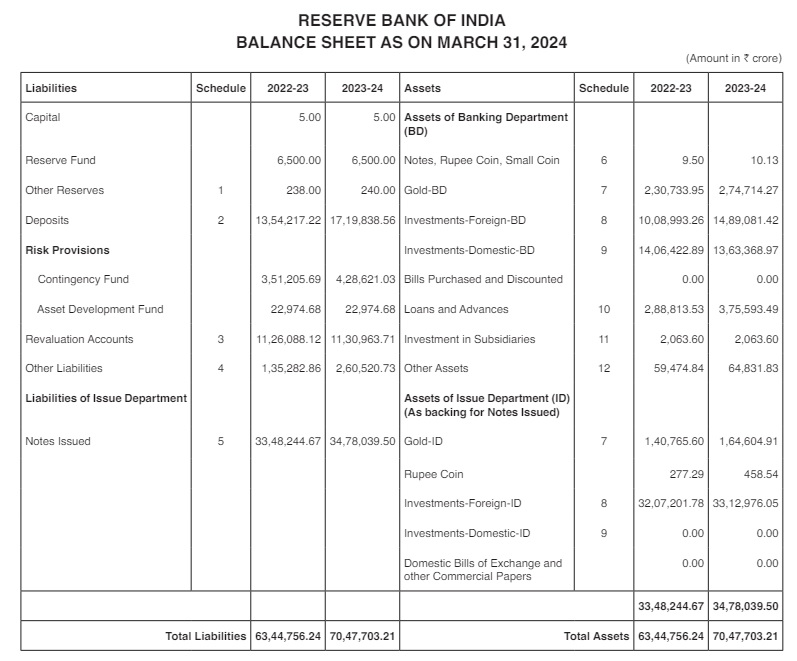

The size of the Reserve Bank’s balance sheet increased by 11.08 per cent for the year ended March 31, 2024 with an overall surplus of Rs2,10,873.99 crore

FinTech BizNews Service

Mumbai, May 31, 2024: RBI released its ANNUAL REPORT 2023-24 on 30 May, 2024.

The size of the Reserve Bank’s balance sheet increased by 11.08 per cent for the year ended March 31, 2024. While income for the year increased by 17.04 per cent, expenditure decreased by 56.30 per cent. The year ended with an overall surplus of Rs2,10,873.99 crore as against Rs87,416.22 crore in the previous year, resulting in an increase of 141.23 per cent.

The size of the balance sheet increased byRs7,02,946.97 crore, i.e., 11.08 per cent from Rs63,44,756.24 crore as on March 31, 2023 to Rs70,47,703.21 crore as on March 31, 2024. Increase on assets side was due to rise in foreign investments, gold, and loans and advances by 13.90 per cent, 18.26 per cent and 30.05 per cent, respectively. On liabilities side, expansion was due to increase in notes issued, deposits and other liabilities by 3.88 per cent, 27.00 per cent and 92.57 per cent, respectively. Domestic assets constituted 23.31 per cent while foreign currency assets, gold (including gold deposit and gold held in India) and loans and advances to financial institutions outside India constituted 76.69 per cent of total assets as on March 31, 2024 as against 26.08 per cent and 73.92 per cent, respectively, as on March 31, 2023. XII.4 A provision of Rs42,819.91 crore was made and transferred to Contingency Fund (CF). No provision was made towards Asset Development Fund (ADF).

Deposits

These represent balances maintained with the Reserve Bank, by banks, the Central and State Governments, All India Financial Institutions, such as, Export Import Bank (EXIM Bank), NABARD, etc., Foreign Central Banks, International Financial Institutions, balances in Administrators of RBI Employee Provident Fund, DEA Fund, amount outstanding against Reverse Repo, SDF, MAF, PIDF, etc. Total deposits increased by 27.00 per cent from Rs13,54,217.22 crore as on March 31, 2023 to Rs17,19,838.56 crore as on March 31, 2024.

The balances held by the Central and State Governments were Rs5,000.30 crore and Rs42.46 crore, respectively, as on March 31, 2024 as compared to Rs5,000.93 crore and Rs42.49 crore, respectively, as on March 31, 2023.

Deposits-Banks

Banks maintain balance in their current accounts with the Reserve Bank to provide for Cash Reserve Ratio (CRR) requirements and for working funds to meet payment and settlement obligations. Deposits held by banks increased by 10.21 per cent from Rs9,30,476.97 crore as on March 31, 2023 to Rs10,25,448.73 crore as on March 31, 2024. Increase in this head was on account of increase in Net Demand and Time Liabilities (NDTL) of banks.

Deposits-Financial Institutions Outside India

The balance under the head increased by 60.02 per cent from Rs1,02,207.19 crore as on March 31, 2023 to Rs1,63,548.81 crore as on March 31, 2024, due to increase in volume of repo transactions during the year.

Deposits-Others

‘Deposits-Others’ consist of balances of Administrators of RBI Employee Provident Fund, DEA Fund, Foreign Central Banks, Indian and International Financial Institutions, MAF, PIDF, amount outstanding under Reverse Repo, SDF, etc. ‘Deposits Others’ increased by 66.13 per cent from Rs3,16,489.64 crore as on March 31, 2023 to Rs5,25,798.26 crore as on March 31, 2024 primarily due to increase in reverse repo deposits.

Contingency Fund (CF)

This is a specific provision meant for meeting unexpected and unforeseen contingencies, including depreciation in value of securities, risks arising out of monetary/ exchange rate policy operations, systemic risks and any risk arising on account of special responsibilities enjoined upon the Reserve Bank. As on March 31, 2024, amounts of Rs1,43,220.82 crore and Rs7,090.29 crore were charged to CF on account of debit balances in IRA-FS and IRA-RS, respectively. The charge to CF is reversed on first working day of the following accounting year. Further, an amount of Rs42,819.91 crore was also provided towards CF to maintain the Available Realised Equity at the level of 6.50 per cent of the size of the balance sheet. Accordingly, balance in CF as on March 31, 2024 was Rs4,28,621.03 crore as compared to Rs3,51,205.69 crore as on March 31, 2023.

Currency and Gold Revaluation Account (CGRA)

Major sources of market risk faced by the Reserve Bank are currency risk, interest rate risk and movement in gold prices. CGRA provides a buffer against exchange rate/ gold price fluctuations. It can come under pressure if there is an appreciation of rupee vis-à-vis major currencies or a fall in price of gold. When CGRA is not sufficient to fully meet exchange losses, it is replenished from CF. The balance in CGRA increased from Rs11,24,733.16 crore as on March 31, 2023 to Rs11,30,793.34 crore as on March 31, 2024 mainly due to depreciation of rupee and increase in price of gold.

Other Liabilities

‘Other Liabilities’ increased by 92.57 per cent from Rs1,35,282.86 crore as on March 31, 2023 to Rs2,60,520.73 crore as on March 31, 2024, primarily due to increase in surplus payable to the Central Government.

Surplus Payable to the Central Government

Under Section 48 of the RBI Act, 1934, the Reserve Bank is not liable to pay income tax or super tax on any of its income, profits or gains. Accordingly, after adjusting the expenditure including provision for CF and contribution of Rs4 crore to four statutory funds, the surplus payable to the Central Government for the year 2023-24 amounted to Rs2,10,873.99 crore (including Rs291.42 crore as against Rs424.07 crore in the previous year payable towards the difference in interest expenditure borne by the Government, consequent on conversion of special securities into marketable securities).

Bills Payable

The Reserve Bank provides remittance facilities for its constituents through issue of Demand Drafts (DDs) and Payment Orders (POs) [besides electronic payment mechanism]. The balance under this head represents unclaimed DDs/ POs. The amount outstanding under this head increased from Rs0.11 crore as on March 31, 2023 to Rs11.35 crore as on March 31, 2024.

Miscellaneous

This is a residual head representing items such as interest earned on earmarked securities, amounts payable on account of leave encashment, medical provisions for employees, global provision, etc. The balance under this head decreased from Rs13,308.32 crore as on March 31, 2023 to Rs11,487.00 crore as on March 31, 2024.

Liabilities of Issue Department-Notes Issued

Liabilities of Issue Department reflect quantum of currency notes in circulation. ‘Notes Issued’ increased by 3.88 per cent from Rs33,48,244.67 crore2 as on March 31, 2023 to Rs34,78,039.50 crore as on March 31, 2024. The value of banknotes in circulation in digital form, i.e., eRs-Wholesale (eRs-W) and eRs-Retail (eRs-R) stood at Rs0.08 crore and Rs234.04 crore, respectively, as on March 31, 2024 as compared to Rs10.69 crore and Rs5.70 crore, respectively, as on March 31, 2023. Earlier, an amount of Rs10,719.37 crore, representing the value of Specified Bank Notes (SBNs) not paid was transferred to ‘Other Liabilities’ as on June 30, 2018. The Reserve Bank has made payments to the extent of Rs5.93 crore towards exchange value of SBNs to eligible tenderers during the year ended March 31, 2024 and the cumulative payment made against the head stands at Rs36.14 crore.

ASSETS OF THE RESERVE BANK

ASSETS OF BANKING DEPARTMENT

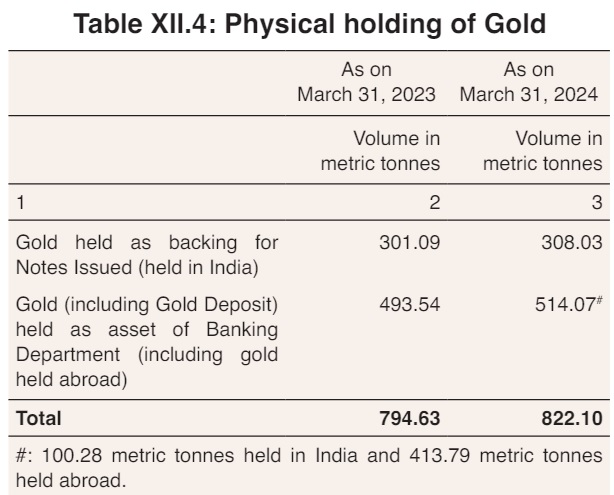

As on March 31, 2024, total gold held by the Reserve Bank was 822.10 metric tonnes (MTs) as compared to 794.63 metric tonnes as on March 31, 2023. This increase is on account of addition of 27.47 metric tonnes of gold during the year. Of 822.10 metric tonnes as on March 31, 2024, 308.03 metric tonnes of gold are held as backing for Notes Issued as compared to 301.09 metric tonnes as on March 31, 2023 and is shown separately as an asset of Issue Department. The balance 514.07 metric tonnes as on March 31, 2024 as compared to 493.54 metric tonnes on March 31, 2023 is treated as an asset of Banking Department.

The value of gold (including gold deposit) held as asset of Banking Department increased by 19.06 per cent from Rs2,30,733.95 crore as on March 31, 2023 to Rs2,74,714.27 crore as on March 31, 2024. This increase is on account of addition of 20.53 metric tonnes of gold, increase in price of gold and depreciation of INR vis-à-vis USD.