Sensex is trading higher today

Aditi Gupta,

Economist,

Bank of Baroda

FinTech BizNews Service

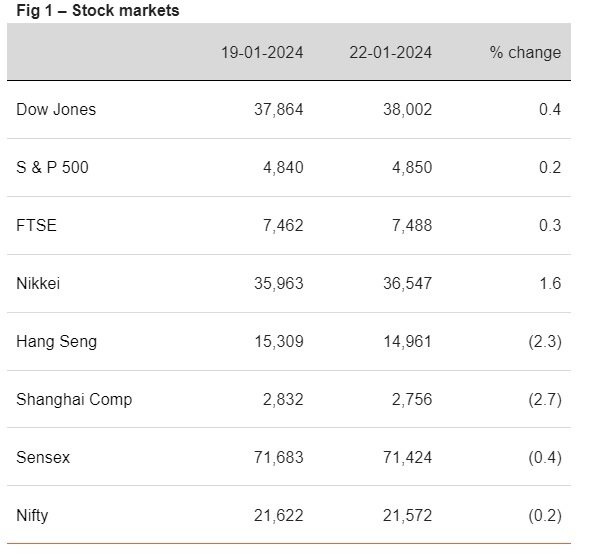

Mumbai, January 23, 2024: Bank of Japan left its policy rate unchanged, in line with market expectations. Reports of a nearly 2tn yuan stimulus package in China to stabilise the stock markets also buoyed investor sentiments. This has led to a rally in Asian stocks, with Japan’s Nikkei trading near a 34-year high today. US stocks too continued their bull-run with the S&P 500 and Dow Jones both ending at a fresh record-high. Focus this week remains on flash PMIs of major economies, US Q4GDP and PCE report and consumer confidence index of UK and Germany. Apart from this, investors will also keep a keen eye on ECB policy decision due later in the week. While it is widely expected to keep rates on pause, investors will await cues from ECB Chair’s statement to assess future trajectory of rates.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)