Policy intent is likely to be made clear through the selective allocation of resources and thrust towards rural development, employment generation and capacity building through infrastructure development

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, January 27, 2024:

The Interim Union Budget is unlikely to see any big-bang announcements. However, policy intent is likely to be made clear through the selective allocation of resources and thrust towards rural development, employment generation and capacity building through infrastructure development. The critical intent of this Budget will be to signal a consolidation towards achieving the promised 4.5% GFD/GDP by FY26. Thus, the government will have to do a tightrope walk in allocating resources for capital expenditure, the incremental pace of which can reduce. With help from tax collections on the back of higher nominal GDP growth in FY25 compared to FY24, we expect GFD/GDP to print at 5.4% for FY25BE (after 5.8% for FY24E). 10-year yields can stay northwards of 7% in H1FY25 as we think that the RBI will have to conduct OMO sales to prevent its balance sheet size from increasing sharply. Dips below 7% will be conditioned by rate cuts by the RBI.

Budget exercise on the back of comfortable macros:

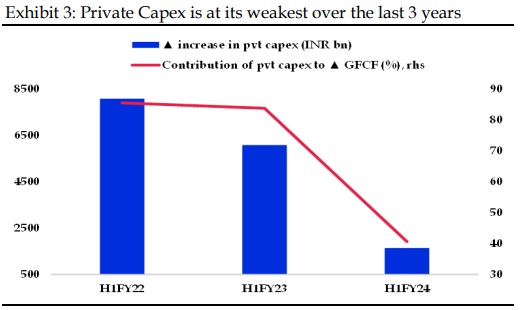

Despite being an interim Budget, Union Budget for FY25 assumes importance due to its need to continue to target fiscal consolidation, given the promise of the government towards achieving 4.5% GFD/GDP. This also assumes importance in the light of the JPM Bond Index inclusion where investors are expected to keep a close eye on India macro risks. Overall, we think that the macros remain good for India at this point, with the government indicating a 7.3% growth for FY24 and the RBI also having engineered the core retail inflation lower by maintaining tight financial conditions. Within the robust growth momentum, there are pockets of softness such as the private final consumption expenditure especially a weak rural sector, lagging private capex spend etc. However, we do not expect the Union Budget to show any attempt to boost domestic consumption, given that it also probably would run contrary to the fiscal measures it has employed (export bans on certain categories of rice and wheat, levying customs duty on onions to restrict exports) to assist the RBI in bringing inflation down. Data clearly indicates that in FY24 the push to the economy has come from government’s capex, with the private capex still slacking. For FY25, this can continue due to the continued demand-side uncertainties. Thus, the government is unlikely to totally withdraw from its capex push, though the growth is likely to be muted at 12-13% compared to a 36% growth assumed in FY24BE. We expect real growth in FY25 to be at 6.9%, and given our assumptions on CPI and WPI inflation, the Budget is expected to factor in nominal GDP growth of 11.3%. Further, external sector dynamics have maintained a positive momentum this year, with CAD/GDP expected at 1%. We see the CAD/GDP getting even better in FY25 at 0.5%.

GFD/GDP for FY25BE anticipated at 5.4% after overachieving at 5.8% in FY24E:

Given current trends in tax collections, we see the gross tax collections for FY24E exceeding FY24BE by around INR 393 bn. On the other hand, the government enjoys a buffer of around INR 568 bn on account of a sharply higher RBI dividend for FY24E. Further, despite higher revenue expenditures towards subsidies (food) and MNREGA, and with the buffer from the revenue side, we see the government likely overachieving in the GFD/GDP target and report a 5.8% for FY24E. As indicated above, we expect the government to use a 11.3% nominal GDP growth for its budget calculations (due to WPI outturn likely much higher in FY25 compared to FY24, on account of base effect), much higher than the 8.9% nominal growth assumed for FY24E. As per our model, this is expected to be reflected in a INR 2347 bn in the net tax revenues. On the other hand, we anticipate expenditures in FY25BE to be higher by around INR 3435 bn compared to FY24E. Overall, we think that the government could be targeting a 5.4% GFD/GDP for FY25BE. This will leave the government a 90 bps correction to be achieved in FY26, if it has to reach its promised 4.5%. Further correction in FY25 may not be possible as the government continues to support growth through its capex.

Comfortable G-sec borrowing for FY25BE:

FY25BE is expected to place net borrowings through G-secs at INR 11.7 tn, almost unchanged from FY24E. Gross borrowings via G-secs is estimated at INR 15.0 tn with a INR 3.3 tn redemption (FY24E at 15.4 tn). For states we assume a GSFD/GSDP of 2.8%, of which 60% is expected to be met by net SDL borrowings of INR 5.5 trn. Gross SDL issuances is placed at INR 8.7 tn. Cumulative government borrowings is thus anticipated at INR 23.7 tn in FY25 (INR 24.9 tn in FY24). With bond inclusion scheduled for June 2024, we do not see the issuance size creating any negative impact on the market while we keep an eye on RBI’s OMO sales that may be needed to counter likely FX purchases of the estimated USD 20-22 bn inclusion related flows. We see 10-year yield at 6.75-7.10% in FY25 with the journey to the sub-7% zone conditional on the timing of the rate cut by the RBI.

Good macros but challenges persist

India is estimated to have grown by 7.3% in FY24 after a 7.2% growth in FY23. Even as monetary policy has been tightened by 250 bps, there has not been much downside to the growth dynamics, as was being earlier estimated by the market. Our analysis also indicates that GDP growth has now surpassed the trend-line, implying that the Covid implications on growth is no longer there. However, it is important to note, that the government capex growth has been signficant, and continues to be the dominant driver of growth, while consumption expenditure lags. In constant prices, the Advance Estimates for GDP indicates that the share of PFCE in GDP has come down to 56.9% in FY24 compared to 58.5% last year. On the other hand, the share of GFCF in GDP has increased to 34.9% in FY24 against 34% in FY23.

Even as growth has recovered to pre-Covid levels, the critical problem is a) still a K-shaped recovery where rural growth continues to lag. We expect rural demand to remain muted given weak kharif output, continued weakness in sowing of rabi rice and a low real wage grwoth for the rural economy, b) further, demand may also be muted on account of the RBI recently raising risk weights on certain categories of personal loans, c) private capex has remained weak despite healthy corporate and bank balance sheets. Private capex, beyond certain sectors that are linked to the government’s capex and construction activities, can remain weak as uncertainty of demand atmosphere continues – both domestic and global. This budget is expected to be used by the government to continue on a consolidation mode, given their promise of 4.5% GFD/GDP by FY26. However, given that growth has been pushed by government’s capex, and as private consumption and private capex remains weak, the challenge for the government would be to totally move itself away from its capex. The centre is likely to also continue to provide a push to capex through the states. Thus, we expect that the interest-free loans that is provided to the states to boost their capex spend could be enhanced. This is mostly as states’ capital expenditure is higher and the efficiency of capital spend at the state level is better than the centre’s. The hope would be that sooner-than-later the private capex would rise in response to the government’s capex cycle. While we expect capex push of the government to continue, the growth is likely to be more muted than in earlier years. Despite some market expectations we do not expect the fiscal to be used in any measure to push consumption expenditure. Having said, even though we do not expect the Budget to announce any signifant policy measures, the continued focus will remain on rural development, affordable housing, employment generation and energizing the manufacturing sector. On the inflation front, the government has provided continued support to the RBI in FY24 to fight off inflation pressures. Tighter financial conditions from the RBI has enabled a reduction in the core retail inflation. Core WPI inflation has also come off due to falling commodity prices globally and also due to a steady USD/INR. The critical risk for domestic inflation continue to be food prices. The diffusion index for food also have exhibited steady trends. Having said, the RBI is likely to continue to watch the evolving dynamics of inflation, given that climate condition changes have lent a risk to the food economy. In a recent paper, RBI noted that food inflation volatility has been higher than volatility in Headline and Core inflation and certain sub-groups such as vegetables, oil and fats and pulses have been relatively more volatile. RBI also notes that “non-trivial” degree of inflation persistence in certain sub-groups increases the risks of spillovers to non-food inflation.

the diffusion index on the food basket is steady while Exhibit 6 indicates our expected trajectory on inflation. We expect a) Headline inflation to soften to <4% in Q2FY25 but is likely to move higher again. However, we have to be guarded on vegetable price shock around June/July as in 2023 that had come through higher tomato prices. Studies by the RBI had noted that such price shocks every year has shown a higher peak than the previous year, b) Average Headline CPI inflation in FY25 expected at 4.8% compared to 5.4% in FY24. However, the comfort of seeing a sustained adherence to the 4% inflation target still eludes. Consequently we think that the RBI will remain watchful of the inflation dynamics into FY25 and is unlikely to therefore provide any signal for a monetary policy pivot. Global financial markets have also started to push out any anticipated rate cuts by the US into June

2024. We therefore see some chance for the RBI to cut rates in August 2024, and not unless the global rate cutting cycle has started. We had noted in our Pre-Budget note of the previous year that “some of the economic challenges that the centre had to fight against in FY23 are likely to be lower in FY24”. This has turned out to be true. India appears to be in a goldilocks situation so far as growth-inflation mix is concerned. However, the challenge is now for the government to gradually pull away from is capex push and focus on consolidation of the GFD/GDP to the 4.5% levels. Given our expectations of a lower capex growth in FY25, continued tightness in financial conditions and a likely weaker personal loan growth (higher risk weights in certain categories), Real GDP growth is expected to be at 6.9% in FY25 (Exhibit 4). Based on our model estimates on CPI and WPI, we anticipate a nominal GDP growth of 11.3%. Our Budget calculations, as indicated below assumes a nominal GDP of 11.3%.

BUDGET MATHS

FY24BE expected nominal GDP growth at 10.5%, while first advance estimates point to a nominal GDP growth of 8.9%. Even with a lower nominal GDP growth, we expect the revenue receipts of the government to overshoot the budget estimates, despite lower disinvestment receipts. The revenue receipts is likely to outstrip the FY24BE by INR 975 bn on account of (i) higher tax buoyancy and (ii) higher than expected dividend transfer from the RBI. Direct tax collection is expected to grow at 16% reaching INR 18.9 tn vs FY24BE of INR 18.2 tn. However, indirect tax collection is expected to undershoot the FY24BE by INR 494 bn on account of lower collections in excise and customs duty. Overall, for FY24E we expect gross tax collections to overstrip FY24BE expectations by around INR 393 bn. On account of higher dividend transfer from the RBI, non-tax reveue is expected at INR 3.6 tn vs INR 3.0 tn in FY24BE. Overall, we expect total receipts in FY24E at INR 27.7 tn vs INR 27.2 tn in FY24BE. On the expenditure side, we expect the revenue expenditure to outgrow FY24BE on account of (i) higher subsidy bill (ii) higher spending towards the salary (iii) higher spending for rural development. For instance, budget allocation for MNREGA stood at INR 600 bn, and was also provided an additional alloaction of INR 145 bn in the first supplmentary grant. However, the total expenditure towards MGNREGA scheme is already at INR 860 bn and thus will need further allocations through the 2nd Supplementary Demand for Grants. On the other hand, given the current pace of capital expenditure by the central government, we feel the government might miss its FY24BE target. To an extent, the recent bulge in government balances is likely a result of lower spending by the Government. Overall, we expect total expenditure for FY24E to fall short of the budget by INR 172 bn. For FY25BE our fiscal calculations are based on an expected nominal GDP growth of 11.3%. We model for an expected net tax collections at 7.9% of GDP in FY25BE as against 8.0% of GDP in FY24E. Our estimates point to revenue receipts at 9.0% of GDP, marginally lower than FY24E of 9.2% of GDP. While committed expenditures of interest payments are likely to remain a drag, capital expenditure targets of the government is expected to increase by 13% or 3.2% of GDP for FY25BE. Our detailed expected numbers for FY25BE for various components of revenues and expenditures are enumerated below. Based on our calculations, we expect the government to end FY24E with a GFD/GDP of 5.8% and likely target a 50 bps consolidation to 5.4% for FY25BE. However, this is unlikely to be reflected in any comfort on the absolute GFD and thus, the government’s borrowing programme. We anticipate an absolute GFD for FY25BE at INR 17.7 tn, higher than INR 17.1 tn of FY24E. We believe that 66% of this gap will be met through net government borrowings. We pencil in a redemption of INR 3314 bn, assuming INR 300 bn of security switches from FY25 into future years. Consequently, gross borrowings through dated securities is placed at INR 15.0 tn.

Growth in receipts to moderate in FY25BE vs FY24E

• Corporate tax: For FY24E, we expect corporate taxes to end the year with an increase of 15.0% YoY as against FY24BE of 10.5% YoY. For FY25BE, we model the corporate tax collections at INR 10.6 tn, assuming a growth rate at 11.3% (translating to 3.2% of GDP).

• Income tax: FY24E income tax collections are likely to be higher than FY24BE of INR 9.0 tn by INR 450 bn on the back of increased compliance and broader tax base. We expect income tax growth at 17.0% for FY24E as against FY24BE of 10.5%. For FY25BE, we model income tax to grow by 11.3% (INR 10.5 tn). As a proportion of GDP, IT collections are likely at 3.2% in FY25BE.

Indirect taxes are likely to register a growth of 7.1% in FY24E against FY24BE for 10.4%. For FY25BE, we expect indirect taxes to grow by 8.8% to INR 16.1 tn. • CGST: Against FY24BE of INR 8.1 tn, we pencil in an actual amount for the year at INR 8.2 tn, a growth of 13.5%. For FY25BE we see CGST/GDP at 2.75% that translates to a growth of 11.3% YoY. CGST collections are expected at INR 9.1 tn for FY25E. • Excise tax: We expect excise collections at INR 3.1 tn in FY24E (1.05% of GDP), lower than FY24BE by INR 278 bn. Assuming that the government continues with the export duty on petroleum products and windfall taxes at current levels, excise duty collections are likely at INR 3.3 tn (0.99% of GDP). • Customs tax: Customs tax collections are likely to underperform FY24BE by INR 240 bn, at INR 2.1 bn.We pencil in custom duty collection for FY25BE at INR 2.2 tn registering a growth of 5%. As a percent of GDP, custom duty collection is expected at 0.7% in FY25BE.

The government is likely to outperform its non-tax revenue target for FY24BE by INR 568 bn, mainly due to higher transfer of RBI dividend at INR 874 bn against a likely budgeted amount of INR 480 bn. For FY25BE, non tax revenues are expected at INR 3.7 tn, registering a growth of 3.5%. We pencil in dividend receipts from the RBI and PSEs at INR 660 bn and INR 627 bn bn in FY25BE.

Non- debt capital receipts are likely to fall short of FY24BE by INR 409 bn on account of lower disinvestment receipts. Disinvestments in PSU entities were anticipated at INR 510 bn in FY24BE. Till date, the government has garnered INR 101 bn or 20% of its target, and is unlikely to garner any additional receipts under this head in the rest of the fiscal. In FY24, government has relied solely on OFS and IPO instruments to achieve the INR 101 bn proceeds. We pencil in INR 450 bn disinvestment target for FY25BE. The ‘recovery of loans and advances’ in FY25BE is estimated at INR 250 bn taking the total non-debt capital recipts to INR 800 bn.

Expenditure to fall short of FY24BE; Capex thrust to continue in FY25E The subsidy bill for FY24E is likely to overshoot FY24BE by INR 295 bn on account of (i) higher allocation towards fertilizer subsidy (ii) the extension of free food scheme for the next five years, and (iii) increased LPG subsidy towards PM Ujjwala yojana. Similarly, DA for central government employees were also increased by 4% in October 2023. As a result revenue expenditure of the government is trending higher than FY24BE. Factoring in the above and taking cues from the 1st supplementary demand for grants, we see revenue expenditure at 11.9% of GDP for FY24E as against FY24BE of 11.6% of GDP; or an additional outgo of INR 387 bn. Capital expenditures have been running at 58.5% of FY24BE in April-November 2023, and we expect the government to underperform on capital expenditure target for FY24E. We thus model for the capital expenditure at 3.2% of GDP for FY24E or INR 9.5 tn, against FY24BE of INR 10 tn. Overall, total expenditure for FY24E is anticipated at INR 44.9 tn v/s FY24BE of INR 45 tn (lower by INR 172 bn).

• Revenue expenditure is likely to overhsoot FY24BE by INR 387 bn on account of (i) higher subidy outgo (ii) increased spending towards rural development and (iii) higher expenditure on account of hike in DA by 4% for central government employees. Revenue expenditure is expected at 11.9% of GDP vs FY24BE at 11.6%. For FY25BE, we expect revenue expenditure at 11.4% of GDP or at INR 37.6 tn. Subsidy bill is expected at INR 4.6 tn (or 1.4% of GDP), with higher subsidy outgo for food at INR 2.3 tn. Interest payments for FY25BE is penciled at INR 11.8 tn (or 3.6% of GDP).

• On capital expenditure, we expect the government to fall short of its FY24BE target of INR 10 tn. While the spending on ‘Roads & highways’ and ‘Railways’ is expected to outstrip FY24BE, expenditure on ‘defence’ and ‘loans to state for capex’ are likely fall short of the target. We model the capital expenditure of the centre to be at 3.2% of GDP in FY25BE similar to FY24E. We have budgeted for a INR 1.4 tn of long-term loan to states (INR 1.3 tn in FY24BE) for FY25BE.

• From a transparency standpoint, the government had been attempting to reduce the off-budget borrowings of the PSUs for capital expenditures and convert them into onbudget capital expenditures. Our analysis on the anticipated capital expenditure for FY25BE takes this into account. Importantly, the share of ‘resources of public enterprises’ in overall capital expenditure (budget + off-budget) has come down from 53% in FY21 to 33% in FY24BE.

• For FY24E, we model total expenditure to fall short by INR 172 bn to INR 44.9 tn with an increase in the revenue expenditure balanced by lower capital expenditure. For FY24E we see total expenditure at 15.1% of GDP vs 14.9% in FY24BE (on account of lower nominal GDP growth). For FY25BE, we expect total expenditure to grow by 7.5% reaching INR 48.3 tn (14.6% of GDP).

Centre’s net market borrowings expected at INR 11.7 tn in FY25E

Overall, we model the GFD/GDP for FY25BE at 5.4%, after achieving 5.8% for FY24E. However, calculations indicate a GFD of INR 17.7 tn for FY25BE, higher than our FY24E of INR 17.1 tn. For FY25BE, we expect the government to meet around 66% of its fiscal deficit through market borrowings, assuming small savings collections continue to remain robust. Consequently, net borrowings of the Central government via dated securities for FY25BE are estimated at INR 11.7 tn, marginally lower than INR 11.8 tn for FY24E. Redemptions in FY25BE are estimated at INR 3314 bn (this assumes INR 300 bn of switch to be conducted by the RBI to bring down the current redemption amount of INR 3614 bn. Gross borrowing of the centre through dated securities are likely at INR 15.0 tn. Given current assessments, we expect state fiscal deficit for all the states to print higher at 3.3% of GSDP compared to FY24BE of 3.1% of GSDP. With redemptions expected at INR 2.8 tn, gross borrowing for FY24E is likely at INR 9.5 tn. For FY25E, we work with a 2.8% GFD/GSDP for states. Net Borrowings of States for FY25E is expected at INR 5.5 tn, assuming 60% of GFD will be covered through SDL issuances. With redemptions of SDL at INR 3.2 tn for FY25, gross SDL issuances will be around INR 8.7 tn. Total gross supplies of government papers through dated securities (G-Secs + SDLs) for FY25 thus amount to INR 23.7 tn (INR 24.9 tn in FY24). Net supplies are expected at INR 17.2 tn for FY25 (INR 18.5 tn for FY24).

In FY24, 10Y yield traded in a range of 6.96%-7.38%. On the positive side, 10Y G-sec yield movement was on the back of (i) global central banks reaching the peak of its rate hiking cycle (ii) lowering of crude oil prices and (iii) announcement of inclusion of Indian bonds in JP Morgan EM index. On the other hand, the balance was brought through (i) OMO sales as an instrument being brought back by the RBI governor in the October MPC meeting and (ii) banking liquidity being maintained in the deficit zone. Importantly, post the December FOMC meeting, markets started pricing in early rate cuts from the Fed that resulted in a rally in US bond market. Tracking the rally in US market, India 10Y yield had also come down to a low of 7.14% on 16th January 2024. However, given the resilient data from the US and hawkish commentary from the Fed, markets have now again started to move back the first rate cut by the US Fed into June, leading to some reversal in gains. We are also expecting the Fed to start cutting rates from June onwards and the rate cutting cycle is expected to be shallow at 75 bps. We anticipate the RBI to cut the repo rate by 50-75 bps in FY25, starting August 2024. From a demand-supply perspective, FY25 is favorable for the Indian bond market. The foreign demand for governmnent bond is set to increase with the index inclusion (JP Morgan GBI-EM in June 2024).

The fresh FPI flows into the G-sec market to the tune of INR 1.8 tn would be able to fund around 12% of fresh G-sec issuances in FY25. Presently, the share of FPIs in total outstanding central government securities stands at only 1.6% (as of Sep 2023). With the index inclusion, we expect the share of FPIs to increase to ~3%. The demand from insurance companies, pension and mutual funds would also provide the necessary support, given the strong growth seen in their AUMs. We also expect demand from banks to remain strong as credit growth is expected to moderate in FY25. However, the RBI could be resorting to some OMO sales in FY25. Mindful that the index related FX flows can reverse in adverse economic conditions, the RBI is expected to continue to shore up its FX reserves. The excess rupee liquidity will then be sterilized through the OMO sales of G-secs, also effectively keeping in check any sharp increase in the balance sheet size of the RBI. Keeping in mind that some of the flows from active funds can front-run the actual date of Index inclusion, we do not totally rule out any OMO action of the RBI in Q1FY25.

Consequently, we remain a bit cautious in calling for a sharp drop in G-sec yields in the near term. Importantly, we also do not think that the RBI will be able to guide for any rate cuts in the Q1FY25. For the immediate period after the Budget to end-March 2024, we still expect the 10-year yield to be in a range of 7.10-7.20, gaining comfort from a steady borrowing programme but still factoring in a hazy rates outlook from the globe. However, with fiscal unlikely to be inflationary, positive surprises for the domestic bond market is not ruled out. Any further dip in the India 10Y yield would, however, be conditioned by the start of rate cut cycle in the globe as well as in India. We see the US Fed starting to cut rates starting in June 2024 while the RBI is expected to start cutting rates in August 2024. Subsequently, we expect the 10-year yield to trade in a zone of 6.75-7.00%.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)