Global stocks ended mixed. Investors shifted their focus to Fed minutes which are scheduled to be released this week. Atlanta Fed President also spoke of more data related evidence before embarking on easing financial conditions

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, February 20, 2024: Producer prices in US rose at the fastest pace in 5-months at 0.3% in Jan’24 (est. 0.1%) compared with a decline of 0.1% in Dec’23. The increase was led by higher services inflation. The persistent increase in inflation has reaffirmed views of a delayed start to the Fed rate cuts. Separate data also showed a decline in housing starts which fell by 14.8% to 1.33mn units (est. 1.46mn units). In China, while PBOC kept the 1Y LPR unchanged at 3.45%, it cut the 5Y year LPR by 25bps to 3.95%. This was the first rate cut since Jun’23 and was higher than estimate of a 5-15bps decline. Separately, minutes of the Reserve Bank of Australia meeting indicated that members remained vigilant on inflation and did not rule out further rate hikes.

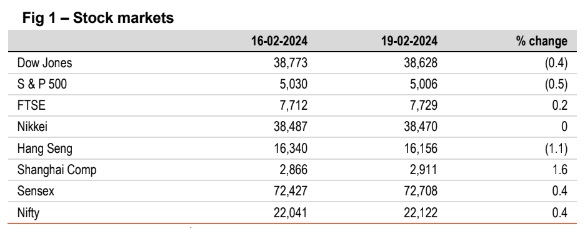

Global stocks ended mixed. Investors shifted their focus to Fed minutes which are scheduled to be released this week. Atlanta Fed President also spoke of more data related evidence before embarking on easing financial conditions. Shanghai Comp rose the most, while Hang Seng and US stocks moderated. Sensex inched up, led by consumer durables and auto stocks. However, it is trading lower today, in line with its Asian peers.

Except EUR and INR, other global currencies closed ended weaker against the dollar. DXY was marginally higher tracking macro data (US PPI and housing starts). Possibility of a rate cut by Fed has been pushed back to Jun’24. JPY depreciated further amidst continued policy divergence between BoJ and Fed.

INR appreciated a tad. It is trading further stronger today, while other Asian currencies are trading mixed. Global yields traded in a narrow range. Investors have already priced in a delayed start of rate cut cycle by Fed. The recent PPI data and inflation expectations data of the US also reaffirmed the same. PBOC’s decision to cut the benchmark 5 year loan prime rate might have some future impact on its yield. India’s 10Y yield inched a tad and is trading at 7.09% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)