The supply-demand mismatch continues to be the major factor driving the crude oil prices

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, November 16, 2023: Trade Deficit widened to USD 31.5 bn in October (USD 19.4 bn in September) mainly on account of higher imports, indicative of resiliency of the Indian economy alongside festive season demand upswing.

India’s Trade Deficit Widens on higher imports

Higher commodity prices in the month were also possibly responsible. Gold imports were at USD 7.2 bn, the highest since March 2021. NONG imports grew by 12.3% MoM whereas non-oil exports registered a sequential decline of 1.3% in October. India’s services surplus improved to USD 14.4 bn in October. Assuming India crude basket to average at USD 85 pb, we revise upwards our CAD/GDP to 1.7% (earlier 1.3%).

Exports decline sequentially

Headline exports at USD 33.6 bn, registered a de-growth of 2.5% MoM (6.2% YoY). Oil exports declined by 7.6% to USD 6.0 bn. The decline in oil exports could be attributed to the maintenance-related dip in production in some of the major refinery units. Non-oil exports declined by 1.3 % MoM to USD 27.6 bn. 12 out of major 31 items registered a MoM decline. Within agriculture exports, tea, coffee, rice, and other cereals registered sequential drops whereas spices, cashew, oil seeds, and fruits and vegetables registered sequential increases. Engineering goods accounted for the highest share in the total exports, however, it registered a sequential decline of 9.2% in October.

Imports at a record high

At USD 65.0 bn, imports rose by 12.3% YoY (or 20.8% MoM). Oil imports came to USD 17.7 bn (26.3% MoM), reflective of the higher crude oil prices. In October 2023, India crude basket averaged at USD 89 pb. Gold imports came to USD 7.2 bn in October 2023 (USD 4.1 bn September). Restocking on account of festive and upcoming wedding season in anticipation of higher gold prices due to geopolitical worries may have led to the sharp rise. Non-oil-non-gold (NONG) imports increased by 12.3% MoM to USD 40.1 bn. 22 out of 31 major import items registered sequential increases. Importantly, iron & steel (18% MoM), non-ferrous metals (5.8% MoM), machine tools (-25% MoM), machinery, electrical & non-electrical (10.6% MoM), transport equipment (28.9% MoM) registered sequential rise. On the other hand, electronic goods and project goods registered sequential declines. Pulses imports continue to increase registering a MoM growth of 38% in October. The higher imports are reflective of government stocking up pulses considering the increased risks to rabi production on account of El Nino and lower reservoir levels.

Net services export improves

Services exports grew by 1.0% MoM (13.4% YoY) to USD 28.7 bn. Last month’s services export number was revised down to USD 28.7 bn from USD 29.4 bn. Though services exports have remained steady to date, there is a growing concern among the major IT companies about the slowing demand for technology services in the global market. Services imports were at USD 14.3 bn (-1.8% MoM, +6.0% YoY). On a net basis, the services surplus came to USD 14.4 bn vs 13.8 bn in September.

GDP estimated at 1.7%

October’s trade deficit came to an all-time high of USD 31.5 bn on account of higher imports, a resultant of both higher volumes and prices. Commodity prices got a boost in October on account of (i) geo-political tensions in the Middle East, and (ii) on optimism that the Fed is done with rate hikes. For instance, gold prices touched a peak of USD 2006 per oz on 27th October 2023, reflecting the safe haven demand and correction in UST yields. This is also coincided with the festive period in India when there is increased demand for gold and other commodities.

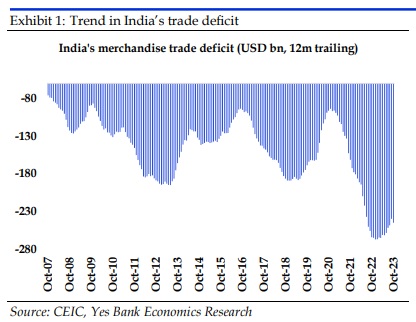

We expect gold prices to average at USD 1970 per oz for the rest of FY24, bringing some pressure to the imports side. Similarly, the risk from higher oil import bills continues to exist. Though crude oil prices have corrected from a peak of USD 96.9 pb (touched on 27th September 2023), the supply-demand mismatch continues to be the major factor driving the prices. Resilience of domestic growth will also mean a resilience to non-oil imports. Based on the above, we revise higher our CAD/GDP estimate for FY24. Assuming crude oil prices to average at USD 85 pb, imports are expected at USD 698 bn and exports at USD 428 bn, bringing the trade balance to USD (-) 270 bn (or -7.6% of GDP). Meanwhile, net services sector flows are expected to remain stable, though risk exists on account of the slowing demand in the major export destinations such as the USA, UK, and EU. Consequently, CAD is expected at USD 59 bn, with the CAD/GDP at 1.7% (earlier 1.3%).

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)