It does look like that during the Elections there is a watchful stance taken by the government on capex. This is also witnessed for company investment announcements as well as foreign investors

FinTech BizNews Service

Mumbai, April 12, 2024: With the Elections season on, there are several conjectures on how economic variables will move. Jahnavi Prabhakar, Economist, Bank of Baroda, has mapped the movements in several variables during the Elections phase in 2019. Alongside she has shown how these variables have moved so far in 2024 up to Feb-March. For some variables like government capex, or FDI investments there is reason to believe there is a wait and watch approach. But otherwise, it is hard to ascertain definite tendencies.

India’s General Election-2024

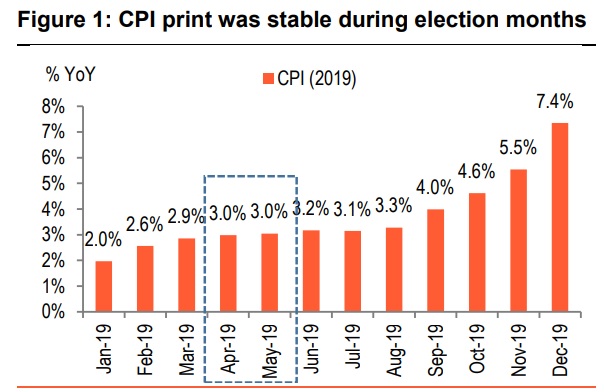

World’s largest democracy will hold General Elections this month with over 96.8cr eligible voters expected to participate in this spectacle and elect 543 members to the Lok Sabha. The study looks at various macroeconomic factors in the last election cycle back in 2019 and how they look in the present calendar year. The focus will be on the months wherein election is scheduled specifically, Apr-May period. Evolving macroeconomic picture during the Election months: In the coming 6-weeks starting from Apr-19 to Jun-1, India will go through the 18th General Elections. Lok Sabha elections will be held in over 7-phases for a period of over 44-days and the results will be announced by June 4. Back in 2019, the elections were held during Apr’19 and May’19 with the results being announced on 23 May 2019. A range of macroeconomic variables has been considered including inflation, movement of bond yields, currency, equity markets, government capex and new investments projects in the analysis. For inflation, the CPI in 2019 started going up post July and peaked in December. It was steady for the Apr-May’19 period. It does not look like that there was any untoward pressure on inflation due to the Elections spending in 2019 in the immediate months though lagged effects cannot be ruled out. For the current year, inflation is expected to remain at the current levels with the possibility of some moderation during the election months. This follows more from the RBI forecasts of inflation put out which are likely to materialize.

Credit Growth

During the election months for 2019, credit growth registered stable growth of 13% for the month of Apr and May’19. It did slow down relative to March but this could also be due to the seasonal impact of being the beginning of the year.

10Y Yield

The 10Y bond yield inched up by 4bps in Apr’19 and the declined by 9bps in May’19. Notably, post the election months, bond yields did drop sharply. Therefore, it is possible to say that bond yields tended to be firm during this Elections period and the softened. However, liquidity conditions too were tight at this time and had eased subsequently. This year in 2024, so far, the bond yield have been softening at a steady pace in the last 3-months.

Equity Market Sensex had registered modest gains in Apr’19. However, these gains were wiped out in May’19. The pattern was jagged again in the next two months. Hence, no clear pattern emerges on the stock market front. So far in 2024, stable gains have been recorded in domestic market.

Similar to the movement in the Sensex market, even for the Nifty index, modest gains were noted in the month of Apr’19 and the index in May’19 registered losses. Thereby, concluding no strict trend was noted during these months. In 2024 so far, the year has started with some modest gains.

FPI flows FPI for the year 2019, recorded net inflow of US$ 19 bn with net inflow of over US$4 bn in the elections months. In Feb’24, inflows of US$ 4bn have been recorded in the current year, followed by US$ 6.2bn in Mar’24.

AUM of Mutual Funds

The net assets under management for mutual funds have been rising steadily in the months of Apr’19 and May’19 to Rs 24.8 lakh crore and 25.9 lakh crore respectively. There was a decline subsequently but the outstanding amount was range bound for the larger part of the year. AUM crossed the Rs 26 lkh crore mark in October and was range bound between Rs 26-27 lakh crore. Notably in the year 2024, assets under management for mutual funds have increased to Rs 53.4 lakh crore in Mar’24. The increase could continue as the stock market has been performing quite well in April reflecting optimism.

INR value

For the months of Apr’19 and May’19, the currency had depreciated by (-) 0.6% and post the elections it made steady improvement as the currency appreciated in the month of Jun’19 and Jul’19. However, due to other macroeconomic factors, the currency depreciated from Aug’19 onwards to Dec’19. It does look like that the Elections may not have had an impact on the value of the currency, which was driven more by external fundamentals. INR has recently registered appreciation in the last 3-months up by 0.1%.

Government Capex

During the elections months (Apr-May), of the total capex target of Rs 3.3 lakh crore in the Budget for FY20, only 14.1% share of capex was utilized in the election months. This was lower than the shares witnessed in the previous two years. It is possible to conclude that the ongoing elections could have had an impact on government capex spending as certain decisions could have been deferred due to the ongoing Elections. It would be interesting to see how this turns out in 2024.

FDI

For FDI, in FY20 the total FDI was over US$ 50 bn and its share during the election months of AprMay’19 turned out to be 18.1%. This share was lower than that in FY19 as well as post-covid years which can mean that foreign investors could be studying the progress and result of the Elections before taking decisions. This may also hold in 2024.

New investments projects announced

A total of new projects announced in FY19 were to the tune of Rs 19 lakh crore and during Q1 a proportion of 11% had been announced. This has been lower than the share in other years indicating thereby that there could be a wait-and-watch approach taken by companies when announcing new projects.

Conclusion

It does look like that during the Elections there is a watchful stance taken by the government on capex. This is also witnessed for company investment announcements as well as foreign investors. But indicators like inflation, credit, currency, bond yields, stock markets etc. have not quite shown any specific tendency in the Last Elections during the polling months. It would be interesting to see if there are any such exogenous shocks for these variables this time.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.