Global yields closed mixed, with 10Y yields in US and China ending flat, and falling across Germany and Japan

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, December 20, 2023: § The dovish pivot by Fed raised the expectations (67.5% chance) of a possible rate cut by as early as Mar’24. This comes in the wake of the PCE report scheduled to release later this week. On data front, sales of new single family home surged to 1.5 year high at 18% in Nov’23. In forex market, Yen declined amidst a dovish policy by BoJ. Separately, PBoC for the 4th time in a row has kept the interest rate unchanged with the one-year rate for household and corporate at 3.45% and 5-year benchmark rate at 4.2% for mortgages. On the domestic front, RBI has tightened norms for lenders towards their investment in alternative investment funds.

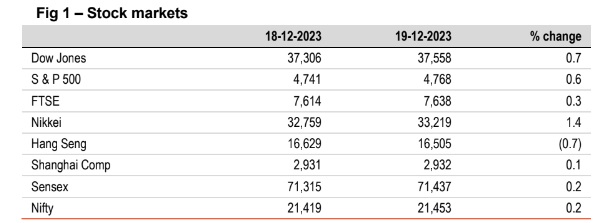

§ Except Hang Seng, other global indices ended higher. Investors monitored commentary by Fed officials ahead of the key inflation data. Nikkei surged to a record high after the BoJ continued with its ultra-loose-monetary policy decision. Amidst the decision to keep the rate unchanged by PBoC, Shanghai Comp edged up marginally. Sensex advanced to fresh record high, supported by gains in oil and gas stocks. It is trading higher today, in line with other Asian markets.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)