Women borrowers in the EWS/LIG/MIG category are benefitting from higher discretionary spending reflected in spiraling transactions across value-volume matrix

FinTech BizNews Service

Mumbai, October 15, 2025: The State Bank of India’s Economic Research Department has come out with a special Research Report on PMAY. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

PMAY is now acting as a change agent with it becoming a catalyst for enhanced discretionary and even non-discretionary spending with a demonstrated wealth effect, financial stability & well-being; women borrowers in the EWS/LIG/MIG category are benefitting from higher discretionary spending reflected in spiraling transactions across value-volume matrix.

Pradhan Mantri Awas Yojana - Urban 2.0 (PMAY-U 2.0) was launched on 01.09.2024 to provide Central Assistance to 1 crore eligible urban families, ensuring that citizens of urban India enjoy an improved quality of life. Eligible families belonging to the EWS, LIG, and MIG categories, living in urban areas, and without a pucca house anywhere in the country can purchase or construct a house under PMAY-U 2.0

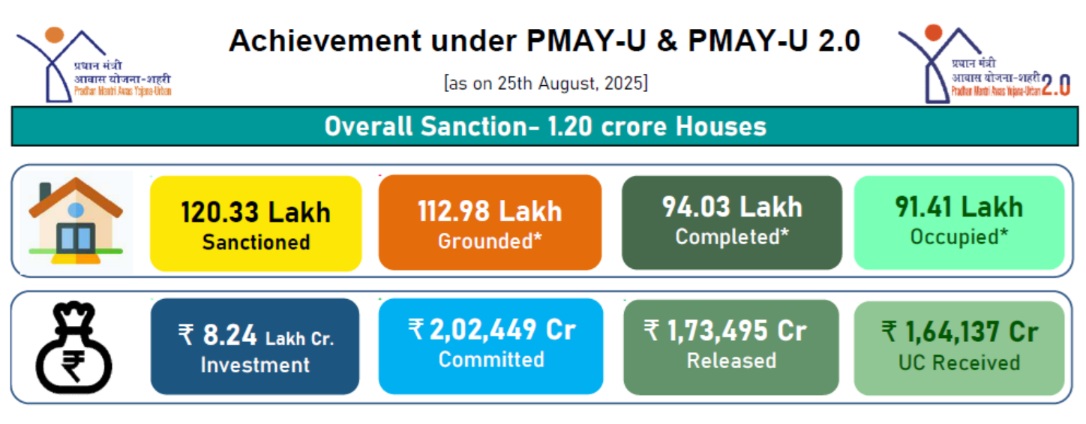

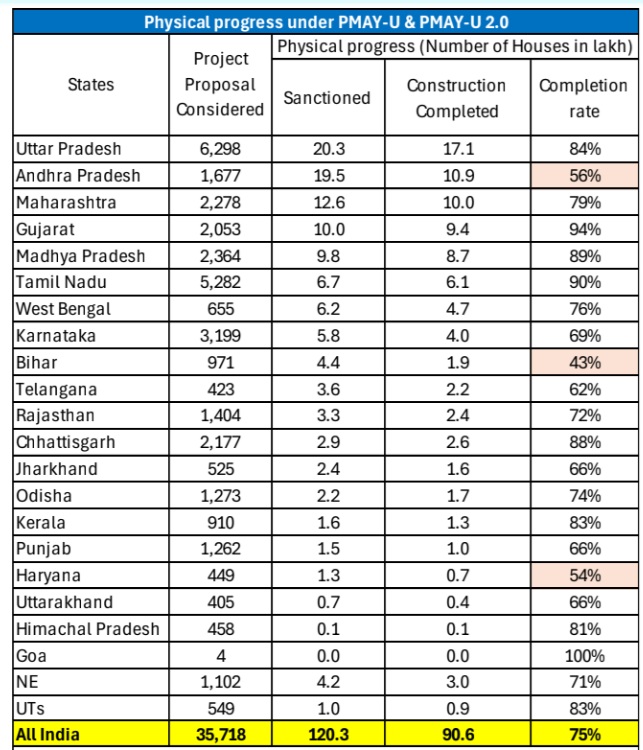

❑ Progress so far: 1.2 crore houses were sanctioned so far (till 25 Aug) under PMAY-U and PMAY-U 2.0...Of all the houses sanctioned, the construction of 75% houses completed. While most of the states have progress rate of 75% or more, there are some states where progress is less than 60% (like Andhra Pradesh, Bihar and Haryana)

❑ The normalized Shannon entropy score is 0.84, indicating spatial evenness in housing construction under PMAY. This suggests that housing benefits are broadly distributed across states...with even low-income states actively participating in the entire process

❑ Impact on Household Spending is positive for both non discretionary / debit card and discretionary spend /UPI transactions

• Debit card spending increases for those households at lowest end of quintile spending indicating that access to subsidized housing loans provides greater financial freedom and flexibility. While part of the loan is used for construction, these households experience a perceived wealth effect—recognizing that their housing costs are effectively lower than market rates. The lowest 25% households in terms of spending channelize their expenditure towards traditional sources such as debit cards

• Separately, higher-spending households at higher end of the quintile are better positioned to translate the perceived gain of subsidized interest rates into discretionary UPI payments, reflecting both increased liquidity and confidence in financial stability creating a sense of increased wealth

❑ Impact of discretionary household spending post disbursement of PMAY instalment is more pronounced for women borrowers

• After taking the PMAY loan the average monthly UPI spending of the sample increases by Rs 5050 to Rs 45,081

– Discretionary / UPI spending increases for all the EWS/LIG/MIG category borrowers

❖ Within this cohort, female borrowers are more efficient in managing household spending......This conditionality that house under PMAY should be in the name

of the female head of the household or in the joint name of the male head of the household has positive aspect on spending. The average monthly change of UPI

spending of female borrowers post disbursal of the home loan is almost double than the male borrowers

❖There is a spontaneous increase in UPI spending across all ages and urban and semi urban regions