IBC Has Improved Credit Culture By Resolving Huge Amount Of Stressed Assets

Over the past two decades, ARCs have set up a robust infrastructure and nurtured skilled and professional manpower to manage stressed assets

FinTech BizNews Service

Mumbai, February 24, 2024: A joint report of ASSOCHAM and CRISIL Ratings on the asset reconstruction companies (ARCs) was released at the Assocham 7th National Summit on Stressed Assets under the theme 'Changing Regulatory Landscape and the Way Forward’, held on Friday in Mumbai.

Over the past two decades, ARCs have set up a robust infrastructure and nurtured skilled and professional manpower to manage stressed assets. This platform can contribute immensely if some challenges, such as ease of fund availability, price expectation mismatch between the selling institution and ARC, and issues in loan aggregation, are addressed.

The performance of ARCs improved considerably in fiscal 2023. As per the Trend and Progress of Banking Report of the Reserve Bank of India (RBI), 9.7% of the previous year’s stock of gross non-performing assets (GNPAs) were sold to ARCs in fiscal 2023 compared with only 3.2% in the previous fiscal. The report also states that the amount of security receipts (SRs) completely redeemed, an indicator of recovery, increased during the fiscal. ARCs have played an important role in the acquisition of NPAs and their resolution. As of March 2023, ARCs had stressed loans of Rs 8.48 trillion in book value.

The growing stress in retail loans/small and medium enterprise (SME) segments provides opportunity for ARCs to diversify their business from the corporate segment to retail and SME. The reduction in mandatory investments by ARCs from 15% to 2.5% in case of full cash exit for sellers, will help ARCs scale up capability, duly supported by eligible qualified buyers (investors).

The government has over the last few years taken a numberof steps in addressing issues faced by various stakeholders and has amended the IBC from time to time. The IBC has improved the credit culture over the seven years since its inception by resolving a considerable amount of stressed assets and achieving better recovery rates than other mechanisms. However, there is still room for strengthening the credit resolution framework.

Executive Summary of ASSOCHAM-CRISIL Joint Report:

- ARCs, since their inception in 2003, have gone through many structural changes. With evolving regulations and changing business models, realignment of business strategies is the need of the hour. Revised regulatory guidelines around improved governance norms, better disclosures, lower funding requirement for asset acquisition, increase in net owned funds (NOF) and option to participate as a resolution applicant under the IBC are all expected to structurally fortify the sector.

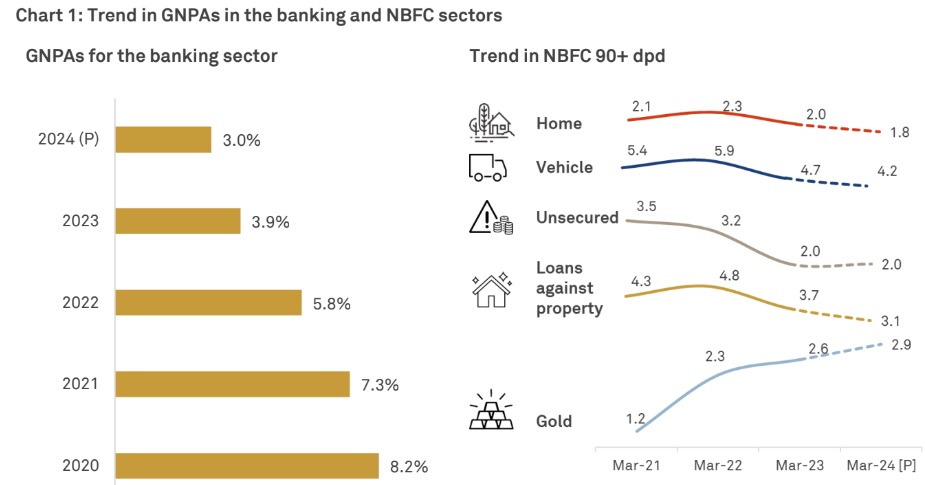

- Growth is expected to moderate to 8-9% this fiscal from ~17% last fiscal. It is likely to further moderate to 5-6% next fiscal due to the cyclically low GNPAs in banks and NBFCs. Despite the reduced GNPAs, there are opportunities for the ARC sector, including expected increase in the proportion of retail acquisitions.

- Moreover, increasing contribution from the national ARC — National Asset Reconstruction Company Ltd (NARCL) — may support growth and enable faster debt aggregation of long-stuck assets.

- Capital requirement for investing in SRs was a bottleneck in the past. The revision in the minimum investment in SRs has helped to free up 80-85% of funds for cash transactions (which involve no participation of the selling entity). Lenders’ expectation of upfront exit has also fuelled increase in cash transactions. The rising share of cash transactions, with a strategic focus on the retail sector, will drive focus on execution through a partnership model in investment.

- The cumulative redemption rate has been on an increasing trajectory, supported by faster settlement/ restructuring due to the deterrent effect of the IBC, increased share of cash deals, higher exposure to retail loans, and better recovery in recent acquisitions due to lower vintage with better-quality assets. This is reflected in the portfolio rated by CRISIL Ratings, where the cumulative recovery rate is expected to increase from 38% in fiscal 2023 to 55-60% by fiscal 2025.

- Lastly, IBC has improved the credit culture over the seven years since its inception by resolving a considerable amount of stressed assets and achieving better recovery rates than other mechanisms. However, there is still room for strengthening the credit resolution framework.

- Amidst all this, ARCs must continue to align the business strategies in light of the evolving stressed assets opportunity in the Indian market. This is important to strengthen their market position, with other alternatives (such as proposed amendments to Special Situation Funds and Securitisation of Stressed Assets Framework) in stressed assets markets likely to emerge over the medium term. Success on this front will remain critical for the long-term sustainable growth of the ARC sector.

It is hoped that this report will help regulators, market participants, government departments and research scholars in further development of the stressed asset reconstruction industry.