Since the India basket has correlation of 0.98 with Brent crude, the trends in Brent suggest further softening of Indian basket.

FinTech BizNews Service

Mumbai, 6 January 2026: The State Bank of India’s Economic Research Department has cpme out with a the Research Report on the Crude oil prices. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Crude oil prices to soften significantly in 2026 (to touch $50 /bbl by June 2026...the deceleration likely to be faster.. positively affecting and FY27 inflation (below 3.4%), rupee (below Rs88/$) growth outlook (>7% at 7.2%):

Internal crude oil prices expected to soften, agnostic to recent geopolitical events

❑ Oil prices in general have remained subdued

due to OPEC+ decision to increase

production. The reversal of the strategy and

reduction in daily production has not resulted

in reversal of price movements and crude

prices continued their southward decline

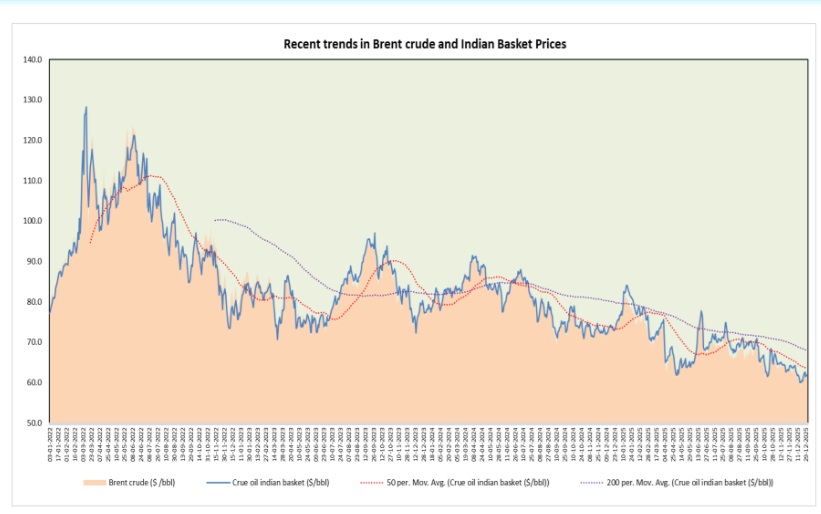

❑ The medium-term trends in prices since 2022

for brent and Indian basket show that there

has been a downward trend in crude prices

❑ The local peaks during the entire stretch

indicate impact of geopolitical risk, although

the latest event in Venezuela has not

impacted the price significantly on the upside

Indian basket expected to soften in line with expected trends internationally: Our base case is $50 per bbl.. or even lower by June 2026

❑ The outlook on Brent crude for 2026 is further

softening from the current levels

❑ U.S. Energy Information Administration estimates

that Brent crude oil price will fall to an average of

$55 per barrel (b) in the first quarter of 2026 largely

driven by buildup of inventory.

❑ Since the India basket has correlation of 0.98 with

Brent crude, the trends in Brent suggest further

softening of Indian basket.

❑ A moving average analysis for Indian crude, shows

that current prices are trending below the 50 and

200 period moving averages suggesting future

lower levels from current level at $62.20 per bbl.

❑ An autoregressive quantile forecast for Indian

Basket indicates that 50th percentile forecast by

March 2026 is $53.31 and $51.85 by June 2026.

The 25th percentile forecast trends very close to

median.

Domestic impact of energy price correction positive across indicators

Inflation dynamics

❑ The expected fall in Indian basket price by to $53.31 per barrel due to dynamic daily pricing mechanism will get transmitted to fuel station prices.

❑ Based on historical average correlation between prices observed in four metro cities, at 0.48, the fuel component of the

CPI basket may see further moderation

❑ The expected 14% correction in India Basket in Q4 FY26 is expected to put downward pressure of 22 bps on CPI basket assuming 48% passthrough. This could average CPI inflation for FY27 decisively below 3.4%

Rupee movement

❑ Since oil prices constitute the largest component in import basket and cannot be substituted with domestic production in short term, contraction of import bill on account of crude imports prices will impact rupee

❑ Analysis using recent history suggests that assuming the USD/INR base price of ₹90.28 the 14% expected correction may

result in 3% appreciation in rupee that is approximately ₹87.5 per dollar..a part of this could play out in Q4FY26

❑ Other things held constant, the appreciation trend is expected in FY27 as well

GDP outlook

❑ Benign energy prices will impact the GDP outlook favorably. The expected impact on annual GDP growth is around 10-15 bps