7 out of 20 commodities have registered softening of prices

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, January 6, 2024: Here is an analysis on movement in prices of essential commodities which goes as the BoB Essential Commodity Index (BoB ECI).

How prices look in Dec’23

BoB Essential Commodity Index (BoB ECI) has fallen by 0.4% in Dec’23, on a sequential basis. This is the first drop since Sep’23. Correction in vegetable prices, seasonal drop in prices and arrival of fresh crops in the harvest month; have all contributed to a favourable outlook for inflation. The drop in prices has been broad based with items such as pulses, edible oil, tea and sugar, all showing moderation. The YoY number is bit charred by unfavourable base. We expect headline CPI to settle at 5.5% in Dec’23 (adverse base of 20bps). In the coming months (Jan and Feb), the drop in inflation is likely to be more pronounced, as is already visible in major high frequency price data of Jan’24. To get an idea about the calculation of the index, refer to our previous edition of BoB ECI.

Price picture using BoB Essential Commodity Index:

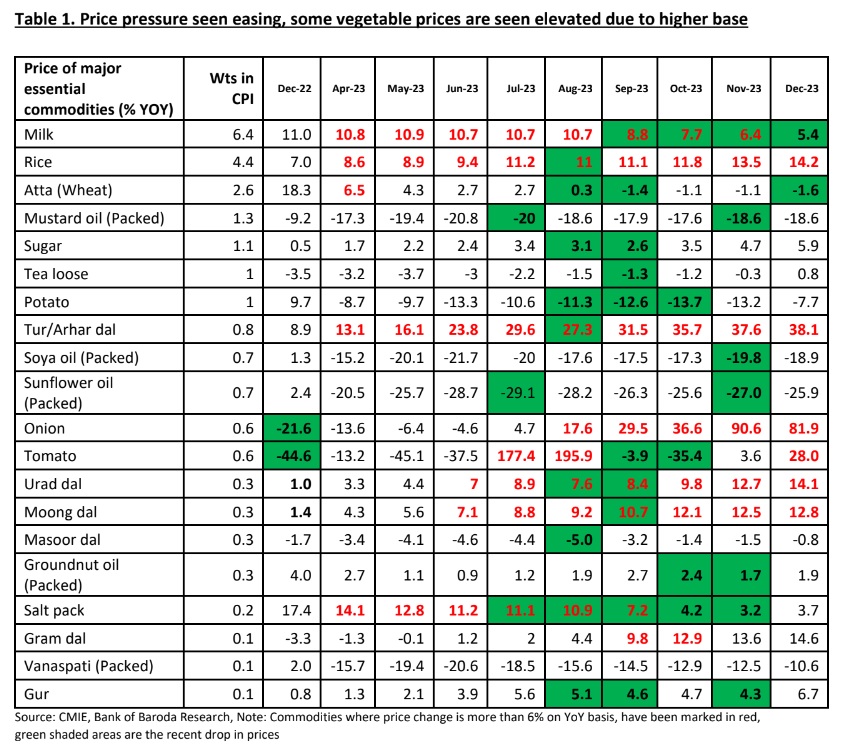

· On MoM basis, BoB ECI fell by 0.4% in Dec’23 from 1.8% increase seen in Nov’23. This is the first decline in the index since Sep’23. 16 out of 20 commodities that is captured in the index have registered a decline in Dec’23 compared to Nov’23. Among them, sharpest correction was visible in case of vegetable prices. Onion prices have fallen by 14.8% in Dec’23 from 56.2% increase in Nov’23, on MoM basis. Even tomato and potato prices have fallen by 4.8% and 4.4%, respectively. Other commodities where prices have inched down are all items of pulses (Gram, Tur, Urad, Moong, Masur), edible oil, tea, sugar and milk. However, on a seasonally adjusted basis, it has risen slightly by 0.9% in Nov’23.

· On YoY basis, BoB ECI registered growth rate of 4.2% in Dec’23. 7 out of 20 commodities have registered softening of prices. Notable ones include edible oil, potato, Masur and Wheat (Atta). Unfavourable base affected prices of other vegetables such as Tomato and Onion.

· For the first 4 days of Jan-24, BoB ECI has fallen by 1% on MoM basis and even on a YoY basis it has moderated to 3.9%. Sequential correction was visible in the prices of rice, wheat, pulses and most importantly for major vegetables (Onion, tomato and potato).

Price picture using BoB Essential Commodity Index

On MoM basis, BoB ECI fell by 0.4% in Dec’23 from 1.8% increase seen in Nov’23. This is the first decline in the index since Sep’23. 16 out of 20 commodities that are captured in the index have registered a decline in Dec’23 compared to Nov’23. Among them, sharpest correction was visible in case of vegetable prices. Onion prices have fallen by 14.8% in Dec’23 from 56.2% increase in Nov’23, on MoM basis. Even tomato and potato prices have fallen by 4.8% and 4.4%, respectively. Other commodities where prices have inched down are all items of pulses (Gram, Tur, Urad, Moong, Masur), edible oil, tea, sugar, and milk. However, on a seasonally

adjusted basis, it has risen slightly by 0.9% in Nov’23.

On YoY basis, BoB ECI registered growth rate of 4.2% in Dec’23. 7 out of 20 commodities have registered softening of prices. Notable ones include edible oil, potato, Masur and Wheat (Atta). Unfavourable base affected prices of other vegetables such as Tomato and Onion.

For the first 4 days of Jan-24, BoB ECI has fallen by 1% on MoM basis and even on a YoY basis it has moderated to 3.9%. Sequential correction was visible in the prices of rice, wheat, pulses and most importantly for major vegetables (Onion, tomato and potato).

So where is CPI print headed?

Based on the price dynamics, we expect CPI to settle at 5.5% in Dec’23. This month witnessed major correction in vegetable prices. Also, this coincides with harvest month. Thus, further downtrend may not be overruled. This coupled with seasonality in prices of major food crops, improved Rabi sowing and stable energy prices provide comfort to inflation. Even Jan and Feb’24 prints will witness a statistical base in their favour. The core services inflation is trailing below 4% currently. Thus, the demand side pull of inflation does not seem to be much of a concern now. Overall inflation outlook looks much more balanced as supply-side pressures have palliated a bit, for now.

(Disclaimer The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of the Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. Bank of Baroda Group or its officers, employees, personnel, and directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.)