9 out of 20 commodities have registered some momentum in prices; BoB Essential Commodity Index increased at the fastest pace in Mar’24

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, April 6, 2024: Economics Research Department of Bank of Baroda has come out with a report on BoB Essential Commodities Index for March 2024.

How prices look in Mar’24

BoB Essential Commodity Index (BoB ECI) has increased at the fastest pace since Aug’23 by 5.9% in Mar’24, on YoY basis and by 0.4%, on a sequential basis. On a seasonally adjusted basis, the increase is sharper at 0.8%. Much of this is attributable to rise in prices of vegetables such as Potato and Onion.

Apart from this, edible oils and pulses have also provided some bit of discomfort on food inflation.

Going forward, the wider gap between retail and wholesale prices of these vegetable items (potato

and onion) and estimated drop in production as per first AE of 2023-24 of Horticulture crops, could

pose some near term pressure on food inflation.

For Mar’24, we expect CPI to settle at 4.8%. Despite some bit of discomfort on food inflation, support

would prevail from a lower fuel price and a comforting core inflation.

To get an idea about the calculation of the index, refer to our previous edition of BoB ECI.

Price picture using BoB Essential Commodity Index:

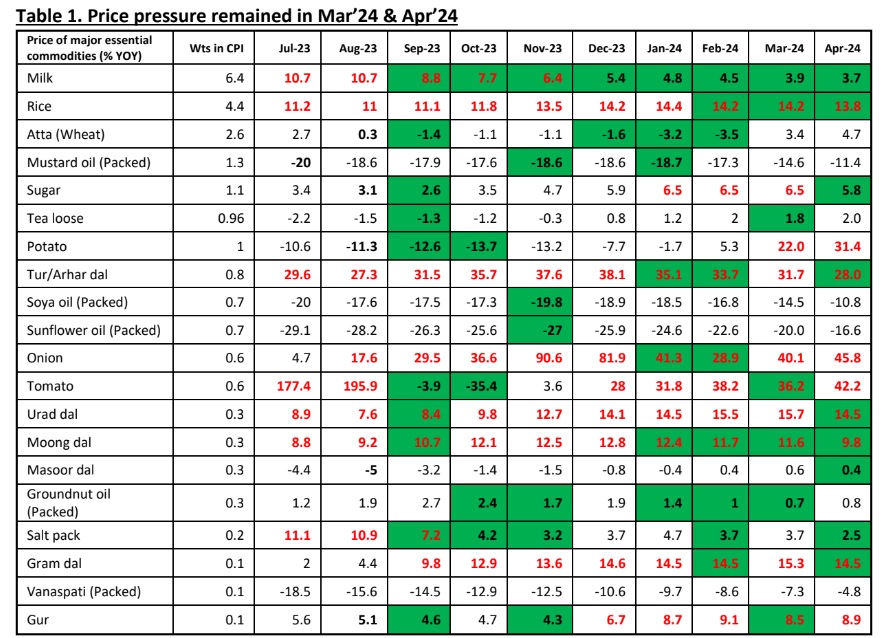

On YoY basis, BoB ECI inched up to 5.9% in Mar’24, the sharpest pace of increase in the index

observed since Aug’23. This is higher compared to last month’s increase of 4.2% of the index.

9 out of 20 commodities have registered some momentum in prices. Vegetables such as

Potato and Onion prices have gained considerably. From 5.3% and 28.9% increase respectively

seen in Feb’24, it inched up to 22% and 40.1% in Mar’24 (on YoY basis). Other items where

price build up was visible were wheat (atta), edible oils such as sunflower oil, soya oil and

mustard oil. Some components of pulses such as Gram dal, Masoor and Urad also showed

some bit of upward correction.

On MoM basis, BoB ECI rose by 0.4% in Mar’24 from 0.2% decline seen in Feb’24. Notably, on

a sequential basis, BoB ECI has been on a path of increase for the first time since Dec’23. A

sequential momentum was seen in 13 out of 20 commodities. The YoY and sequential picture

broadly mirrored the same trend. On sequential basis as well, wheat, major components of

pulses, edible oils and most importantly Potato and Onion prices have shown pick up in

Mar’24 compared to Feb’24. On a seasonally adjusted basis, the increase in BoB ECI is sharper

at 0.8% in Mar’24.

For the first 4 days of Apr-24, BoB ECI has inched up further by 6.7%, on YoY basis. On MoM

basis, it has inched up by another 0.5%. The sequential pick up in prices was visible for edible

oils, sugar, milk. Amongst vegetables, tomato prices reversed their trajectory noting an

upward correction in Apr’24. Potato prices also increased moderately while Onion prices

moderated.

So where is CPI print headed?

High frequency price data showed that vegetable prices, especially potato and onion

continue to pose considerable upside risk to food inflation. Potato prices were impacted as

production was hampered due to unseasonal December rains. Added to this, there has been

considerable gap between wholesale and retail prices for Potato, Onion, and Tomato. The

significant difference is seen for Onion and Tomato. Thus, along with an upward correction

in trajectory which happens in Q1, we can expect considerable upside risk to the prices of these items on account of limited pass-through of wholesale to retail prices. Apart from this,

adverse weather conditions and fear of prolonged summer might again result in cost push

inflation. The only comfort comes from core. But how long is the question?

We expect headline CPI to be at 4.8% on Mar’24. Our FY25 forecast is in the range of 4.5-5%,

with risks tilted to the upside.