech BizNews Service

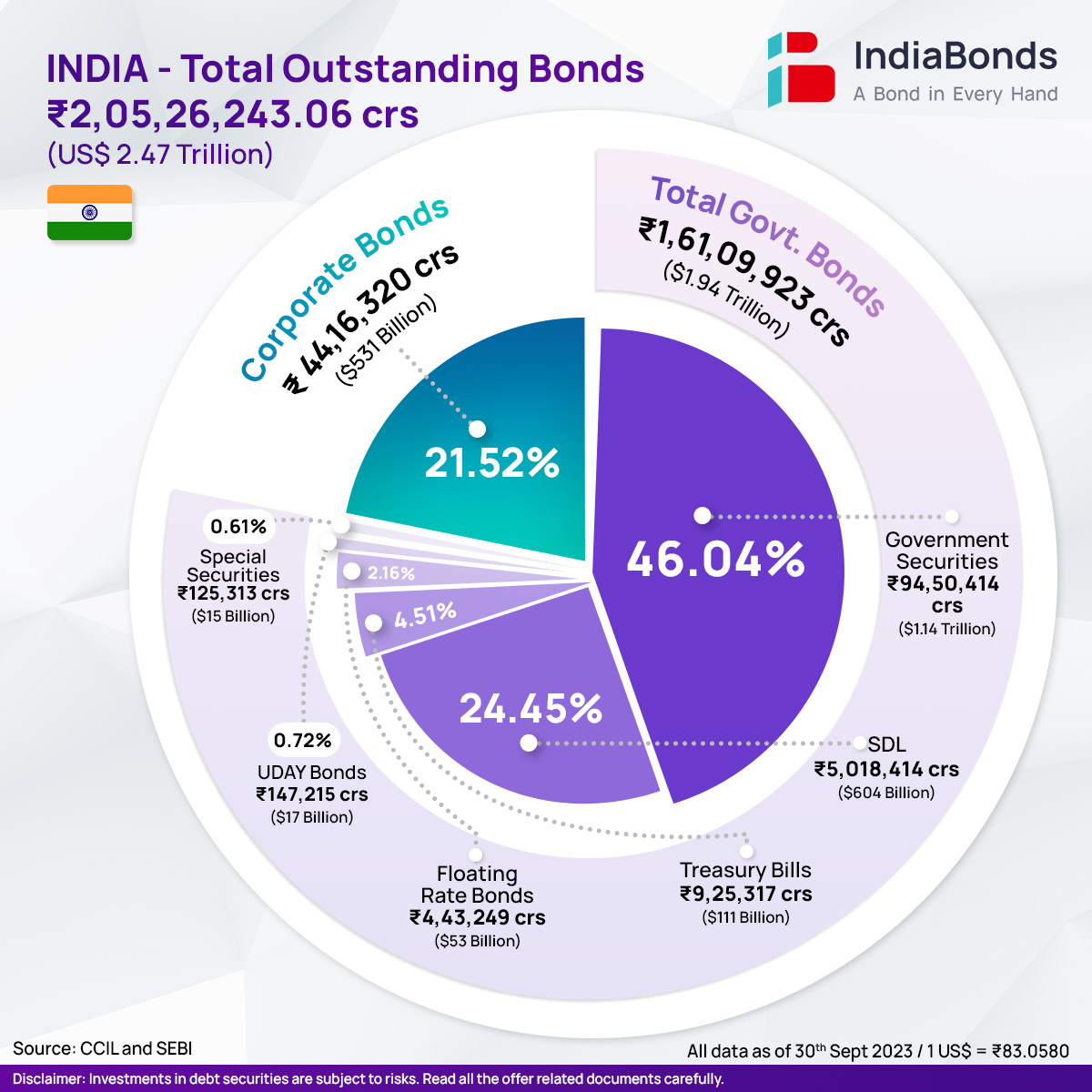

Mumbai, November 27, 2023: The team at IndiaBonds.com has collated data of India’s total outstanding bonds. The source of the data is Clearing Corporation of India Limited (CCIL) and Securities and Exchange Board of India (SEBI).

The total outstanding bonds data is from July 1, 2023 to September 29, 2023. Also, the data from January to March 2023 and from April to June 2023 are also collated.

The total outstanding (O/S) government securities market stood at INR 161.1 trillion (source: RBI) which is an increase of 7.1% in FY 23-24 from INR 150.4 trillion as of 31 March 2023. Vishal Goenka, Co-founder, IndiaBonds.com, on government securities thinks that yields will remain range bound and RBI is likely close to end of rate hike cycle. He believes that short-end segment up to 3 years offers good value to retail investors as interest rates moved most in this segment and up by about 3.00% from Covid lows in 2020.

Launched in 2021, IndiaBonds is a SEBI-registered leading Online Bond Platform Provider. It provides access to investors in the fixed-income market in a low-cost, transparent, and easy-to-use manner. At the helm of this bondtech company are industry veterans - Vishal Goenka, Co-Founder; and Aditi Mittal, Co-Founder & Director. This core team is committed to pioneering the digital revolution in the corporate bond market in India.

IndiaBonds provides a wholesome solution to bond investing to its customers; and enable them to unlock the value of the fixed-income asset class. The experienced team assists investors with access to a wide choice of bond investment opportunities that provide stability, generate predictable income, and meet their investment objectives. Within the Online Bond Platform Providers community, IndiaBonds is recognized as a revolutionizing fintech start-up owing to some of its ground-breaking innovations in the fixed-income industry.

In 2022, it announced the launch of its strategic tool, the Bond Yield Calculator, which aids investors by simplifying the complexities of calculating corporate bond prices and yield. In 2021, it launched a comprehensive Bond Directory for the general public to have detailed information on all INR-denominated bonds outstanding in India.