Big Bang Dividend Reflects RBI Managing Volatility Deftly In An Uncertain World

FinTech BizNews Service

Mumbai, May 21, 2024: The declaration of a record dividend by the RBI today was well received by the financial markets, the benchmark yields softening to sub-7% in testimony to the highest ever surplus transfer that is estimated to ease fiscal deficit by 30 to 40 bps from the budgeted level of 5.1% of GDP for FY25 as was set in Interim Budget. The Board also recommended that the risk provisioning under the Contingent Risk Buffer (CRB) be maintained within a range of 6.5% to 5.5% of the RBI’s balance sheet. RBI said that surplus transfer to government for financial year 2023-24 is based on the Economic Capital Framework (ECF) adopted by the RBI on August 26, 2019 as per recommendations of the Bimal Jalan committee. The Bimal Jalan committee recommendations in 2019 which recognized that the RBI’s provisioning be maintained within a range of 6.5% to 5.5% of the RBI's balance sheet, comprising 5.5 to 4.5% for monetary and financial stability risks and 1% for credit and operational risks, had recommended a surplus distribution policy which should target not only the total economic capital (as per the extant framework) but also the realised equity level of the RBI’s capital, bringing about greater stability of surplus transfer to the Government, with the quantum of the latter depending on balance sheet dynamics as well as the risk equity positioning by the Central Board.

The sharp jump in the surplus amount could be attributed to higher income from the forex holding of the central bank, among other factors. The dynamics of surplus for RBI was decided by its LAF operations and interest income from its holding of domestic and foreign securities. The balances under the daily LAF show that RBI was in absorption mode for the most part of the financial year as it kept the monetary policy steady. RBI absorbed liquidity for 259 days out of the 365 days. The average absorptions add to RBI expenses under LAF. Furthermore RBI asked banks to hold an incremental CRR of 10% on an increase in deposits between May 19 and July 28 in August 2023 altering the daily LAF dynamics contracting its net payables under the LAF.

On the asset sides the provisional RBI balance sheet components show that the RBI domestic assets increased marginally while is foreign assets grew sharply. With higher domestic interest rates and foreign interest rates and possible contracting payable under LAF, RBI surplus swelled in FY24. The increase in price of gold also added to overall expansion in RBI balance sheet. RBI’s income was Rs 1.6 lakh crore in FY22 and Rs 2.35 lakh crore in FY23. For FY24, it is projected to be around Rs 3.75 to 4 lakh crore. While all other things in the balance sheet are either steady or increasing as per trend, however, foreign investments have increased sharply. Therefore, nearly 60-70% YoY increase in RBI’s income is expected to be from Interest Income from Foreign Securities as well as Exchange gain from foreign exchange transactions. This, we believe, is an ode to the RBI managing volatility deftly while leveraging the turbulence in global markets to its advantage.

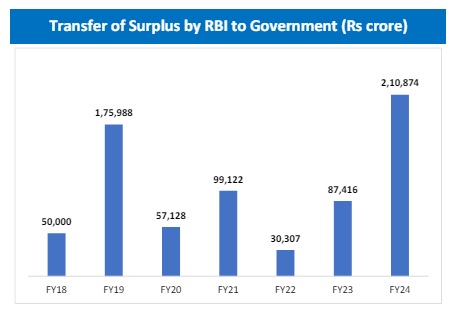

RBI’S RECORD DIVIDEND TO GOVERNMENT

¨ Reserve Bank of India (RBI) has announced a record (highest ever) dividend of Rs 2.11 lakh crore to the Government of India for the financial year 2023-24 as against Rs 87,416 crore transferred for FY23, an increase of 141%. The Board had recommended that the risk provisioning under the Contingent Risk Buffer (CRB) be maintained within a range of 6.5% to 5.5% of the RBI’s balance sheet. ¨ RBI said that surplus transfer to government for financial year 2023-24 is based on the Economic Capital Framework (ECF) adopted by the RBI on August 26, 2019 as per recommendations of the Bimal Jalan committee. The sharp jump in the surplus amount could be attributed to higher income from the forex holding of the central bank, among other factors.

This highest ever dividend transfer is expected to ease fiscal deficit by 30 to 40 bps from the budgeted level of Rs 5.1% of GDP.

IMPACT ON RBI’S BALANCE SHEET

¨ The dynamics of surplus for RBI was decided by its LAF operations and interest income from its holding of domestic and foreign securities. ¨ The balances under the daily LAF show that RBI was in absorption mode for the most part of the financial year as it kept the monetary policy steady. RBI absorbed liquidity for 259 days out of the 365 days. The average absorptions add to RBI expenses under LAF. Furthermore, RBI asked banks to hold an incremental CRR of 10% on an increase in deposits between May 19 and July 28 in August 2023 will altered the daily LAF dynamics contracting its net payables under the LAF. ¨ On the asset sides the provisional RBI balance sheet components show that the RBI domestic assets increased marginally while is foreign assets grew sharply. With higher domestic interest rates and foreign interest rates and possible contracting payable under LAF, RBI surplus swelled in FY24. ¨ The increase in price of gold also added to overall expansion in RBI balance sheet.

POSSIBLE IMPACT OF FOREIGN TRANSACTIONS ON SURPLUS TRANSFER TO GOVERNMENT

RBI’s income was Rs 1.6 lakh crore in FY22 and Rs 2.35 lakh crore in FY23. For FY24, it is projected to be around Rs 3.75 to 4 lakh crore. ¨ While all other things in the balance sheet are either steady or increasing as per trend, however, foreign investments have increased sharply. Therefore, nearly 60-70% YoY increase in RBI’s income is expected to be from Interest Income from foreign securities as well as Exchange gain from foreign exchange transactions.