Gain in Hang Sang index led by a rally in tech stocks

INR is trading stronger today, in line with other Asian currencies after China announced more stimulus

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, 25 October, 2023: Concerns around global economic slowdown specially in Europe resurfaced after Eurozone Composite PMI (flash) worsened to 46.5 in Oct’23 (lowest since-Nov’20) from 47.2 in Sep’23. This comes ahead of the ECB policy meet, scheduled later this week wherein it is expected the members might not continue with higher interest rates for a longer period of time. On the other hand, US composite PMI expanded to 51 (highest level since Jul’23) in Oct’23 from 50.2 in Sep’23. This is led by improvement in both manufacturing and services activity with pickup in new orders and easing of inflationary pressures. Separately, Chinese government announced the issuance of 1 tn yuan in government bond as part of the natural disaster relief measures. This is expected to raise the deficit to 3.8% from 3%.

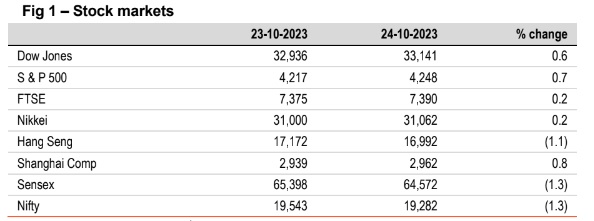

- Barring Hang Seng and Sensex, other global indices advanced. Investors monitored business activity indexes from across the globe. US indices ended higher ahead of the earnings reports even as investors remained watchful of the movement of treasury yields. Sensex ended in red. It opened higher today in line with other Asian stocks. The gain in the Hang Sang index has been led by a rally in technology and consumer durable stocks.

- Global currencies broadly depreciated against the dollar, as flash PMIs suggested that US economy continues to outperform other major peers. DXY rose by 0.7%, while GBP and EUR both fell by 0.7% each. JPY depreciated further fuelling expectations of BoJ intervention. INR is trading stronger today, in line with other Asian currencies after China announced more stimulus.

- Except India and China (higher), other major global bond yields ended lower. 10Y yields in UK and Germany fell the most as flash PMI signalled a worsening economic outlook. US 10Y yield also dipped after breaching the 5% mark last week. India’s 10Y yield rose by 2bps in the last trading session. However, it is trading lower at 7.34% today, following a drop in global yields and oil prices.