Sensex is trading higher today

Jahnavi Prabhakar

Economist,

Bank of Baroda

FinTech BizNews Service

Mumbai, March 28, 2024: In India, Centre’s borrowing calendar was released for H1FY25. Out of the total gross borrowing of Rs 14.1 lakh crore, the centre is expected to borrow Rs 7.5 lakh crore (53% of the target) in H1. The proportion is lower than H1FY24 and is expected to be positive for the G-sec, with yield expected to fall down. Additionally, a new dated security of 15-year tenor has also been introduced and Centre also plans to issue green bonds in two tranches of Rs 6,000 crore (maturity of 10-year) each in FY25. Separately, in Europe, the economic sentiment indicator (ESI) jumped up to 96.2 (+0.7 points) and 96.3 (+0.8 points) levels in EU and Euro area respectively in Mar’24. The employment expectations indicator remained stable for both the regions.

§ Global stock indices ended mixed. US indices rebounded and closed in green with all the major S&P indices edging up, real estate and utilities stocks were the biggest gainers. Hang and Shanghai Comp ended lower. On the other hand, Sensex registered modest gains supported by cap goods and consumer durable stocks. It is trading higher today while other Asian indices are trading mixed.

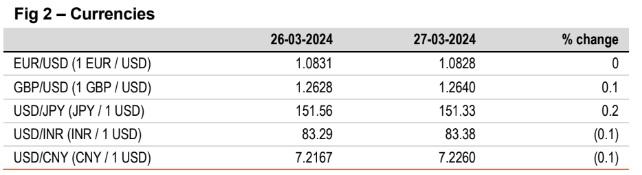

§ Global currencies closed mixed against US$, with JPY and GBP appreciating. DXY ended flat. JPY, despite slight improvement, continues to hover at near 34-year low. Investors await US and UK macro data to gauge Fed and BoE’s rate trajectory. INR fell by 0.1%, despite easing oil prices. However, it is trading higher today, while other Asian currencies are trading mixed.

Global 10Y yields fell, with those in Germany, UK and US declining the most. Investors are expecting Central Banks outside the US to be able to cut rates early, with inflation correcting itself. In the US, investors await labour market and inflation data for more cues. India’s 10Y yield fell by 2bps. It is trading further lower today, as centre announced smaller than expected H1 borrowing plan.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)