Standardisation of procedure for settlement of claims in respect of deposit accounts of deceased customers of banks; The MPC noted that the inflation outlook in the near term has become more benign than anticipated earlier, and the average CPI inflation this year is expected to remain significantly below the target.

FinTech BizNews Service

Mumbai, August 6, 2025: The Monetary Policy Committee (MPC) held its 56th meeting from August 4 to 6, 2025 under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Dr. Rajiv Ranjan attended the meeting.

Sanjay Malhotra, Governor, Reserve Bank of India

The Governor made a Statement today on Developmental and Regulatory Policies. This Statement sets out the developmental and regulatory policy measures relating to (i) Regulation; (ii) Financial Markets.

I. Regulation

1. Standardisation of procedure for settlement of claims in respect of deposit accounts of deceased customers of banks

Under the provisions of Banking Regulation Act, 1949, nomination facility is available in respect of deposit accounts, articles kept in safe custody or safe deposit lockers. This is intended to facilitate expeditious settlement of claims or return of articles or release of contents of safe deposit locker upon death of a customer and to minimise hardship caused to family members. The extant instructions require banks to adopt a simplified procedure to facilitate expeditious and hassle-free settlement of claims made by survivors/ nominees/ legal heirs, the procedures vary across banks. With a view to enhance customer service standards, it has been decided to streamline the procedures and standardise the documentation to be submitted to the banks. A draft circular in this regard shall be issued shortly for public consultation.

II. Financial Markets

2. Introduction of Auto-bidding facilities in RBI Retail Direct for Investment and Re-investment in T-bills

The Retail Direct portal was launched in November 2021 to facilitate retail investors to open their Gilt accounts with the Reserve Bank under the Retail Direct Scheme. The scheme allows retail investors to buy Government Securities (G-Secs) in primary auctions as well as buy and sell G-Secs in the secondary market. Since the launch of the Scheme, various new features, in terms of product as well as payment options, have been introduced, including launch of a mobile app in May 2024.

To enable investors to systematically plan their investments, an auto-bidding facility for Treasury bills (T-bills), covering both investment and re-investment options, has been enabled in Retail Direct. The new functionality helps investors to mandate automatic placement of bids in primary auctions of T-bills.

RBI MPC Maintains Policy Repo Rate At 5.50%

The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Dr. Rajiv Ranjan attended the meeting.

2. After assessing the current and evolving macroeconomic situation, the MPC voted to maintain the policy repo rate at 5.50 per cent. Consequently, the standing deposit facility (SDF) rate under the liquidity adjustment facility (LAF) remains unchanged at 5.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 5.75 per cent. This decision is in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

Growth and Inflation Outlook

3. The global environment continues to be challenging. Although financial market volatility and geopolitical uncertainties have abated somewhat from their peaks in recent months, trade negotiation challenges continue to linger. Global growth, though revised upwards by the IMF, remains muted. The pace of disinflation is slowing down, with some advanced economies even witnessing an uptick in inflation.

4. Domestic growth remains resilient and is broadly evolving along the lines of our assessment. Private consumption, aided by rural demand, and fixed investment, supported by buoyant government capex, continue to boost economic activity. On the supply side, a steady south-west monsoon is supporting kharif sowing, replenishing reservoir levels and boosting agriculture activity. Moreover, services sector and construction activity remain robust. However, growth in industrial sector remained subdued and uneven across segments, pulled down by electricity and mining.

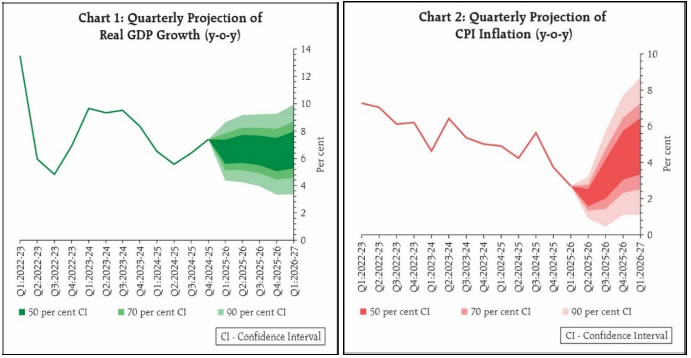

5. As for the growth outlook, the above normal southwest monsoon, lower inflation, rising capacity utilization and congenial financial conditions continue to support domestic economic activity. The supportive monetary, regulatory and fiscal policies including robust government capital expenditure should also boost demand. The services sector is expected to remain buoyant, with sustained growth in construction and trade in the coming months. Prospects of external demand, however, remain uncertain amidst ongoing tariff announcements and trade negotiations. The headwinds emanating from prolonged geopolitical tensions, persisting global uncertainties, and volatility in global financial markets pose risks to the growth outlook. Taking all these factors into account, projection for real GDP growth for 2025-26 has been retained at 6.5 per cent, with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent. Real GDP growth for Q1:2026-27 is projected at 6.6 per cent (Chart 1). The risks are evenly balanced.

6. CPI headline inflation declined for the eighth consecutive month to a 77-month low of 2.1 per cent (y-o-y) in June 2025. This was driven primarily by a sharp decline in food inflation led by improved agricultural activity and various supply side measures. Food inflation recorded its first negative print since February 2019 at (-) 0.2 per cent in June. High-frequency price indicators signal a continuation of the lower price momentum in food prices this year to July as well. Core inflation, which remained within a narrow range of 4.1-4.2 per cent during February-May, increased to 4.4 per cent in June, driven partly by a continued increase in gold prices.

7. The inflation outlook for 2025-26 has become more benign than expected in June. Large favourable base effects combined with steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels and comfortable buffer stocks of foodgrains have contributed to this moderation. CPI inflation, however, is likely to edge up above 4 per cent by Q4:2025-26 and beyond, as unfavourable base effects, and demand side factors from policy actions come into play. Barring any major negative shock to input prices, core inflation is likely to remain moderately above 4 per cent during the year. Weather-related shocks pose risks to inflation outlook. Considering all these factors, CPI inflation for 2025-26 is now projected at 3.1 per cent with Q2 at 2.1 per cent; Q3 at 3.1 per cent; and Q4 at 4.4 per cent. CPI inflation for Q1:2026-27 is projected at 4.9 per cent (Chart 2). The risks are evenly balanced.

Rationale for Monetary Policy Decisions

8. The MPC noted that the inflation outlook in the near term has become more benign than anticipated earlier, and the average CPI inflation this year is expected to remain significantly below the target. This is driven mainly by lower food inflation that entered deflationary territory in June. However, CPI inflation is likely to edge up above the 4 per cent target from Q4:2025-26 onwards. Moreover, core inflation has been rising steadily from the recent low of 3.6 per cent recorded during December-January 2024-25 and averaged 4.3 per cent in Q1 this year. Core excluding precious metals has witnessed an uptick and averaged 3.4 per cent in Q1.

9. Growth has held up well with some pick-up expected in the coming festive season and is evolving in line with our assessment of 6.5 per cent for 2025-26.

10. Thus, while headline inflation is much lower than projected earlier, it is mainly due to volatile food prices, especially of vegetables. Core inflation, on the other hand, has remained steady around the 4 per cent mark, as anticipated. Inflation is projected to go up from the last quarter of this financial year. Growth is robust and as per earlier projections though below our aspirations. The uncertainties of tariffs are still evolving. Monetary policy transmission is continuing. The impact of the 100 bps rate cuts since February 2025 on the economy is still unfolding.

11. On balance, therefore, the current macroeconomic conditions, outlook and uncertainties call for continuation of the policy repo rate of 5.5 per cent and wait for further transmission of the front-loaded rate cuts to the credit markets and the broader economy. Accordingly, the MPC unanimously voted to keep the repo rate unchanged. The MPC further resolved to maintain a close vigil on the incoming data and the evolving domestic growth-inflation dynamics to chart out the appropriate monetary policy path. Accordingly, all members decided to continue with the neutral stance.

12. The minutes of the MPC’s meeting will be published on August 20, 2025.

13. The next meeting of the MPC is scheduled from September 29 to October 1, 2025.