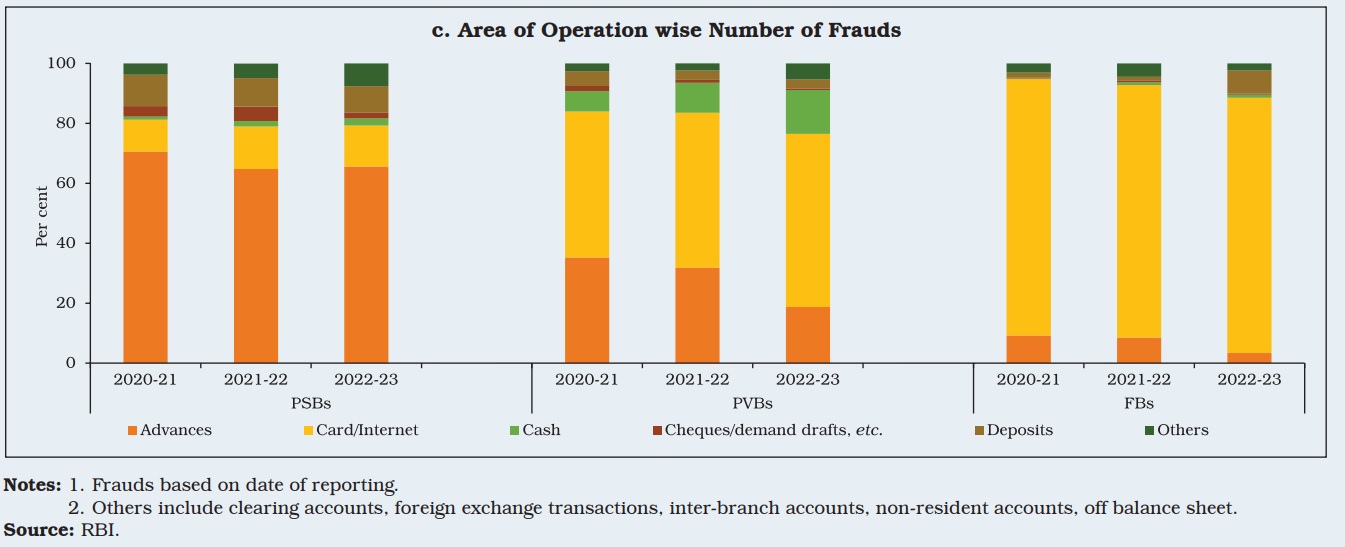

While the majority of the frauds in PSBs were related to advances, PVBs accounted for a majority of card/ internet and cash-related cases

Frauds banks operation-wise

FinTech BizNews Service

Mumbai, December 28, 2023: Frauds lead to reputational, operational and business risk for banks and undermine customers’ trust in the banking system with financial stability implications.

Frauds in the Banking Sector

During 2022-23, the total amount of frauds reported by banks declined to a six-year low while the average amount involved in frauds was the lowest in a decade. In H1:2023-24, although the number of frauds reported rose over the corresponding period a year ago, the amount involved was only 14.9 per cent of the previous year’s amount.

Based on the date of occurrence of frauds, the average amount involved declined during 2022-23, with the number of cases concentrated in card or internet related frauds.

The number of fraud cases reported by PVBs accounted for 66.2 per cent of the total. In terms of amount involved, PSBs had a higher share. While the majority of the frauds in PSBs were related to advances, PVBs accounted for a majority of card/ internet and cash-related cases.

Enforcement Actions

The increase in instances of penalties imposed on regulated entities (REs) during 2022-23 was led by co-operative banks. For both PSBs and PVBs, they declined during the year. The average penalty per instance was the highest for PVBs.