With the government's announcement of a new affordable housing scheme for the middle class in the Interim Budget, there is hope for small businesses in the housing and homes value chain in the years to come

FinTech BizNews Serviced

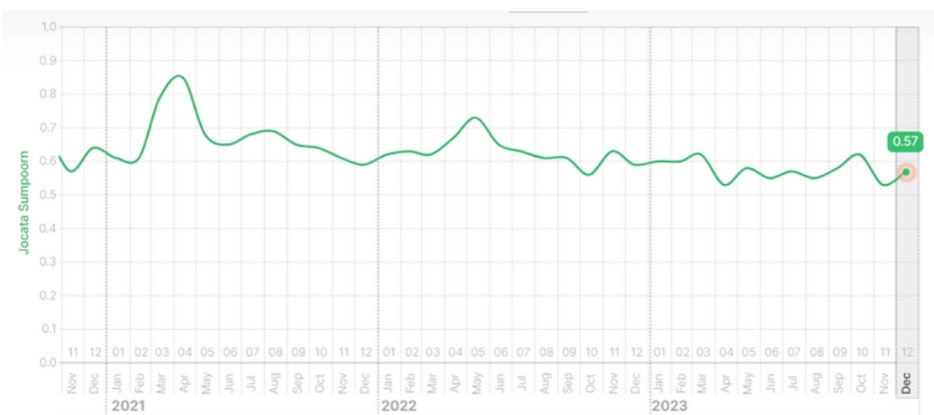

Mumbai: 9th February, 2024: Jocata Sumpoorn Index that stood at 0.57 in December, moving up from the level of 0.53 in November. The latest insights from Jocata Sumpoorn Index are very interesting, indicating that sales activity of MSMEs is in the phase of mild expansion. Jocata is a subsidiary of BillDesk.

Key Highlights:

In the future, challenges to growth from global economic slowdown and declining rural incomes are likely to persist. The MSME sector anticipates support from the upcoming budget, including modifications to ECLGS, incentives for Udyam Assist and Udyam registration to facilitate access to bank credit.

You can also visit https://sumpoorn.in/indexfor more details on the index

About Jocata Sumpoorn Index

The role of MSMEs as the backbone of our economy is undeniable. And while there have been government and private efforts that have given impetus to their growth and development, there is a missing piece- A reliable lens to examine the health of the MSME sector. Jocata Sumpoorn in association with SIDBI was born out of an ambition to fill this gap and evolved into- India’s first and only MSME economic index. The MSME-specific high frequency indicator is built using consent-led, digitally accessible and anonymised GST sales data of cumulatively more than 50,000 MSMEs seeking credit from financial institutions from October 2019 to date.

Built and tracked over the past 4 years by a team of credit experts, data scientists and economists, the Index is mapping strongly to macro-economic conditions. The index movement mapped with other published macro-Indices including the Index of Industrial Production (IIP) by GoI, Purchasing Managers’ Index (PMI) by S&P Global and GVA Growth can help unearth different dimensions at play in the Indian economy for deeper analysis of the MSME sector.