Indian Banks need enhanced assessment of Interest rate impact: BCG Report

FinTech BizNews Service

Mumbai, July 9, 2025: Over the last decade, India has witnessed a predominantly downward trajectory in interest rates, marked by only brief periods of reversal. The prolonged low and relatively stable interest rate over the past decade has created a challenging backdrop for the period since 2022. Post 2022, the inflation induced spike in interest rate and the more recent reversal of interest trajectory sets one up to a period which may experience higher two-way swings in interest rate. To clarify, the geopolitical uncertainties as well as arguable structural imbalance and ensuing uncertainty in certain corners of global financial systems may cause two-way volatility in India’s interest regime. As of this point in time, the exogenous risk outweighs any domestic growth-inflation risk.

Between 2010 and 2022, India enjoyed a largely stable and downward-trending interest rate regime. However, that trajectory reversed after the COVID-19 pandemic, when inflation forced the Reserve Bank of India (RBI) to raise the repo rate by 250 basis points between 2022 and 2023. That tightening was short-lived. Beginning in February 2025, the RBI reversed course, cutting the repo rate by 100 basis points in a bid to revive growth, bringing it down to 5.5%.

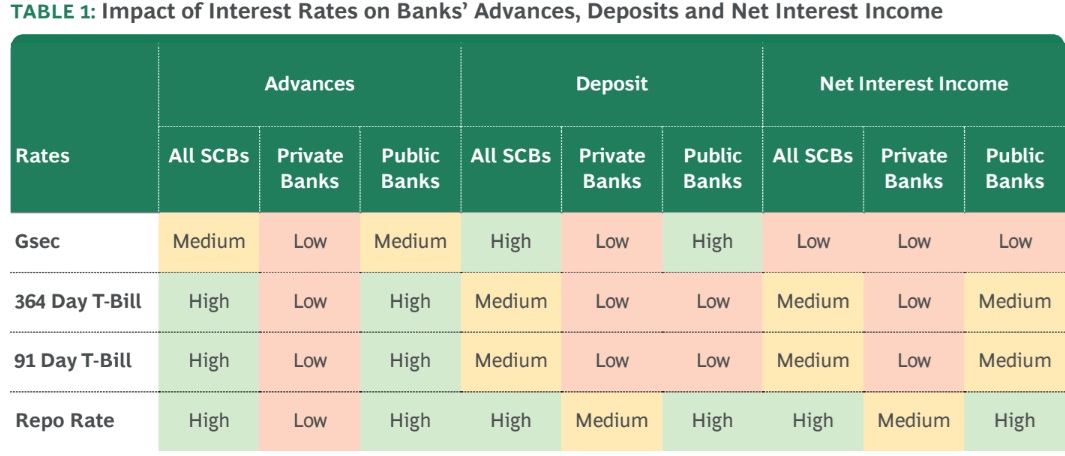

A study conducted by BCG titled, ‘Interest Rate Sensitivity in Indian Banking: An Empirical Look & its Strategic Implications’ determined the effect of rate changes—specifically the repo rate and treasury bill rates—on key banking metrics- advances, deposits, and Net Interest Income (NII). The study finds that while all Scheduled Commercial Banks (SCBs) are influenced by rate changes, the repo rate emerges as the most reliable predictor across metrics. However, transmission is neither immediate nor uniform—it takes 12 to 24 months for the full effects of rate changes to materialize in banking performance.

“Contrary to popular belief, lower interest rates do not always lead to increased lending. While rates act as enablers, the actual expansion of credit hinges on borrower sentiment and lenders’ risk appetite. As such, policy rates are often increased to cool down an over-heated economy, with the objective of reining in inflation. But credit demand follows the momentum in economic activity and often continues to rise despite a rate hike. The reverse is also empirically observed. If credit demand is moderate, a reduced interest rate may not boost it over the next 12-24 months.”, said Deep Narayan Mukherjee, Partner & Director, BCG.

“Banks need to improve deposit pricing strategies and liability analytics. As Indian savers increasingly explore mutual funds, pensions, and direct investments, banks will need to leverage data science to understand depositor behavior and tailor their products. The era of one-way, predictable interest rate cycles is likely over. With geopolitical disruptions and domestic market shifts reshaping the landscape, Indian banks can no longer afford to rely on conventional planning models. Banks need to improve deposit pricing strategies and liability analytics.”, said Gopal Sharma, Director, BCG.

This two-way interest rate movement reflects broader global uncertainties—from geopolitical tensions to structural imbalances in financial systems. “Exogenous risks now outweigh domestic concerns,” notes the report, urging Indian banks to adopt more scenario-driven strategies.

Impact on Credit Growth, Deposits and Net Interest Income

Contrary to popular belief, lower interest rates do not always lead to increased lending. While rates act as enablers, the actual expansion of credit hinges on borrower sentiment and lenders’ risk appetite. For instance, between 2014 and 2016, credit growth failed to pick up despite falling rates. Similarly, 2022 to 2023 witnessed robust credit growth even amid rising rates. A 50-basis point increase in the repo rate was found to result in a 1.16% rise in advances across SCBs, while a similar cut led to a 1.25% drop.

Public Sector Banks (PSBs) were more responsive than private ones. A 50-bps hike triggered a 1.4% increase in advances for PSBs, compared to a more muted response among private sector players, particularly larger ones.

For deposits, the study concludes that changes in interest rates do not have a statistically significant effect on deposit mobilization. This remains true even after accounting for the one-year lag typically associated with monetary transmission. Public sector banks, which traditionally enjoy a stable and loyal depositor base, showed little sensitivity to interest rate shifts. Private banks, while somewhat more agile, still showed only a weak correlation. Competitive factors, customer outreach, and liquidity management appear to play a far larger role in attracting deposits than monetary policy.

In stark contrast, Net Interest Income—banks’ core earnings component—showed high sensitivity to interest rate changes. A 50bps increase in the repo rate translated to a 1.11% rise in NII across SCBs. PSBs again stood out, with a 1.45% jump in income following a rate hike, and a 1.56% decline with a rate cut. Private banks were also affected, though to a lesser extent.

Implications

Given the two-way swings in interest rate trajectory, banks need to strengthen their interest rate risk frameworks. Forecasting must evolve from linear models to scenario-based planning. Banks need to supplement balance sheet extrapolations with simulations that capture extreme and path-dependent events.

Many banks continue to base internal pricing on historical cost of funds rather than opportunity or marginal costs. This practice distorts loan pricing and internal profitability assessments, potentially misallocating capital and overstating profits in lending-heavy units.

The Path Forward: More analytical rigor on interest rate impact on business

The era of one-way, predictable interest rate cycles is likely over. With geopolitical disruptions and domestic market shifts reshaping the landscape, Indian banks can no longer afford to rely on conventional planning models. Banks need to more explicitly embed Interest rate sensitivity in business projections than has been the case for at least some of them till now

Banks need to improve deposit pricing strategies and liability analytics. As Indian savers increasingly explore mutual funds, pensions, and direct investments, banks will need to leverage data science to understand depositor behavior and tailor their products.

Historically, the focus has been on loan analytics, but as competition for savings heats up, liability-side analytics will be just as critical.